2472 Amelia Ct Signal Hill, CA 90755

Estimated Value: $1,286,937 - $1,395,000

4

Beds

3

Baths

2,677

Sq Ft

$494/Sq Ft

Est. Value

About This Home

This home is located at 2472 Amelia Ct, Signal Hill, CA 90755 and is currently estimated at $1,322,984, approximately $494 per square foot. 2472 Amelia Ct is a home located in Los Angeles County with nearby schools including Alvarado Elementary, Nelson Academy, and Woodrow Wilson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 2, 2012

Sold by

Yoon Ok Hee and Ok Hee Yoon 2006 Revocable Tru

Bought by

Yoon Ok Hee

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Outstanding Balance

$207,213

Interest Rate

3.91%

Mortgage Type

New Conventional

Estimated Equity

$1,115,771

Purchase Details

Closed on

Jul 7, 2006

Sold by

Yoon Ok Hee

Bought by

Yoon Ok Hee and Ok Hee Yoon 2006 Revocable Tru

Purchase Details

Closed on

Jan 31, 2003

Sold by

Centex Homes

Bought by

Yoon Suk T and Yoon Ok Hee

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$322,700

Interest Rate

5.76%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Yoon Ok Hee | -- | Fidelity Van Nuys | |

| Yoon Ok Hee | -- | None Available | |

| Yoon Suk T | $474,000 | Commerce Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Yoon Ok Hee | $300,000 | |

| Closed | Yoon Suk T | $322,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,007 | $686,051 | $347,587 | $338,464 |

| 2024 | $9,007 | $672,600 | $340,772 | $331,828 |

| 2023 | $8,862 | $659,413 | $334,091 | $325,322 |

| 2022 | $8,329 | $646,485 | $327,541 | $318,944 |

| 2021 | $8,162 | $633,810 | $321,119 | $312,691 |

| 2019 | $8,047 | $615,013 | $311,596 | $303,417 |

| 2018 | $7,812 | $602,955 | $305,487 | $297,468 |

| 2017 | $7,730 | $591,134 | $299,498 | $291,636 |

| 2016 | $7,186 | $579,544 | $293,626 | $285,918 |

| 2015 | $6,828 | $570,840 | $289,216 | $281,624 |

| 2014 | $6,779 | $559,659 | $283,551 | $276,108 |

Source: Public Records

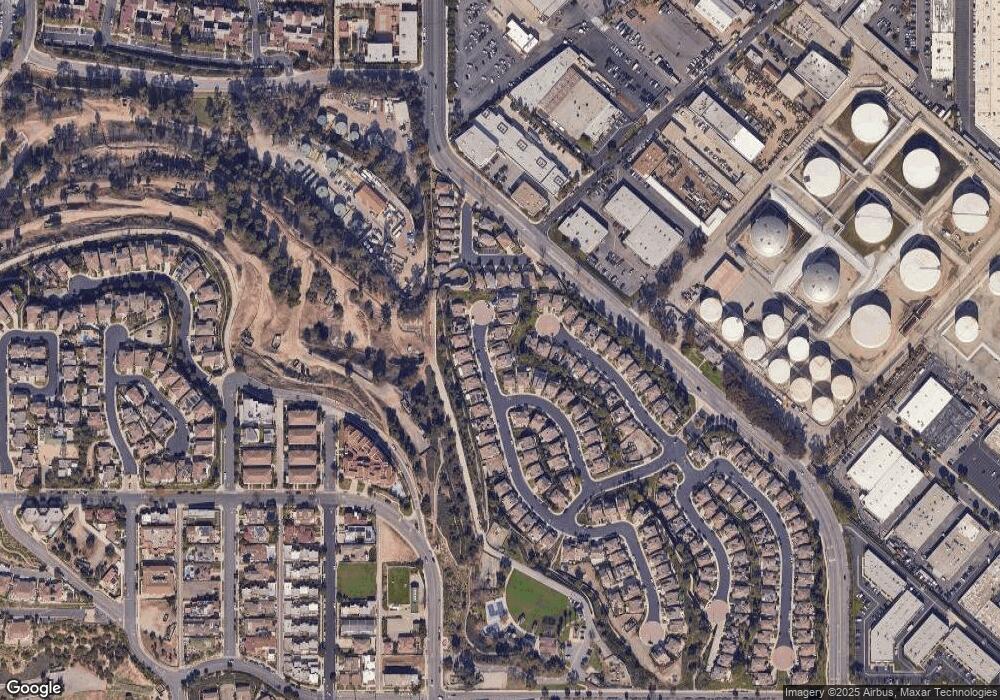

Map

Nearby Homes

- 2700 E Panorama Dr Unit 208

- 2700 E Panorama Dr Unit 402

- 2265 Ohio Ave

- 2215 Molino Ave Unit C

- 2240 Stanley Ave Unit 9

- 2510 E Willow St Unit 109

- 2150 Ohio Ave Unit E

- 2125 Temple Ave Unit 2

- 2125 Ridgeview Terrace Dr

- 2205 Starlight Ln

- 2722 E 20th St Unit 104

- 1995 Molino Ave Unit 301

- 1994 Stanley Ave

- 2604 E 20th St Unit 304F

- 3318 Ridge Park Ct Unit 3

- 2071 Raymond Ave

- 1988 Junipero Ave Unit 2

- 2231 Saint Louis Ave Unit 101B

- 3247 E Grant St

- 2240 N Legion Dr Unit 217