245 High Point Blvd Unit D Boynton Beach, FL 33435

Downtown Boynton NeighborhoodEstimated Value: $168,000 - $214,000

2

Beds

2

Baths

1,000

Sq Ft

$191/Sq Ft

Est. Value

About This Home

This home is located at 245 High Point Blvd Unit D, Boynton Beach, FL 33435 and is currently estimated at $191,115, approximately $191 per square foot. 245 High Point Blvd Unit D is a home located in Palm Beach County with nearby schools including Forest Park Elementary School, Boynton Beach Community High School, and Congress Community Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 12, 2010

Sold by

Pm Tramps Capital Llc

Bought by

Stanfield Cathy

Current Estimated Value

Purchase Details

Closed on

Apr 29, 2010

Sold by

Robertson Kurtis L

Bought by

Pm Tramps Capital Llc

Purchase Details

Closed on

Oct 6, 2005

Sold by

Larson Marjorie L

Bought by

Robertson Kurtis L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$143,000

Interest Rate

9.75%

Mortgage Type

Balloon

Purchase Details

Closed on

Aug 1, 1995

Sold by

Burton Roger and Burton Garold

Bought by

Larson Marjorie L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stanfield Cathy | $50,000 | None Available | |

| Pm Tramps Capital Llc | $20,600 | None Available | |

| Robertson Kurtis L | $143,000 | -- | |

| Larson Marjorie L | $49,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Robertson Kurtis L | $143,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $639 | $93,301 | -- | -- |

| 2024 | $639 | $90,672 | -- | -- |

| 2023 | $1,155 | $88,031 | $0 | $0 |

| 2022 | $1,115 | $85,467 | $0 | $0 |

| 2021 | $1,088 | $82,978 | $0 | $0 |

| 2020 | $1,071 | $81,832 | $0 | $0 |

| 2019 | $1,045 | $79,992 | $0 | $0 |

| 2018 | $983 | $78,500 | $0 | $78,500 |

| 2017 | $1,545 | $71,500 | $0 | $0 |

| 2016 | $1,415 | $52,575 | $0 | $0 |

| 2015 | $1,290 | $47,795 | $0 | $0 |

| 2014 | $1,207 | $43,450 | $0 | $0 |

Source: Public Records

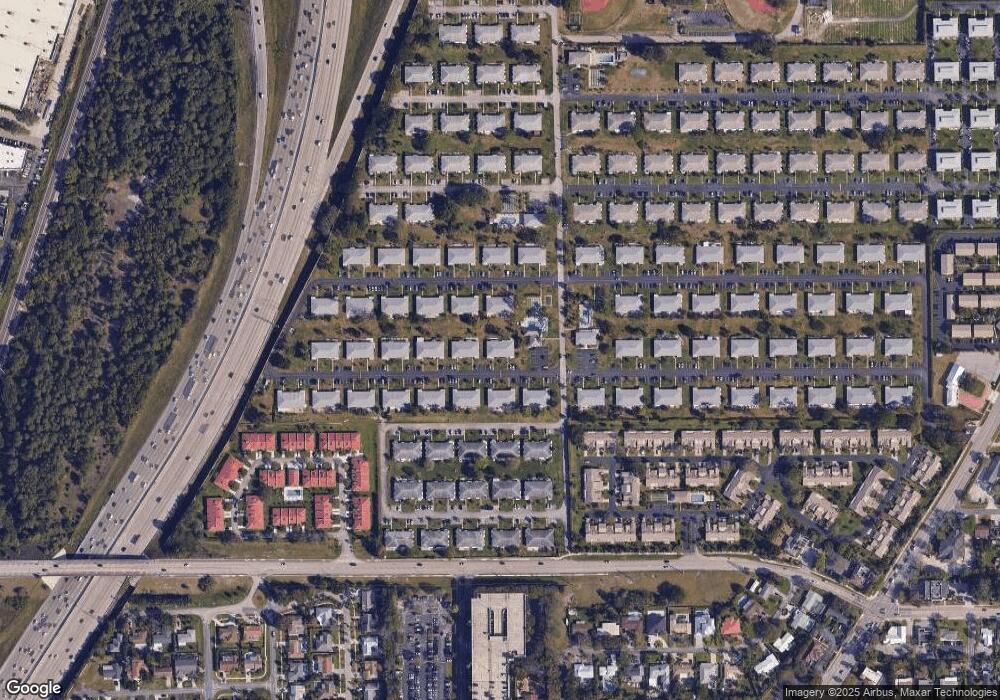

Map

Nearby Homes

- 200 N High Point Blvd Unit C

- 215 N High Point Blvd Unit B

- 280 High Point Blvd Unit C

- 210 South Blvd Unit C

- 215 South Blvd Unit C

- 240 N High Point Blvd Unit C

- 290 Main Blvd Unit C

- 330 Main Blvd Unit A

- 155 N High Point Blvd Unit A

- 260 High Point Blvd Unit C

- 260 South Blvd Unit A

- 245 High Point Ct Unit C

- 255 High Point Ct Unit C

- 360 Main Blvd Unit B

- 145 South Blvd Unit D

- 355 Main Blvd Unit C

- 355 Main Blvd Unit B

- 285 N High Point Blvd Unit A

- 270 High Point Ct Unit D

- 135 South Blvd Unit A

- 265 High Point Blvd

- 280 High Point Blvd Unit 280D

- 270 High Point Blvd Unit 270A

- 130 High Point Blvd Unit D

- 250 High Point Blvd Unit D

- 270 High Point Blvd Unit D

- 205 High Point Blvd Unit B

- 270 High Point Blvd Unit C

- 205 High Point Blvd Unit D

- 140 High Point Blvd Unit A

- 130 High Point Blvd Unit D

- 245 High Point Blvd Unit C

- 250 High Point Blvd Unit A

- 130 High Point Blvd Unit C

- 130 High Point Blvd Unit B

- 130 High Point Blvd Unit A

- 205 High Point Blvd Unit C

- 140 High Point Blvd Unit D

- 140 High Point Blvd Unit C

- 140 High Point Blvd Unit B