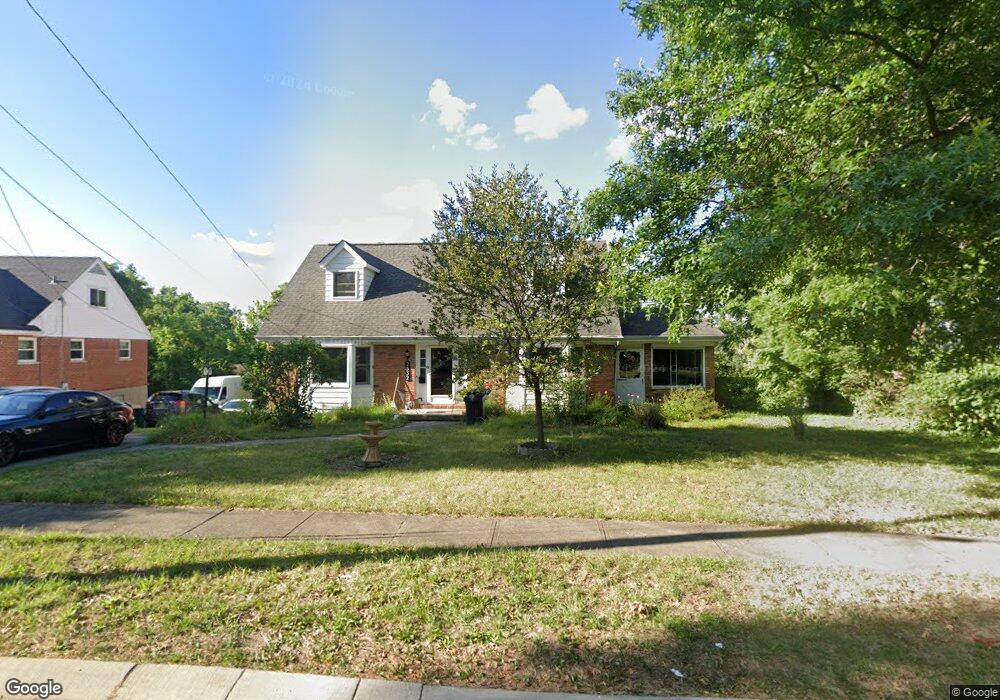

2532 Meyerhill Dr Cincinnati, OH 45211

Westwood NeighborhoodEstimated Value: $215,000 - $339,000

4

Beds

4

Baths

2,268

Sq Ft

$118/Sq Ft

Est. Value

About This Home

This home is located at 2532 Meyerhill Dr, Cincinnati, OH 45211 and is currently estimated at $268,530, approximately $118 per square foot. 2532 Meyerhill Dr is a home located in Hamilton County with nearby schools including Dater Montessori Elementary School, Western Hills High School, and Gilbert A. Dater High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 16, 2021

Sold by

Estate Of Valerie Ann Foltz

Bought by

Foltz Jayce F

Current Estimated Value

Purchase Details

Closed on

Mar 16, 2011

Sold by

Secretary Of Housing & Urban Development

Bought by

Foltz Valerie

Purchase Details

Closed on

Aug 6, 2010

Sold by

Udoh Essien E and Udoh Gloria E

Bought by

Chase Home Finance Llc

Purchase Details

Closed on

Apr 26, 2010

Sold by

Chase Home Finance Llc

Bought by

The Secretary Of Housing & Urban Develop

Purchase Details

Closed on

Sep 29, 1997

Sold by

Furlong Mary Leaetta and Tenoever Donald A

Bought by

Udoh Essien E and Udoh Gloria E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$112,750

Interest Rate

7.54%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 29, 1994

Sold by

Mitchell Albert U and Mitchell Sybilla A

Bought by

Tenoever Donald A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$70,000

Interest Rate

7.31%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Foltz Jayce F | -- | None Available | |

| Foltz Valerie | $42,000 | Attorney | |

| Chase Home Finance Llc | $65,000 | None Available | |

| The Secretary Of Housing & Urban Develop | -- | Attorney | |

| Udoh Essien E | $113,200 | -- | |

| Tenoever Donald A | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Udoh Essien E | $112,750 | |

| Previous Owner | Tenoever Donald A | $70,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,570 | $76,346 | $7,585 | $68,761 |

| 2023 | $4,673 | $76,346 | $7,585 | $68,761 |

| 2022 | $3,089 | $45,161 | $6,160 | $39,001 |

| 2021 | $2,969 | $45,161 | $6,160 | $39,001 |

| 2020 | $3,056 | $45,161 | $6,160 | $39,001 |

| 2019 | $3,037 | $41,055 | $5,600 | $35,455 |

| 2018 | $3,042 | $41,055 | $5,600 | $35,455 |

| 2017 | $2,889 | $41,055 | $5,600 | $35,455 |

| 2016 | $3,601 | $50,505 | $6,489 | $44,016 |

| 2015 | $3,247 | $50,505 | $6,489 | $44,016 |

| 2014 | $3,270 | $50,505 | $6,489 | $44,016 |

| 2013 | $3,464 | $52,609 | $6,759 | $45,850 |

Source: Public Records

Map

Nearby Homes

- 3116 Gobel Ave

- 3162 Sunshine Ave

- 3418 Millrich Ave

- 3072 Worthington Ave

- 3046 Bracken Woods Ln

- 3073 Bracken Woods Ln

- 3069 Bracken Woods Ln

- 3042 Percy Ave

- 3427 Bighorn Ct

- 3064 Mchenry Ave

- 2424 Westwood Northern Blvd

- 3331 Felicity Dr

- 3025 Mchenry Ave

- 3413 Fyffe Ave

- 2508 Mustang Dr

- 2822 Montana Ave

- 3345 Meyer Place

- 3355 Cavanaugh Ave

- 2738 Powell Dr

- 2454 Mustang Dr

- 2538 Meyerhill Dr

- 2526 Meyerhill Dr

- 2531 Westwood Northern Blvd

- 2527 Westwood Northern Blvd

- 2539 Westwood Northern Blvd

- 2525 Westwood Northern Blvd

- 2525 Westwood Northern Blvd Unit A

- 2544 Meyerhill Dr

- 2520 Meyerhill Dr

- 2537 Meyerhill Dr

- 2521 Westwood Northern Blvd

- 2545 Westwood Northern Blvd

- 2515 Meyerhill Dr

- 2550 Meyerhill Dr

- 2514 Meyerhill Dr

- 2519 Westwood Northern Blvd

- 2551 Westwood Northern Blvd

- 2549 Meyerhill Dr

- 2556 Meyerhill Dr

- 2555 Meyerhill Dr