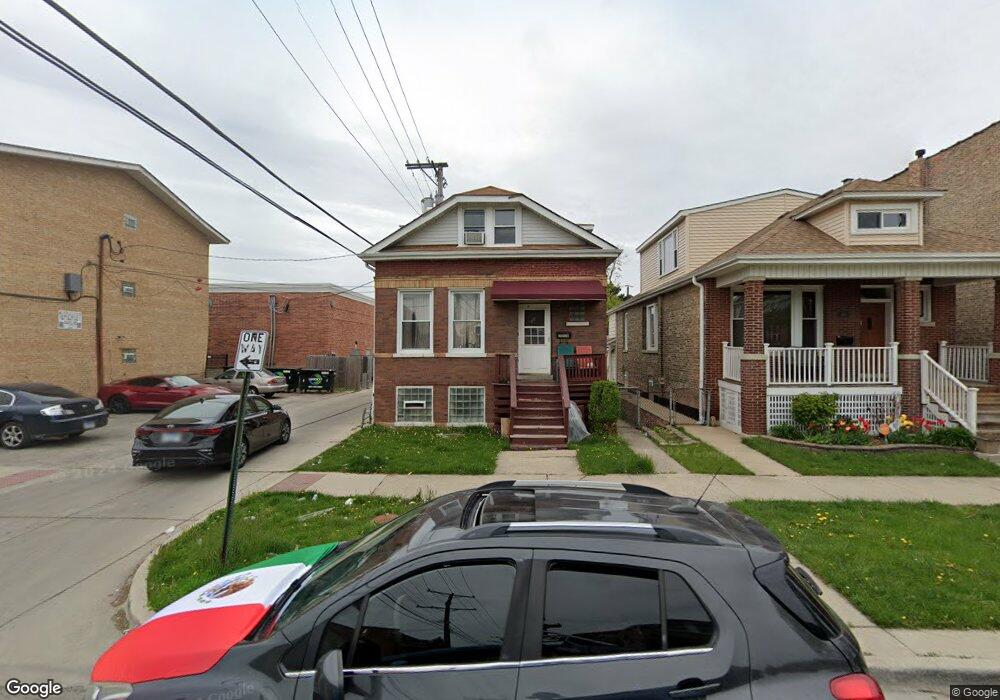

2530 S 58th Ct Cicero, IL 60804

Estimated Value: $261,000 - $378,000

3

Beds

2

Baths

1,216

Sq Ft

$248/Sq Ft

Est. Value

About This Home

This home is located at 2530 S 58th Ct, Cicero, IL 60804 and is currently estimated at $301,731, approximately $248 per square foot. 2530 S 58th Ct is a home located in Cook County with nearby schools including Goodwin Elementary School, Unity Jr High School, and J Sterling Morton Freshman Center.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 23, 2009

Sold by

Widup Kim R

Bought by

Reyna Ivan

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$131,562

Outstanding Balance

$86,041

Interest Rate

5.19%

Mortgage Type

FHA

Estimated Equity

$215,690

Purchase Details

Closed on

May 12, 1999

Sold by

Chattin Timothy

Bought by

Gomez Jose R and Reyna Maricela

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,998

Interest Rate

6.92%

Purchase Details

Closed on

Feb 8, 1999

Sold by

Boyle Noreen M

Bought by

Chattin Timothy

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Reyna Ivan | -- | Ctic | |

| Gomez Jose R | $109,000 | Chicago Title Insurance Co | |

| Chattin Timothy | -- | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Reyna Ivan | $131,562 | |

| Previous Owner | Gomez Jose R | $108,998 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,953 | $15,000 | $3,386 | $11,614 |

| 2023 | $3,547 | $15,000 | $3,386 | $11,614 |

| 2022 | $3,547 | $11,543 | $2,914 | $8,629 |

| 2021 | $3,544 | $11,541 | $2,913 | $8,628 |

| 2020 | $3,542 | $11,541 | $2,913 | $8,628 |

| 2019 | $2,909 | $9,392 | $2,677 | $6,715 |

| 2018 | $2,832 | $9,392 | $2,677 | $6,715 |

| 2017 | $2,753 | $9,392 | $2,677 | $6,715 |

| 2016 | $2,887 | $8,513 | $2,205 | $6,308 |

| 2015 | $2,793 | $8,513 | $2,205 | $6,308 |

| 2014 | $2,717 | $8,513 | $2,205 | $6,308 |

| 2013 | $2,894 | $9,634 | $2,205 | $7,429 |

Source: Public Records

Map

Nearby Homes

- 2517 S 59th Ct

- 2504 S 57th Ct

- 2423 S 57th Ct

- 2632 S Austin Blvd

- 2730 S 58th Ct

- 2633 S 60th Ct

- 2345 S 59th Ct

- 2407 S 60th Ct

- 2407 S 61st Ave

- 2321 S 60th Ct

- 6032 W 28th St

- 2816 S Austin Blvd

- 2232 S 59th Ave

- 5529 W 24th Place

- 5716 W 23rd St

- 5518 W 25th Place

- 5527 W 24th Place

- 2306 S 60th Ct

- 5616 W 23rd Place

- 2419 S Lombard Ave