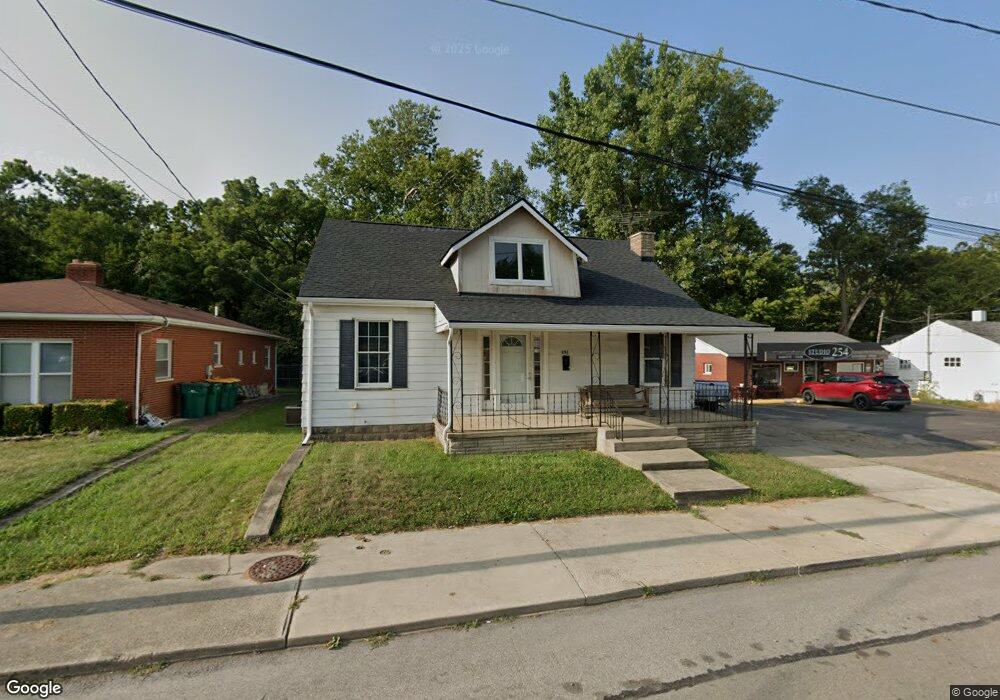

252 E Main St West Jefferson, OH 43162

Estimated Value: $235,000 - $271,000

3

Beds

3

Baths

1,698

Sq Ft

$153/Sq Ft

Est. Value

About This Home

This home is located at 252 E Main St, West Jefferson, OH 43162 and is currently estimated at $259,296, approximately $152 per square foot. 252 E Main St is a home located in Madison County with nearby schools including Norwood Elementary School, West Jefferson Middle School, and West Jefferson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 27, 2003

Sold by

Est Estel Scott

Bought by

Cutler Chad J and Cutler Terry L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$60,000

Outstanding Balance

$27,889

Interest Rate

7%

Mortgage Type

New Conventional

Estimated Equity

$231,407

Purchase Details

Closed on

Jan 13, 2003

Sold by

Hannah Perry

Bought by

Cutler Chad J and Cutler Terry L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$60,000

Outstanding Balance

$27,889

Interest Rate

7%

Mortgage Type

New Conventional

Estimated Equity

$231,407

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cutler Chad J | $76,000 | -- | |

| Cutler Chad J | $76,000 | Marketable Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cutler Chad J | $60,000 | |

| Closed | Cutler Chad J | $60,800 | |

| Closed | Cutler Chad J | $5,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,538 | $57,280 | $15,780 | $41,500 |

| 2023 | $2,538 | $57,280 | $15,780 | $41,500 |

| 2022 | $1,988 | $41,750 | $11,500 | $30,250 |

| 2021 | $1,996 | $41,750 | $11,500 | $30,250 |

| 2020 | $2,032 | $41,750 | $11,500 | $30,250 |

| 2019 | $2,076 | $41,990 | $10,500 | $31,490 |

| 2018 | $1,931 | $41,990 | $10,500 | $31,490 |

| 2017 | $1,934 | $41,990 | $10,500 | $31,490 |

| 2016 | $1,712 | $36,440 | $10,500 | $25,940 |

| 2015 | $1,712 | $36,440 | $10,500 | $25,940 |

| 2014 | $3,455 | $36,440 | $10,500 | $25,940 |

| 2013 | -- | $42,820 | $11,960 | $30,860 |

Source: Public Records

Map

Nearby Homes

- 63 Jones St

- 360 State Route 142 NE

- 304 Middle Dr

- 622 Brookdale Dr

- 700 Shawn Dr Unit 88

- 10763 Southwood Rd

- 0 W Jeff Kiousville Rd Unit 225000725

- 125 Dogwood Ct

- 8629 Canyon Cove Rd

- 8548 Canyon Cove Rd

- 8830 Hubbard Dr N

- 8873 Canoe Dr

- 749 Hubbard Rd

- 8482 Dover Crest Ct

- 1000 W Main St Unit 120

- 9519 High Free Pike

- 1280 Four Star Dr W

- 1278 Lieutenant Dr

- 0 Dellinger Rd Unit 9 2030113

- 1890 Wilson Rd SE