25 Middleton Ct SE Unit 25 Smyrna, GA 30080

Estimated Value: $247,619 - $266,000

2

Beds

2

Baths

1,404

Sq Ft

$183/Sq Ft

Est. Value

About This Home

This home is located at 25 Middleton Ct SE Unit 25, Smyrna, GA 30080 and is currently estimated at $256,405, approximately $182 per square foot. 25 Middleton Ct SE Unit 25 is a home located in Cobb County with nearby schools including Smyrna Elementary School, Campbell Middle School, and Campbell High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 26, 2006

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Berman Ellen B

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$74,600

Interest Rate

6.52%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 7, 2006

Sold by

Wells Fargo Bank Na

Bought by

Federal Home Loan Mortgage Corporation

Purchase Details

Closed on

Oct 12, 2001

Sold by

Odom Betty G

Bought by

Dannemann Lisa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,800

Interest Rate

5.75%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 30, 1995

Sold by

Cardin Patricia P

Bought by

Odom Betty G

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Berman Ellen B | $93,250 | -- | |

| Federal Home Loan Mortgage Corporation | -- | -- | |

| Wells Fargo Bank Na | $84,128 | -- | |

| Dannemann Lisa | $101,000 | -- | |

| Odom Betty G | $64,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Berman Ellen B | $74,600 | |

| Previous Owner | Dannemann Lisa | $80,800 | |

| Closed | Odom Betty G | $0 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $294 | $112,488 | $40,000 | $72,488 |

| 2024 | $294 | $112,488 | $40,000 | $72,488 |

| 2023 | $142 | $104,708 | $32,000 | $72,708 |

| 2022 | $294 | $87,796 | $8,800 | $78,996 |

| 2021 | $304 | $71,492 | $8,800 | $62,692 |

| 2020 | $303 | $68,620 | $8,800 | $59,820 |

| 2019 | $302 | $62,576 | $8,800 | $53,776 |

| 2018 | $302 | $62,576 | $8,800 | $53,776 |

| 2017 | $242 | $49,936 | $8,000 | $41,936 |

| 2016 | $242 | $44,968 | $8,000 | $36,968 |

| 2015 | $204 | $36,684 | $8,800 | $27,884 |

| 2014 | $172 | $31,696 | $0 | $0 |

Source: Public Records

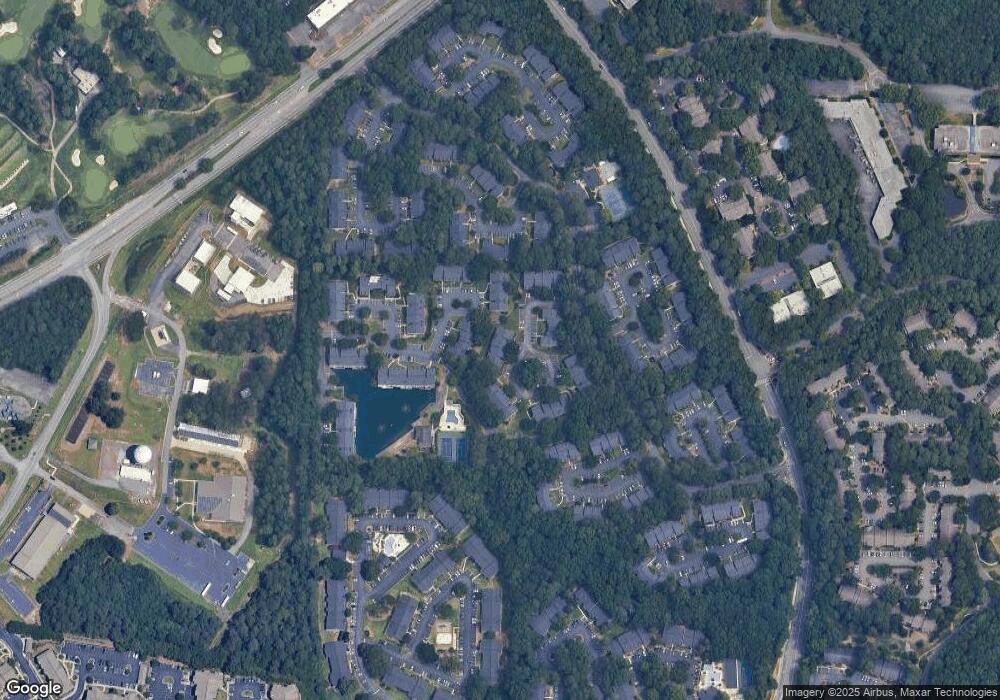

Map

Nearby Homes

- 14 Muncy Ct SE

- 64 Middleton Ct SE Unit 64

- 21 Muncy Ct SE

- 31 Muncy Ct SE

- 72 Fair Haven Way SE

- 75 Fair Haven Way SE

- 36 Doranne Ct SE

- 47 Arbor End SE

- 51 Doranne Ct SE

- 26 Springhedge Ct SE

- 35 Rumson Ct SE

- 0 Northwest Dr

- 2042 Brightleaf Way Unit 104

- 2030 Brightleaf Way Unit 101

- 2097 Brightleaf Way Unit 116

- 1704 Evenstad Way

- 2909 Ferrington Way

- 26 Middleton Ct SE Unit 26

- 28 Middleton Ct SE

- 27 Middleton Ct SE

- 26 Middleton Ct SE

- 24 Middleton Ct SE

- 23 Middleton Ct SE

- 22 Middleton Ct SE

- 21 Middleton Ct SE

- 26 Middleton Ct SE Unit 47

- 13 Matawan Cir SE Unit 13

- 18 Matawan Cir SE

- 16 Matawan Cir SE

- 15 Matawan Cir SE Unit 15

- 14 Matawan Cir SE

- 13 Matawan Cir SE

- 13 Matawan Cir SE Unit 48

- 11 Matawan Cir SE Unit 11

- 12 Matawan Cir SE

- 35 Middleton Ct SE

- 31 Middleton Ct SE