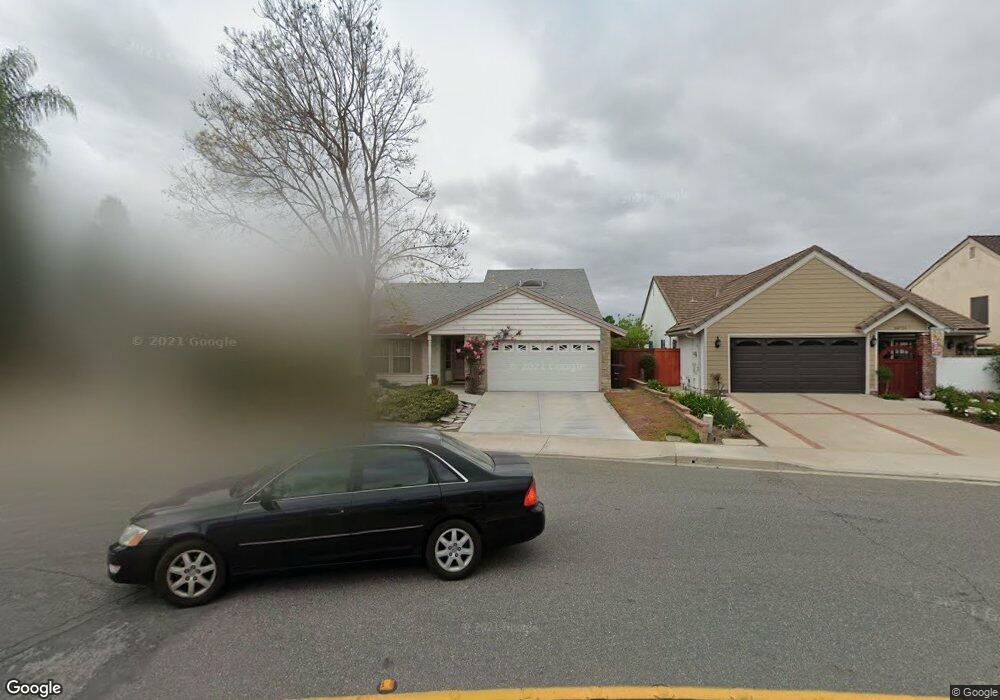

24721 Georgia Sue Laguna Hills, CA 92653

Estimated Value: $1,349,960 - $1,575,000

5

Beds

3

Baths

2,263

Sq Ft

$653/Sq Ft

Est. Value

About This Home

This home is located at 24721 Georgia Sue, Laguna Hills, CA 92653 and is currently estimated at $1,477,990, approximately $653 per square foot. 24721 Georgia Sue is a home located in Orange County with nearby schools including Lomarena Elementary School, Los Alisos Intermediate School, and Laguna Hills High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 1, 2004

Sold by

Finley Warren Telford

Bought by

Pscheidt Edward A

Current Estimated Value

Purchase Details

Closed on

Aug 20, 1996

Sold by

Finley Warren and Finley Marcia R

Bought by

Finley Warren Telford and Finley Childrens Trust

Purchase Details

Closed on

Mar 11, 1996

Sold by

Emc Mtg Corp

Bought by

Finley Warren and Finley Marcia R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$188,000

Interest Rate

6.98%

Purchase Details

Closed on

Nov 27, 1995

Sold by

Great Western Bank

Bought by

Emc Mtg Corp

Purchase Details

Closed on

Sep 21, 1995

Sold by

Vanvannguyen Khanh Van and Nguyen Ngoc Thu

Bought by

Great Western Bank

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pscheidt Edward A | -- | -- | |

| Finley Warren Telford | -- | -- | |

| Finley Warren | $235,000 | Chicago Title Co | |

| Emc Mtg Corp | $175,000 | Chicago Title Co | |

| Great Western Bank | $168,000 | Orange Coast Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Finley Warren | $188,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,776 | $875,816 | $663,568 | $212,248 |

| 2024 | $8,776 | $858,644 | $650,557 | $208,087 |

| 2023 | $8,568 | $841,808 | $637,801 | $204,007 |

| 2022 | $8,414 | $825,302 | $625,295 | $200,007 |

| 2021 | $8,245 | $809,120 | $613,034 | $196,086 |

| 2020 | $8,171 | $800,824 | $606,748 | $194,076 |

| 2019 | $8,007 | $785,122 | $594,851 | $190,271 |

| 2018 | $7,856 | $769,728 | $583,187 | $186,541 |

| 2017 | $7,394 | $725,000 | $560,541 | $164,459 |

| 2016 | $7,417 | $725,000 | $560,541 | $164,459 |

| 2015 | $7,439 | $725,000 | $563,404 | $161,596 |

| 2014 | $6,943 | $678,374 | $516,778 | $161,596 |

Source: Public Records

Map

Nearby Homes

- 24641 Paige Cir

- 24861 Camberwell St

- 24882 Avenida Avalon

- 660 Avenida Sevilla Unit P

- 25061 Silverleaf Ln

- 161 Avenida Majorca Unit C

- 661 Avenida Sevilla Unit O

- 199 Avenida Majorca Unit C

- 141 Avenida Majorca Unit B

- 783 Via Los Altos Unit A

- 662 Via Los Altos Unit N

- 662 Via Los Altos Unit P

- 214 Avenida Majorca Unit A

- 683 Via Alhambra Unit N

- 207 Avenida Majorca Unit A

- 24252 Palmek Cir

- 629 Avenida Sevilla Unit P

- 224 Avenida Majorca Unit A

- 665 Via Los Altos Unit A

- 620 Avenida Sevilla Unit N

- 24731 Georgia Sue

- 24711 Georgia Sue

- 24741 Georgia Sue

- 24745 Georgia Sue

- 24682 Jorie Dr

- 24751 Georgia Sue

- 24692 Jorie Dr

- 24651 Kim Cir

- 24761 Georgia Sue

- 24702 Jorie Dr

- 24661 Kim Cir

- 24671 Kim Cir

- 24771 Georgia Sue

- 24712 Jorie Dr

- 24681 Kim Cir

- 24646 Kim Cir

- 24781 Georgia Sue

- 24722 Jorie Dr

- 24592 Christina Ct

- 24652 Kim Cir