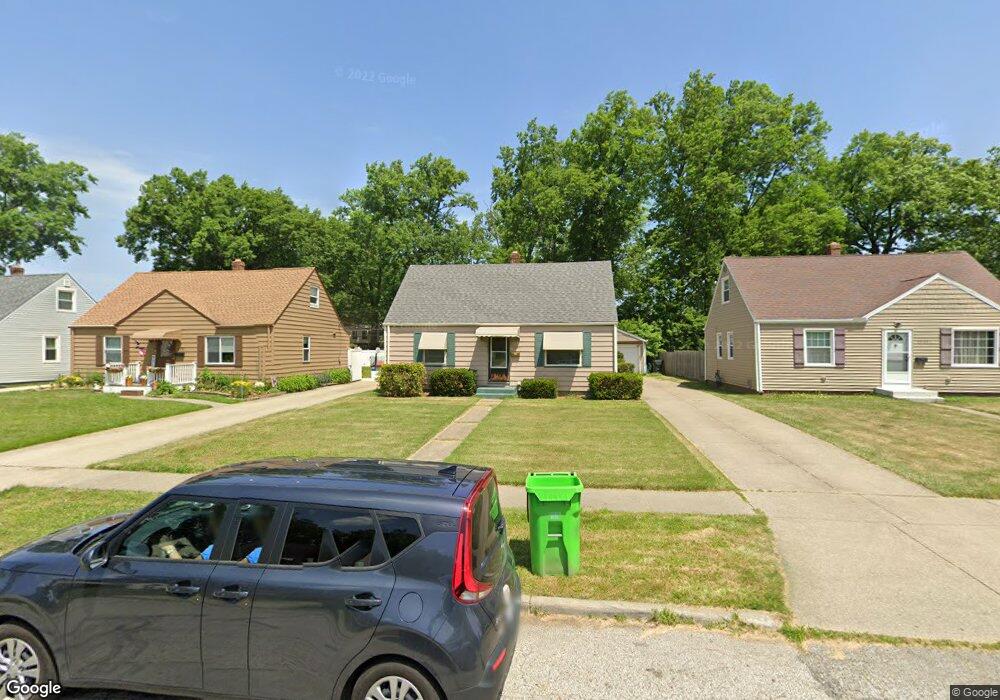

25291 Richards Ave Euclid, OH 44132

Estimated Value: $124,111 - $145,000

4

Beds

1

Bath

1,164

Sq Ft

$118/Sq Ft

Est. Value

About This Home

This home is located at 25291 Richards Ave, Euclid, OH 44132 and is currently estimated at $137,278, approximately $117 per square foot. 25291 Richards Ave is a home located in Cuyahoga County with nearby schools including Shoreview Elementary School, Euclid High School, and Ss Robert & William Catholic School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 23, 2008

Sold by

Lasalle Bank Na

Bought by

Jackson Charles

Current Estimated Value

Purchase Details

Closed on

Nov 17, 2006

Sold by

Bartram Mark A and Bartram Kim A

Bought by

Lasalle Bank Na and The Holders Of The Structured Asset Secu

Purchase Details

Closed on

Mar 11, 2003

Sold by

Watkins Irene L

Bought by

Bartram Mark A and Bartram Kim A

Purchase Details

Closed on

May 13, 1983

Sold by

Watkins Joseph J and I L

Bought by

Irene L Watkins

Purchase Details

Closed on

Jan 1, 1975

Bought by

Watkins Joseph J and I L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jackson Charles | $33,500 | Prism Title & Closing | |

| Lasalle Bank Na | $56,667 | Attorney | |

| Bartram Mark A | -- | -- | |

| Irene L Watkins | -- | -- | |

| Watkins Joseph J | -- | -- |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,816 | $39,935 | $9,275 | $30,660 |

| 2023 | $2,488 | $28,010 | $7,040 | $20,970 |

| 2022 | $2,433 | $28,000 | $7,040 | $20,970 |

| 2021 | $2,711 | $28,000 | $7,040 | $20,970 |

| 2020 | $2,570 | $24,120 | $6,060 | $18,060 |

| 2019 | $2,315 | $68,900 | $17,300 | $51,600 |

| 2018 | $2,337 | $24,120 | $6,060 | $18,060 |

| 2017 | $2,441 | $21,040 | $5,040 | $16,000 |

| 2016 | $2,447 | $21,040 | $5,040 | $16,000 |

| 2015 | $2,233 | $21,040 | $5,040 | $16,000 |

| 2014 | $2,233 | $21,040 | $5,040 | $16,000 |

Source: Public Records

Map

Nearby Homes

- 25650 Richards Ave

- 25700 Briardale Ave

- 25751 Briardale Ave

- 25401 Farringdon Ave

- 650 E 260th St

- 464 E 250th St

- 25671 Farringdon Ave

- 24871 Farringdon Ave

- 25151 Zeman Ave

- 25731 Zeman Ave

- 24891 Zeman Ave

- 825 E 256th St

- 571 E 260th St

- 368 E 248th St

- 26430 Drakefield Ave

- 26351 Farringdon Ave

- 24181 Devoe Ave

- 26471 Shoreview Ave

- 24571 Alberton Rd

- 610 E 266th St

- 25301 Richards Ave

- 25281 Richards Ave

- 25271 Richards Ave

- 25351 Richards Ave

- 25290 Briardale Ave

- 25251 Richards Ave

- 25300 Briardale Ave

- 25371 Richards Ave

- 25280 Briardale Ave

- 25270 Briardale Ave

- 25350 Briardale Ave

- 25290 Richards Ave

- 25201 Richards Ave

- 25300 Richards Ave

- 25280 Richards Ave

- 25391 Richards Ave

- 25250 Briardale Ave

- 25370 Briardale Ave

- 25350 Richards Ave

- 25270 Richards Ave