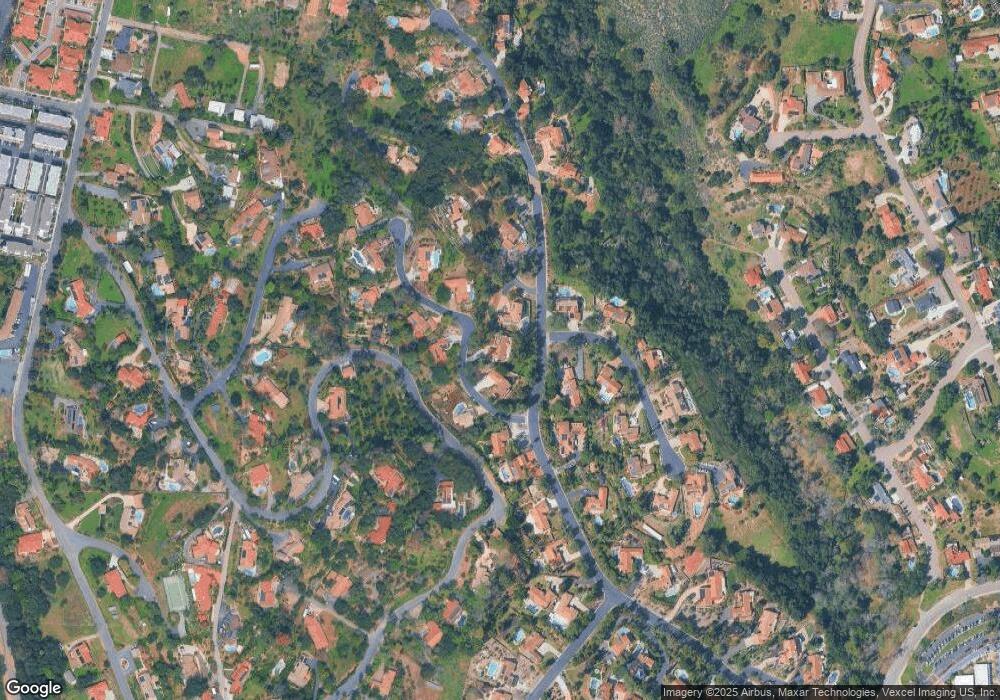

248 Tampico Glen Escondido, CA 92025

Kit Carson NeighborhoodEstimated Value: $1,215,295 - $1,345,000

4

Beds

3

Baths

2,580

Sq Ft

$490/Sq Ft

Est. Value

About This Home

This home is located at 248 Tampico Glen, Escondido, CA 92025 and is currently estimated at $1,264,824, approximately $490 per square foot. 248 Tampico Glen is a home located in San Diego County with nearby schools including L. R. Green Elementary School, Bear Valley Middle School, and San Pasqual High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 10, 2017

Sold by

Moebus Louis F and Moebus Jewell Lasley

Bought by

Gephart Bruce D and Gephart Cynthia L

Current Estimated Value

Purchase Details

Closed on

May 2, 2013

Sold by

Lasley Jewell D

Bought by

Moebus Louis F and Moebus Jewell Lasley

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Interest Rate

3.54%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 20, 2011

Sold by

Lasley Jewell D

Bought by

Lasley Jewell D

Purchase Details

Closed on

Jul 9, 2010

Sold by

Lasley S William and Lasley Jewell

Bought by

Lasley Jewell D

Purchase Details

Closed on

Jul 19, 2004

Sold by

Lasley S William and Lasley Jewell D

Bought by

Lasley S William and Lasley Jewell

Purchase Details

Closed on

Apr 21, 2004

Sold by

Allison Arthur V and Allison Della S

Bought by

Lasley S William and Lasley Jewell D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$560,000

Interest Rate

5.5%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 12, 1987

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gephart Bruce D | $735,500 | Wfg National Title | |

| Moebus Louis F | -- | Fidelity National Title | |

| Lasley Jewell D | -- | None Available | |

| Lasley Jewell D | -- | None Available | |

| Lasley S William | -- | -- | |

| Lasley S William | $700,000 | Fidelity National Title | |

| -- | $222,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Moebus Louis F | $150,000 | |

| Previous Owner | Lasley S William | $560,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,489 | $853,581 | $284,408 | $569,173 |

| 2024 | $9,489 | $836,845 | $278,832 | $558,013 |

| 2023 | $9,274 | $820,437 | $273,365 | $547,072 |

| 2022 | $9,174 | $804,351 | $268,005 | $536,346 |

| 2021 | $9,024 | $788,580 | $262,750 | $525,830 |

| 2020 | $8,971 | $780,495 | $260,056 | $520,439 |

| 2019 | $8,752 | $765,192 | $254,957 | $510,235 |

| 2018 | $8,509 | $750,189 | $249,958 | $500,231 |

| 2017 | $5,697 | $494,949 | $164,914 | $330,035 |

| 2016 | $5,588 | $485,245 | $161,681 | $323,564 |

| 2015 | $5,542 | $477,957 | $159,253 | $318,704 |

| 2014 | $5,312 | $468,596 | $156,134 | $312,462 |

Source: Public Records

Map

Nearby Homes

- 300 Tesoro Glen Unit 101

- 347 W Citracado Pkwy Unit 14

- Residence 4 Plan at Tesoro Square

- Residence 1 Plan at Tesoro Square

- Residence 2 Plan at Tesoro Square

- Residence 3 Plan at Tesoro Square

- 1365 Amanda Glen S

- 1374 S Amanda Glen S

- 440 W Citracado Pkwy Unit 16

- 440 Citracado Pkwy Unit 14

- 440 Citracado Pkwy Unit 30

- 363 Boulevard Park

- 2401 Sunset Dr

- 449 Atlas Glen

- 408 Carina Glen

- 2310 Stardust Glen

- 2147 Sunset Dr

- 2328 Columba Glen

- 2731 Peet Ln

- 2211 Sunset Dr

- 256 Tampico Glen

- 2641 Pasatiempo Glen

- 245 Tampico Glen

- 311 Saratoga Glen

- 255 Tampico Glen

- 236 Tampico Glen

- 308 Saratoga Glen

- 265 Tampico Glen

- 235 Tampico Glen

- 321 Saratoga Glen

- 2730 Pasatiempo Glen

- 316 Saratoga Glen

- 226 Tampico Glen

- 2625 Pasatiempo Glen

- 2739 Pasatiempo Glen

- 2785 Las Palmas Ave

- 331 Saratoga Glen

- 225 Tampico Glen

- 324 Saratoga Glen

- 2629 Pasatiempo Glen