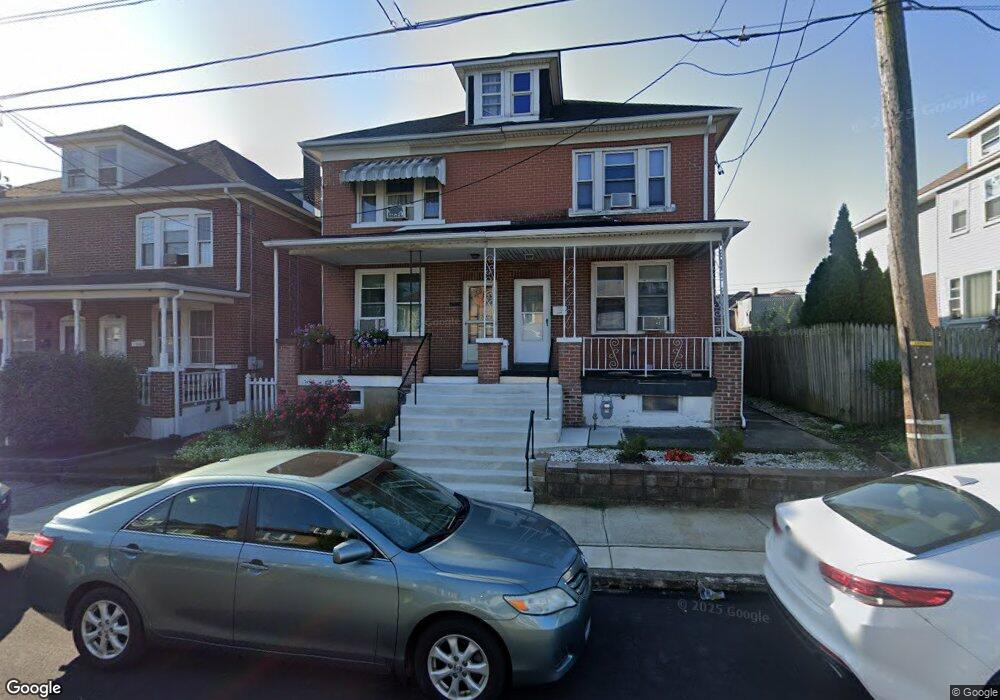

2476 Forest St Easton, PA 18042

Estimated Value: $230,000 - $238,000

3

Beds

1

Bath

1,280

Sq Ft

$184/Sq Ft

Est. Value

About This Home

This home is located at 2476 Forest St, Easton, PA 18042 and is currently estimated at $235,589, approximately $184 per square foot. 2476 Forest St is a home located in Northampton County with nearby schools including Wilson Area High School, Easton Arts Academy Elementary Cs, and St Jane Frances De Chantal School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 17, 2021

Sold by

Parminder Singh

Bought by

Kaur Harjinder and Since Parminder

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$97,750

Interest Rate

2.8%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 25, 2010

Sold by

Boehm James D and Boehm Lisa A

Bought by

Singh Parminder and Bilku Nirmal

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$118,405

Interest Rate

5.12%

Mortgage Type

FHA

Purchase Details

Closed on

Apr 30, 2001

Bought by

Boehm Ii James D and Boehm Lisa A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kaur Harjinder | -- | None Listed On Document | |

| Singh Parminder | $120,000 | First American Title Ins Co | |

| Boehm Ii James D | $70,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kaur Harjinder | $97,750 | |

| Previous Owner | Singh Parminder | $118,405 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $381 | $35,300 | $13,600 | $21,700 |

| 2024 | $3,395 | $35,300 | $13,600 | $21,700 |

| 2023 | $3,314 | $35,300 | $13,600 | $21,700 |

| 2022 | $3,303 | $35,300 | $13,600 | $21,700 |

| 2021 | $3,247 | $35,300 | $13,600 | $21,700 |

| 2020 | $3,212 | $35,300 | $13,600 | $21,700 |

| 2019 | $3,154 | $35,300 | $13,600 | $21,700 |

| 2018 | $3,004 | $35,300 | $13,600 | $21,700 |

| 2017 | $2,943 | $35,300 | $13,600 | $21,700 |

| 2016 | -- | $35,300 | $13,600 | $21,700 |

| 2015 | -- | $35,300 | $13,600 | $21,700 |

| 2014 | -- | $35,300 | $13,600 | $21,700 |

Source: Public Records

Map

Nearby Homes

- 2439 Hay St

- 0 1049 & 1051 S 25th St Unit 759228

- 2028 Ealer Ave

- 705 Sterlingworth Terrace

- 2024 Freemansburg Ave

- 2333 4th St

- 2303 4th St

- 2463 Hillside Ave

- 2247 Fairview Ave

- 1906 Hay Terrace

- 2721 Victoria Ln

- 1115 Keane St

- 0 Stewart St

- 2246 2nd St

- 1823 Hay Terrace

- 530 Milford St

- 220 S Kathryn St

- 2400 Lawnherst Ave

- 0 S Greenwood Ave Unit 11 737666

- 138 S 17th St