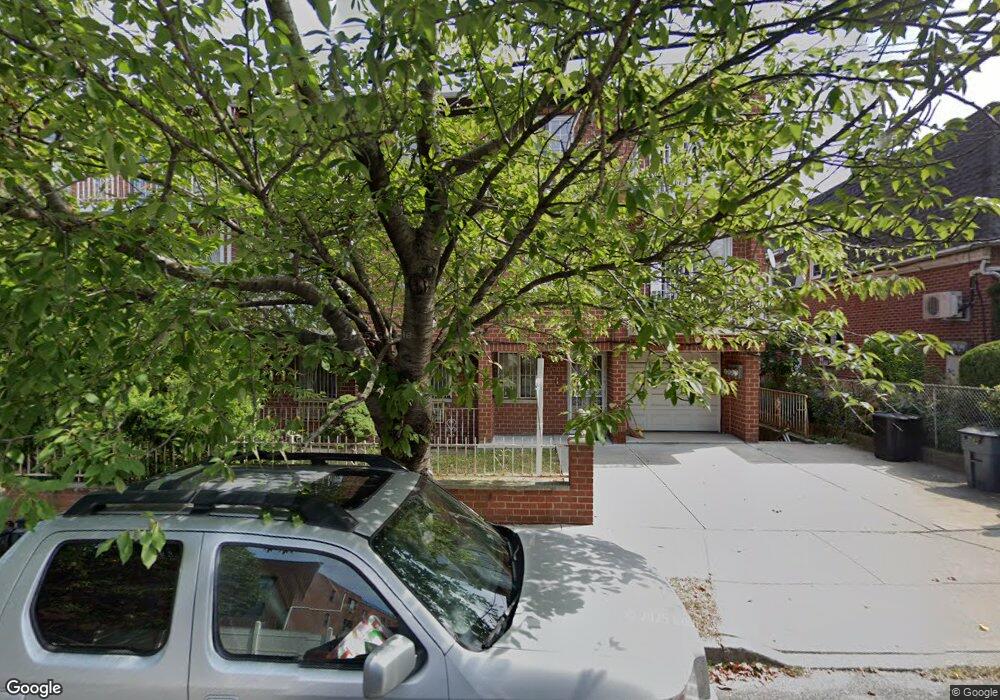

25-05 124th St Unit 2Fl Flushing, NY 11354

College Point NeighborhoodEstimated Value: $1,590,000 - $1,678,000

3

Beds

2

Baths

2,753

Sq Ft

$595/Sq Ft

Est. Value

About This Home

This home is located at 25-05 124th St Unit 2Fl, Flushing, NY 11354 and is currently estimated at $1,637,476, approximately $594 per square foot. 25-05 124th St Unit 2Fl is a home located in Queens County with nearby schools including P.S. 29, Jhs 185 Edward Bleeker, and Flushing High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 21, 2024

Sold by

Qu Xiao Qiong and Weng Liang Guo

Bought by

Li Jian and Shi Jinlan

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$650,000

Outstanding Balance

$642,970

Interest Rate

6.2%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$994,506

Purchase Details

Closed on

Nov 23, 2004

Sold by

Gailas Despina and Gailas George

Bought by

Qu Xiao Qiong and Weng Liang Guo

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$516,000

Interest Rate

5.63%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 25, 1995

Sold by

Artman Robert

Bought by

Kapetanos John and Kapetanos Alexandra

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$210,000

Interest Rate

7.37%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Li Jian | $1,600,000 | -- | |

| Li Jian | $1,600,000 | -- | |

| Qu Xiao Qiong | $782,000 | -- | |

| Qu Xiao Qiong | $782,000 | -- | |

| Kapetanos John | $300,000 | Commonwealth Land Title Ins | |

| Kapetanos John | $300,000 | Commonwealth Land Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Li Jian | $650,000 | |

| Closed | Li Jian | $650,000 | |

| Previous Owner | Qu Xiao Qiong | $516,000 | |

| Previous Owner | Kapetanos John | $210,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,000 | $58,051 | $7,387 | $50,664 |

| 2024 | $11,000 | $54,766 | $8,071 | $46,695 |

| 2023 | $10,377 | $51,667 | $6,468 | $45,199 |

| 2022 | $10,027 | $65,100 | $9,780 | $55,320 |

| 2021 | $10,495 | $69,660 | $9,780 | $59,880 |

| 2020 | $9,944 | $76,560 | $9,780 | $66,780 |

| 2019 | -- | $73,380 | $9,780 | $63,600 |

| 2018 | -- | $43,056 | $5,790 | $37,266 |

| 2017 | $8,477 | $43,056 | $6,690 | $36,366 |

| 2016 | $8,232 | $43,056 | $6,690 | $36,366 |

Source: Public Records

Map

Nearby Homes

- 12411 25th Ave

- 12214 25th Ave Unit 3A

- 2559 123rd St

- 12206 25th Ave Unit 2A

- 5-05 College Point Blvd

- 25-72 127th St

- 2354 128th St

- 122-08 23rd Ave

- 23-47 128th St

- 22-40 125th St

- 126-01 23rd Ave

- 23-24 128th St

- 25-56 120th St Unit 2C

- 2232 124th St

- 11950 27th Ave

- 25-2 120th St Unit Fl 2

- 2220 126th St

- 119-26 27th Ave

- 2348 130th St

- 2201 125th St

- 25-05 124th St Unit 1st Fl

- 25-05 124th St Unit 2nd Fl

- 2505 124th St Unit 2nd

- 2505 124th St Unit 2Fl

- 2505 124th St Unit 1st Fl

- 2505 124th St Unit 2nd Fl

- 25-05 124th St Unit 2nd

- 2505 124th St

- 25-03 124th St

- 25-03 124th St Unit 1

- 2503 124th St

- 12408 25th Ave

- 2513 124th St

- 124-10 25th Ave

- 12410 25th Ave

- 2515 124th St

- 12412 25th Ave

- 12318 25th Ave

- 2517 124th St

- 12414 25th Ave Unit 2nd Fl