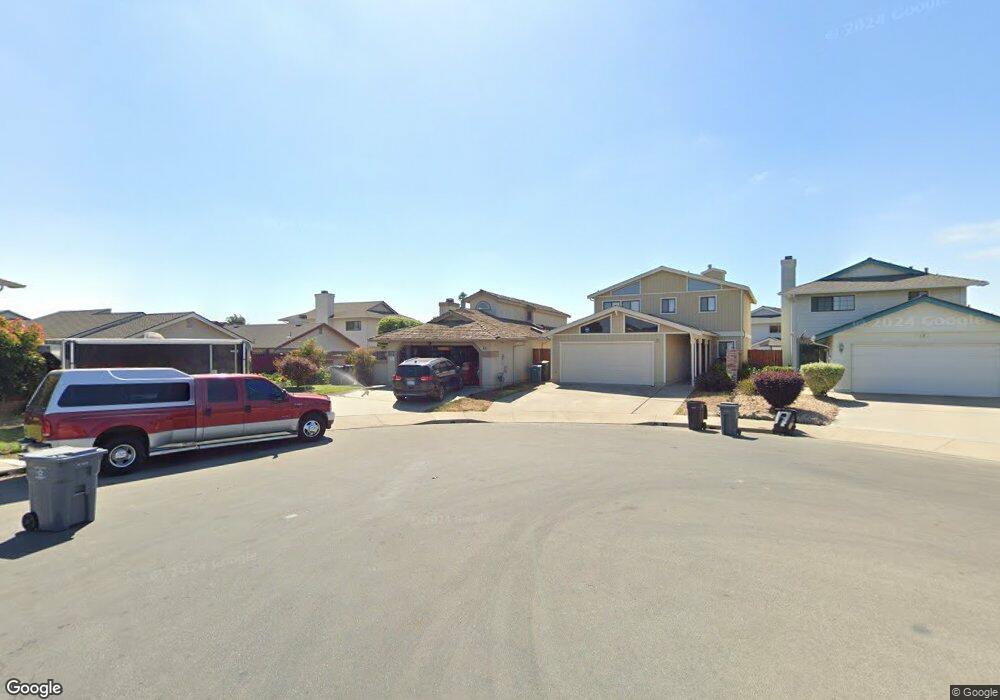

25 Sepulveda Cir Salinas, CA 93906

Northridge NeighborhoodEstimated Value: $698,000 - $734,895

3

Beds

2

Baths

1,549

Sq Ft

$463/Sq Ft

Est. Value

About This Home

This home is located at 25 Sepulveda Cir, Salinas, CA 93906 and is currently estimated at $716,474, approximately $462 per square foot. 25 Sepulveda Cir is a home located in Monterey County with nearby schools including Henry F. Kammann Elementary School, Boronda Meadows Elementary School, and Harden Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 6, 2011

Sold by

Biehn Adela J and Caputo Adela J

Bought by

Caputo Adela J

Current Estimated Value

Purchase Details

Closed on

Feb 24, 2003

Sold by

Biehn Adela J

Bought by

Biehn Adela J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$128,000

Outstanding Balance

$54,739

Interest Rate

5.93%

Estimated Equity

$661,735

Purchase Details

Closed on

Feb 19, 2003

Sold by

Fahey Robert M

Bought by

Biehn Adela J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$128,000

Outstanding Balance

$54,739

Interest Rate

5.93%

Estimated Equity

$661,735

Purchase Details

Closed on

Apr 30, 2002

Sold by

Biehn Michael R

Bought by

Biehn Adela J

Purchase Details

Closed on

Sep 22, 2000

Sold by

Schwartz Robert H and Schwartz Peggy

Bought by

Fahey Robert M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$221,250

Interest Rate

7.98%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Caputo Adela J | -- | None Available | |

| Biehn Adela J | -- | Stewart Title | |

| Biehn Adela J | -- | Stewart Title | |

| Biehn Adela J | -- | Stewart Title | |

| Fahey Robert M | $295,000 | Fidelity National Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Biehn Adela J | $128,000 | |

| Previous Owner | Fahey Robert M | $221,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,147 | $444,517 | $150,681 | $293,836 |

| 2024 | $3,147 | $435,802 | $147,727 | $288,075 |

| 2023 | $3,103 | $427,258 | $144,831 | $282,427 |

| 2022 | $3,076 | $418,882 | $141,992 | $276,890 |

| 2021 | $2,949 | $410,669 | $139,208 | $271,461 |

| 2020 | $2,898 | $406,459 | $137,781 | $268,678 |

| 2019 | $2,888 | $398,490 | $135,080 | $263,410 |

| 2018 | $2,871 | $390,678 | $132,432 | $258,246 |

| 2017 | $2,888 | $383,019 | $129,836 | $253,183 |

| 2016 | $4,283 | $375,510 | $127,291 | $248,219 |

| 2015 | $4,156 | $356,000 | $121,000 | $235,000 |

| 2014 | $3,070 | $277,000 | $94,000 | $183,000 |

Source: Public Records

Map

Nearby Homes

- 316 Quintero Cir

- 1515 Aragon Cir

- 730 N Main St

- 1588 Cherokee Dr

- 438 Seminole Way

- 1680 Seville St

- 1518 Duran Cir

- 1807 Cherokee Dr Unit 3

- 530 Inca Way

- 1607 Cuevas Cir

- 1635 Cherokee Dr

- 344 Pueblo Dr

- 1829 Delancey Dr

- 1823 Broadway Dr

- 427 W Laurel Dr Unit A

- 336 Rainier Dr

- 1421 Amador Cir

- 55 San Juan Grade Rd Unit 18

- 55 San Juan Grade Rd Unit 63

- 1443 Parsons Ave

- 21 Sepulveda Cir

- 234 Alhambra St

- 17 Sepulveda Cir

- 240 Alhambra St

- 228 Alhambra St

- 246 Alhambra St

- 222 Alhambra St

- 13 Sepulveda Cir

- 252 Alhambra St

- 216 Alhambra St

- 9 Sepulveda Cir

- 1532 Sepulveda Dr

- 1534 Sepulveda Dr

- 258 Alhambra St

- 1538 Sepulveda Dr

- 1536 Sepulveda Dr

- 24 Sepulveda Cir

- 1540 Sepulveda Dr

- 210 Alhambra St

- 5 Sepulveda Cir