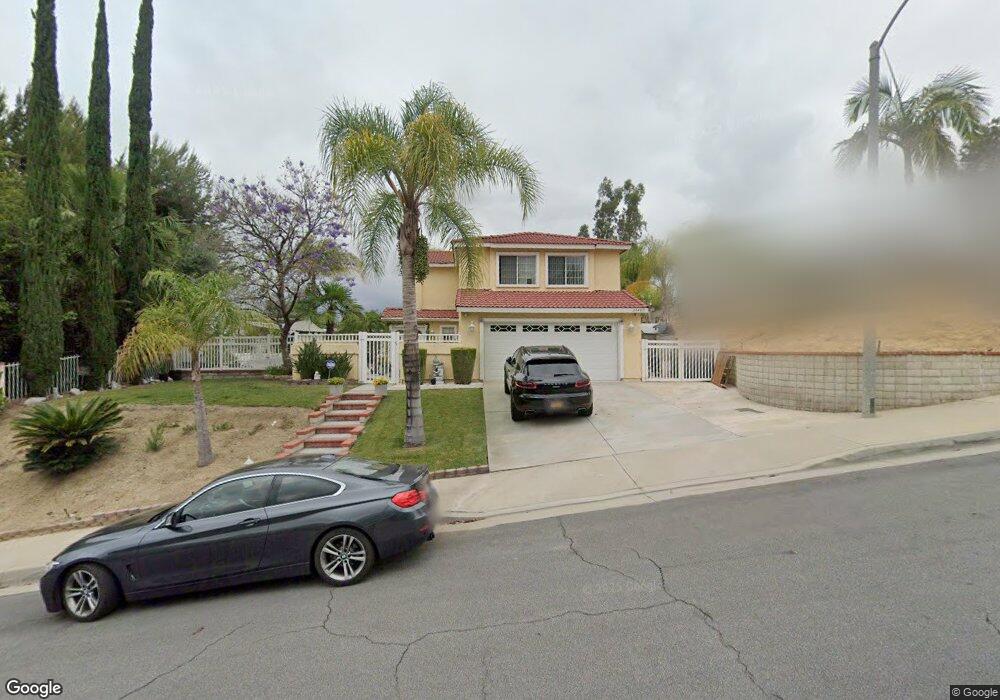

24409 Pikes Ct Diamond Bar, CA 91765

Estimated Value: $968,000 - $1,160,000

4

Beds

3

Baths

1,937

Sq Ft

$565/Sq Ft

Est. Value

About This Home

This home is located at 24409 Pikes Ct, Diamond Bar, CA 91765 and is currently estimated at $1,093,554, approximately $564 per square foot. 24409 Pikes Ct is a home located in Los Angeles County with nearby schools including Golden Springs Elementary School, Lorbeer Middle School, and Diamond Ranch High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 30, 2012

Sold by

Sarafian Yeghia Elo and Sarafian Salpie

Bought by

Sarafian Yeghia Elo and Sarafian Salpie

Current Estimated Value

Purchase Details

Closed on

Dec 28, 2011

Sold by

Sarafian Yeghia Flo and Sarafian Salpie

Bought by

Sarafian Yeghia Elo and Sarafian Salpie

Purchase Details

Closed on

Nov 21, 2000

Sold by

Blackstone Llc

Bought by

Sarafian Yeghia Elo and Sarafian Salpie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Outstanding Balance

$73,328

Interest Rate

7.81%

Estimated Equity

$1,020,226

Purchase Details

Closed on

Jul 12, 2000

Sold by

Tan James S and Tan Laura

Bought by

Blackstone Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sarafian Yeghia Elo | -- | None Available | |

| Sarafian Yeghia Elo | -- | None Available | |

| Sarafian Yeghia Elo | $265,500 | Fidelity Title | |

| Blackstone Llc | $199,400 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sarafian Yeghia Elo | $200,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,467 | $485,755 | $230,383 | $255,372 |

| 2024 | $6,467 | $476,231 | $225,866 | $250,365 |

| 2023 | $6,297 | $466,894 | $221,438 | $245,456 |

| 2022 | $6,150 | $457,741 | $217,097 | $240,644 |

| 2021 | $6,012 | $448,767 | $212,841 | $235,926 |

| 2019 | $6,138 | $435,458 | $206,529 | $228,929 |

| 2018 | $5,662 | $426,921 | $202,480 | $224,441 |

| 2016 | $5,314 | $410,345 | $194,618 | $215,727 |

| 2015 | $5,269 | $404,182 | $191,695 | $212,487 |

| 2014 | $5,235 | $396,265 | $187,940 | $208,325 |

Source: Public Records

Map

Nearby Homes

- 437 Carpio Dr

- 547 Bellows Ct

- 454 Ballena Dr

- 760 Featherwood Dr

- 24471 Rockbury Dr

- 24232 Sylvan Glen Rd Unit A

- 428 Golden Springs Dr Unit E

- 330 Ballena Dr

- 529 Bregante Dr

- 25 Franciscan Place

- 651 Radbury Place

- 23966 Decorah Rd

- 683 Radbury Place

- 536 N Del Sol Ln

- 980 Golden Springs Dr Unit A

- 17 Westbrook Ln

- 1030 Golden Springs Dr Unit B

- 901 Golden Springs Dr Unit E14

- 901 Golden Springs Dr Unit D13

- 24161 High Knob Rd

- 24415 Pikes Ct

- 428 Armitos Place

- 426 Armitos Place

- 24421 Pikes Ct

- 24445 Darrin Dr

- 420 Armitos Place

- 441 Wayside Place

- 444 Armitos Place

- 24427 Pikes Ct

- 414 Armitos Place

- 24439 Darrin Dr

- 24422 Pikes Ct

- 447 Wayside Place

- 24433 Pikes Ct

- 450 Armitos Place

- 24378 Northview Place

- 24432 Pikes Ct

- 24433 Darrin Dr

- 408 Armitos Place

- 24428 Pikes Ct