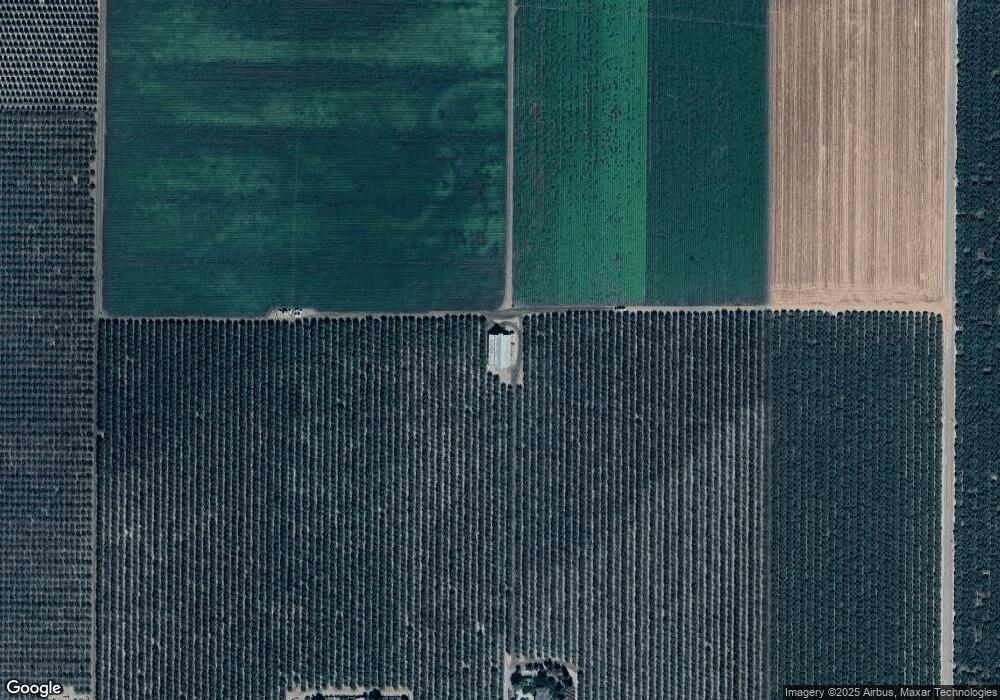

25155 Jorgensen Rd Newman, CA 95360

Estimated Value: $1,010,000 - $1,587,844

6

Beds

5

Baths

4,897

Sq Ft

$271/Sq Ft

Est. Value

About This Home

This home is located at 25155 Jorgensen Rd, Newman, CA 95360 and is currently estimated at $1,326,281, approximately $270 per square foot. 25155 Jorgensen Rd is a home located in Stanislaus County with nearby schools including Orestimba High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 30, 2024

Sold by

Escobar Richard J

Bought by

Perez Kyle and Perez Samantha A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,018,400

Outstanding Balance

$1,004,708

Interest Rate

7.1%

Mortgage Type

Seller Take Back

Estimated Equity

$321,573

Purchase Details

Closed on

Dec 7, 2020

Sold by

J & R Farms

Bought by

Escobar Richard J

Purchase Details

Closed on

Jul 28, 2004

Sold by

Escobar Joseph R and Escobar Joseph R

Bought by

J & R Farms

Purchase Details

Closed on

Jan 1, 1985

Sold by

Escobar Joseph R and Escobar Rosalyn V

Bought by

Escobar Joseph R and Escobar Rosalyn V

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Perez Kyle | $1,520,000 | Wfg National Title Insurance C | |

| Escobar Richard J | $679,000 | None Available | |

| J & R Farms | -- | Fidelity National Title | |

| Escobar Joseph R | -- | -- | |

| Escobar Joseph R | -- | -- | |

| Escobar Joseph R | -- | -- | |

| Escobar Rosalyn V | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Perez Kyle | $1,018,400 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $14,183 | $1,178,608 | $349,037 | $829,571 |

| 2024 | $11,495 | $951,667 | $296,392 | $655,275 |

| 2023 | $11,365 | $951,024 | $289,820 | $661,204 |

| 2022 | $10,601 | $884,513 | $281,968 | $602,545 |

| 2021 | $6,764 | $560,826 | $146,392 | $414,434 |

| 2020 | $6,589 | $551,165 | $141,226 | $409,939 |

| 2019 | $6,414 | $522,945 | $137,264 | $385,681 |

| 2018 | $5,842 | $497,185 | $118,966 | $378,219 |

| 2017 | $6,314 | $485,210 | $114,307 | $370,903 |

| 2016 | $6,034 | $473,955 | $110,224 | $363,731 |

| 2015 | $3,190 | $259,407 | $86,103 | $173,304 |

| 2014 | $3,166 | $254,728 | $84,417 | $170,311 |

Source: Public Records

Map

Nearby Homes

- 0 Anderson Rd

- 19054 California 33

- 572 St Helena Dr

- 728 R St

- 100-ac Draper Rd

- 737 Orestimba Peak Dr

- 662 Cedar Mountain Dr

- 1441 Kern St

- 1059 Q St

- 0 E Stuhr Rd

- 1625 Blue Spruce Way

- 24 Armstrong Rd

- 1235 N St

- 1938 Taylor Ave

- 1122 Fresno St

- 613 Ranee Ct

- 1542 Corgiat Dr

- 507 Lady Slipper Ln

- 1233 Amy Dr

- 619-657 Inyo Ave