24815 Via Pradera Calabasas, CA 91302

Estimated Value: $1,887,462 - $2,274,000

4

Beds

3

Baths

2,509

Sq Ft

$831/Sq Ft

Est. Value

About This Home

This home is located at 24815 Via Pradera, Calabasas, CA 91302 and is currently estimated at $2,085,116, approximately $831 per square foot. 24815 Via Pradera is a home located in Los Angeles County with nearby schools including Bay Laurel Elementary School, Alice C. Stelle Middle School, and Calabasas High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 3, 2010

Sold by

Eisner Jeffrey and Eisner Sheri

Bought by

Eisner Jeffrey and Eisner Sheri

Current Estimated Value

Purchase Details

Closed on

May 12, 1998

Sold by

Ivaska Gary A

Bought by

Eisner Jeffrey and Eisner Sheri

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$440,000

Interest Rate

7.03%

Purchase Details

Closed on

Oct 7, 1994

Sold by

Morgan Stephen R and Morgan Kathleen L

Bought by

Ivaska Gary Allen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$392,000

Interest Rate

3.95%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Eisner Jeffrey | -- | None Available | |

| Eisner Jeffrey | $550,000 | Progressive Title Company | |

| Ivaska Gary Allen | $490,000 | First American Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Eisner Jeffrey | $440,000 | |

| Previous Owner | Ivaska Gary Allen | $392,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,916 | $864,848 | $433,464 | $431,384 |

| 2024 | $10,916 | $847,891 | $424,965 | $422,926 |

| 2023 | $10,708 | $831,267 | $416,633 | $414,634 |

| 2022 | $10,345 | $814,968 | $408,464 | $406,504 |

| 2021 | $10,292 | $798,989 | $400,455 | $398,534 |

| 2019 | $9,912 | $775,292 | $388,578 | $386,714 |

| 2018 | $9,796 | $760,091 | $380,959 | $379,132 |

| 2016 | $9,291 | $730,578 | $366,167 | $364,411 |

| 2015 | $9,141 | $719,605 | $360,667 | $358,938 |

| 2014 | $9,018 | $705,510 | $353,603 | $351,907 |

Source: Public Records

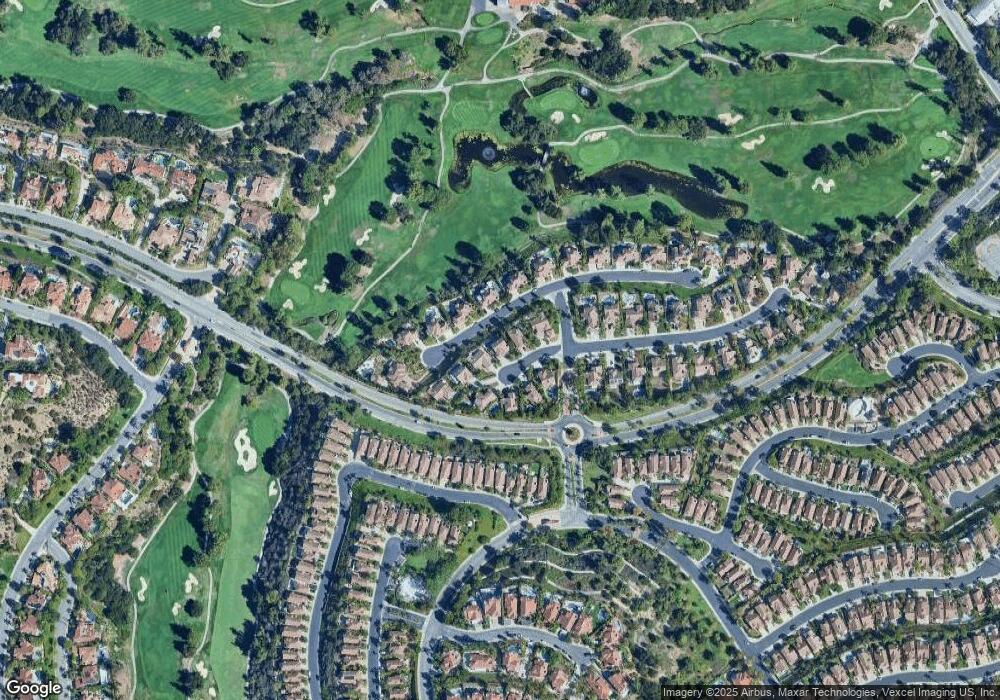

Map

Nearby Homes

- 3829 Calle Joaquin

- 24823 Alexandra Ct

- 3622 Reina Ct

- 3788 Camino Codorniz

- 24735 Calle Serranona

- 24409 Voltara Ct

- 24464 Park Granada

- 3467 Malaga Ct

- 4130 Prado de Los Caballos

- 24932 Normans Way

- 25230 Prado de Las Panteras

- 23777 Mulholland Hwy

- 23777 Mulholland Hwy Unit 108

- 23777 Mulholland Hwy Unit 70

- 23777 Mulholland Hwy Unit 89

- 23777 Mulholland Hwy Unit 118

- 23777 Mulholland Hwy Unit Sp 134

- 23777 Mulholland Hwy Unit 190

- 23777 Mulholland Hwy Unit 86

- 24809 Via Pradera

- 24819 Via Pradera

- 24823 Via Pradera

- 24827 Avenida Asoleada

- 24803 Via Pradera Unit B

- 24803 Via Pradera

- 24822 Via Pradera

- 24817 Avenida Asoleada

- 24818 Via Pradera

- 24806 Via Pradera

- 24814 Via Pradera

- 24837 Avenida Asoleada

- 24807 Avenida Asoleada

- 24825 Via Pradera

- 24751 Avenida Asoleada

- 24769 Via Pradera

- 24845 Avenida Asoleada

- 24770 Via Pradera

- 24849 Avenida Asoleada

- 24743 Avenida Asoleada