High Meadow Terrace 24501 Via Mar Monte Unit 82 Carmel, CA 93923

High Meadow NeighborhoodEstimated Value: $914,328 - $1,020,000

2

Beds

2

Baths

1,370

Sq Ft

$711/Sq Ft

Est. Value

About This Home

This home is located at 24501 Via Mar Monte Unit 82, Carmel, CA 93923 and is currently estimated at $973,582, approximately $710 per square foot. 24501 Via Mar Monte Unit 82 is a home located in Monterey County with nearby schools including Carmel River Elementary School, Carmel Middle School, and Carmel High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 30, 2013

Sold by

Hearn Bernice N

Bought by

Hearn Bernice N

Current Estimated Value

Purchase Details

Closed on

Oct 18, 2010

Sold by

Hearn Bernice N

Bought by

Hearn Bernice N

Purchase Details

Closed on

Apr 5, 2007

Sold by

Hearn Bernice N

Bought by

Hearn Bernice N

Purchase Details

Closed on

Nov 8, 2002

Sold by

Grasing Robert and Grasing Kathleen

Bought by

Hearn Bernice N

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$352,500

Outstanding Balance

$150,468

Interest Rate

6.28%

Estimated Equity

$823,114

Purchase Details

Closed on

Sep 10, 1998

Sold by

Usui Susumu and Usui Michiko

Bought by

Grasing Robert and Grasing Kathleen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$168,000

Interest Rate

6.89%

Mortgage Type

Unknown

Purchase Details

Closed on

Dec 2, 1994

Sold by

Emc Mtg Corp

Bought by

Emc Mtg Corp

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hearn Bernice N | -- | Accommodation | |

| Hearn Bernice N | -- | None Available | |

| Hearn Bernice N | -- | None Available | |

| Hearn Bernice N | $442,500 | Old Republic Title | |

| Grasing Robert | $275,000 | Stewart Title | |

| Emc Mtg Corp | $220,542 | First American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hearn Bernice N | $352,500 | |

| Previous Owner | Grasing Robert | $168,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,713 | $660,600 | $398,280 | $262,320 |

| 2024 | $7,713 | $647,648 | $390,471 | $257,177 |

| 2023 | $7,678 | $634,950 | $382,815 | $252,135 |

| 2022 | $7,510 | $622,501 | $375,309 | $247,192 |

| 2021 | $7,317 | $610,296 | $367,950 | $242,346 |

| 2020 | $7,155 | $604,040 | $364,178 | $239,862 |

| 2019 | $7,009 | $592,197 | $357,038 | $235,159 |

| 2018 | $6,837 | $580,587 | $350,038 | $230,549 |

| 2017 | $6,648 | $569,204 | $343,175 | $226,029 |

| 2016 | $6,498 | $558,045 | $336,447 | $221,598 |

| 2015 | $6,345 | $549,664 | $331,394 | $218,270 |

| 2014 | $6,224 | $538,898 | $324,903 | $213,995 |

Source: Public Records

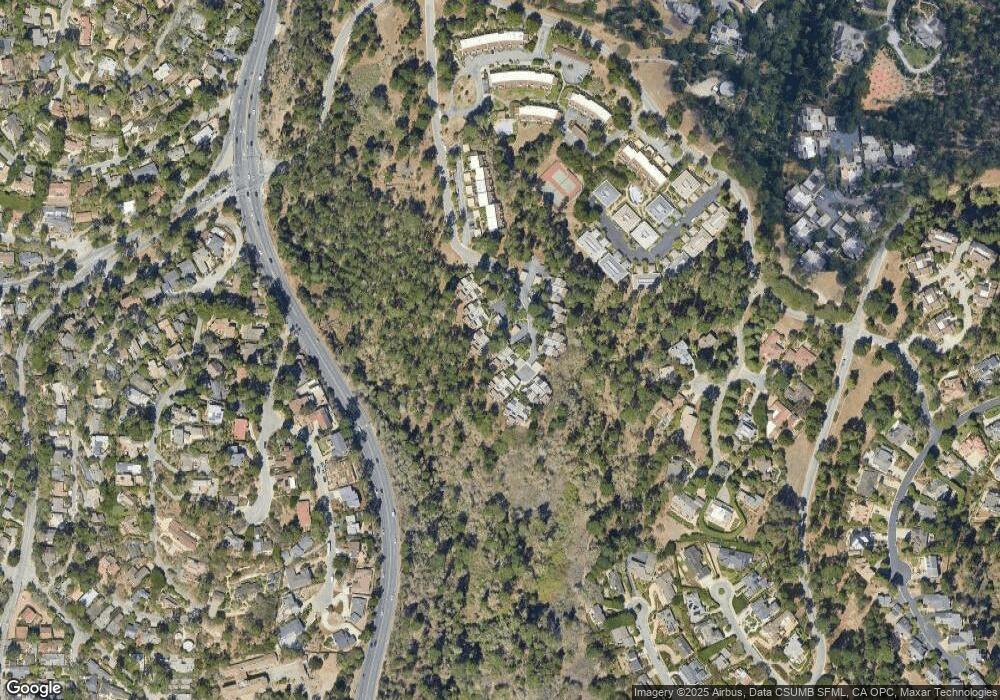

About High Meadow Terrace

Map

Nearby Homes

- 24501 Via Mar Monte Unit 48

- 3600 High Meadow Dr Unit 9

- 24751 Crestview Cir

- 24520 Outlook Dr Unit 24

- 24520 Outlook Dr Unit 8

- 3600 Via Mar Monte

- 24805 Lower Trail

- 3587 Eastfield Ct

- 3380 San Luis Ave

- 3721 Raymond Way

- 24320 San Pedro Ln

- 24429 Portola Ave

- 24703 Camino Del Monte

- 4 Guadalupe St

- 0 Aguajito Rd Unit ML82017412

- 24308 San Juan Rd

- 24587 Castro Ln

- 24424 San Juan Rd

- 24584 Castro Ln

- 24940 Outlook Dr

- 24501 Via Mar Monte

- 24501 Via Mar Monte Unit 56

- 24501 Via Mar Monte Unit 73

- 24501 Via Mar Monte Unit 71

- 24501 Via Mar Monte Unit 64

- 24501 Via Mar Monte Unit 64

- 24501 Via Mar Monte Unit 62

- 24501 Via Mar Monte Unit 61

- 24501 Via Mar Monte Unit 60

- 24501 Via Mar Monte Unit 59

- 24501 Via Mar Monte Unit 58

- 24501 Via Mar Monte Unit 57

- 24501 Via Mar Monte Unit 56

- 24501 Via Mar Monte Unit 55

- 24501 Via Mar Monte Unit 54

- 24501 Via Mar Monte Unit 53

- 24501 Via Mar Monte Unit 52

- 24501 Via Mar Monte Unit 51

- 24501 Via Mar Monte Unit 50

- 24501 Via Mar Monte Unit 49