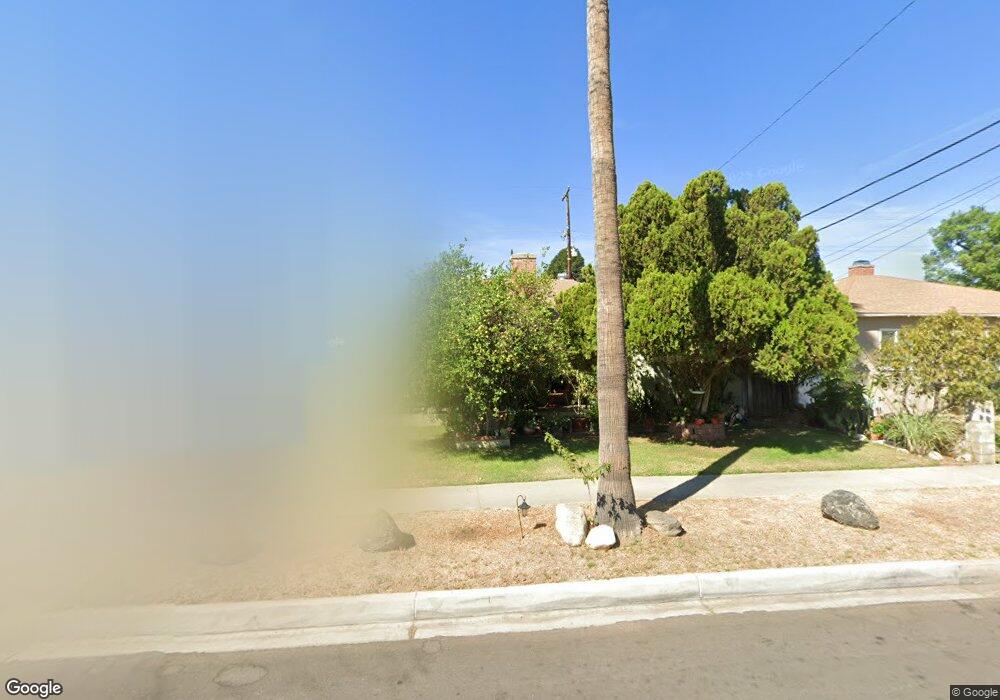

2451 El Sol Ave Altadena, CA 91001

Estimated Value: $707,000 - $879,000

3

Beds

1

Bath

1,157

Sq Ft

$707/Sq Ft

Est. Value

About This Home

This home is located at 2451 El Sol Ave, Altadena, CA 91001 and is currently estimated at $817,642, approximately $706 per square foot. 2451 El Sol Ave is a home located in Los Angeles County with nearby schools including Charles W. Eliot Arts Magnet Academy, John Muir High School, and Odyssey Charter School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 10, 2003

Sold by

Robles Alfredo and Garcia Maria Elvira

Bought by

Robles Alfredo

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$131,600

Outstanding Balance

$55,486

Interest Rate

5.15%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$762,156

Purchase Details

Closed on

Apr 27, 1998

Sold by

Robles Roberto and Garcia Juan A

Bought by

Robles Alfredo

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,592

Interest Rate

7.06%

Mortgage Type

FHA

Purchase Details

Closed on

May 7, 1993

Sold by

Stella Joseph J and Stella Josephine

Bought by

Robles Alfredo

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$146,260

Interest Rate

6.94%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Robles Alfredo | -- | Old Republic Title Company | |

| Robles Alfredo | -- | Gateway Title | |

| Robles Alfredo | $148,000 | United Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Robles Alfredo | $131,600 | |

| Closed | Robles Alfredo | $140,592 | |

| Previous Owner | Robles Alfredo | $146,260 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,245 | $239,110 | $166,353 | $72,757 |

| 2024 | $3,245 | $234,423 | $163,092 | $71,331 |

| 2023 | $3,213 | $229,828 | $159,895 | $69,933 |

| 2022 | $3,109 | $225,322 | $156,760 | $68,562 |

| 2021 | $2,933 | $220,905 | $153,687 | $67,218 |

| 2019 | $2,832 | $214,355 | $149,130 | $65,225 |

| 2018 | $2,786 | $210,153 | $146,206 | $63,947 |

| 2016 | $2,692 | $201,995 | $140,530 | $61,465 |

| 2015 | $2,663 | $198,962 | $138,420 | $60,542 |

| 2014 | $2,620 | $195,066 | $135,709 | $59,357 |

Source: Public Records

Map

Nearby Homes

- 2589 El Sol Ave

- 585 Mountain View St

- 114 116 Mountain View St

- 508 Vermont St

- 672 W Mendocino St

- 337 Figueroa Dr

- 309 Acacia St

- 343 W Woodbury Rd

- 1918 Linda Vista Ave

- 351 W Harriet St

- 2246 Glenrose Ave

- 2252 Glenrose Ave

- 660 Devirian Place

- 169 W Woodbury Rd

- 1897 Braemar Rd

- 637 W Altadena Dr

- 2698 Glenrose Ave

- 2191 El Sereno Ave

- 3117 Lincoln Ave

- 2415 Fair Oaks Ave

- 2459 El Sol Ave

- 2443 El Sol Ave

- 2467 El Sol Ave

- 841 Figueroa Dr

- 801 Figueroa Dr

- 2475 El Sol Ave

- 800 Neldome St

- 853 Figueroa Dr

- 849 Figueroa Dr

- 840 Neldome St

- 793 Figueroa Dr

- 2483 El Sol Ave

- 790 Neldome St

- 855 Figueroa Dr

- 859 Figueroa Dr

- 852 Neldome St

- 785 Figueroa Dr

- 840 Figueroa Dr

- 2491 El Sol Ave

- 782 Neldome St