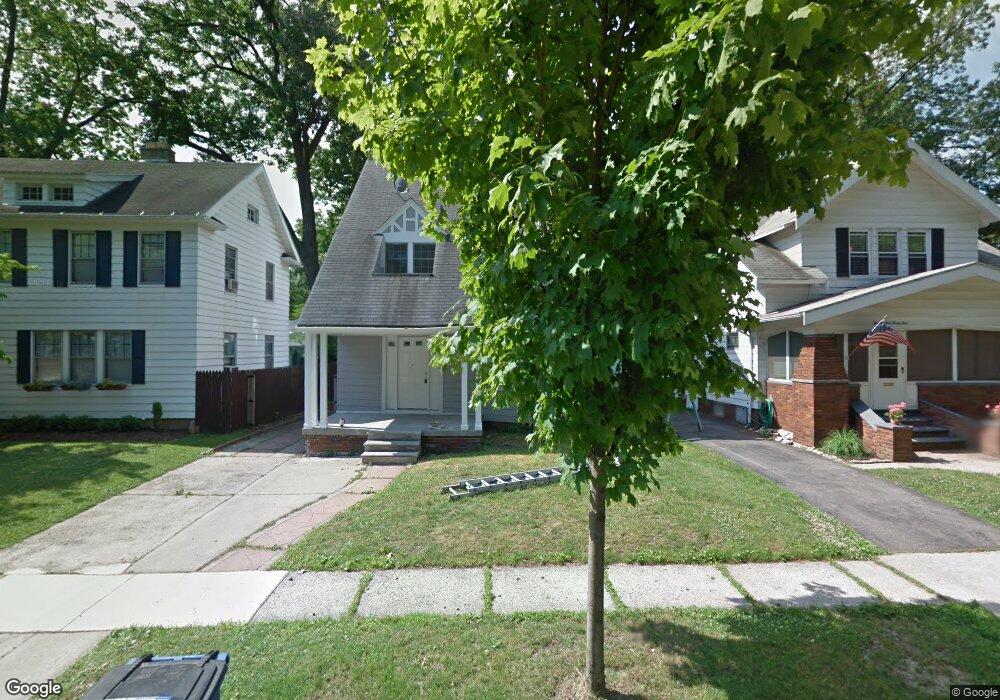

2541 Charlestown Ave Toledo, OH 43613

DeVeaux NeighborhoodEstimated Value: $143,240 - $163,000

3

Beds

2

Baths

1,522

Sq Ft

$99/Sq Ft

Est. Value

About This Home

This home is located at 2541 Charlestown Ave, Toledo, OH 43613 and is currently estimated at $151,060, approximately $99 per square foot. 2541 Charlestown Ave is a home located in Lucas County with nearby schools including DeVeaux Elementary School, Start High School, and Horizon Science Academy - Toledo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 31, 2011

Sold by

Fielding Chad R and Fielding Jacqueline S

Bought by

Byrd Marcus M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$52,826

Outstanding Balance

$35,760

Interest Rate

3.87%

Mortgage Type

FHA

Estimated Equity

$115,300

Purchase Details

Closed on

Jan 4, 2010

Sold by

Wells Fargo Financial Ohio 1 Inc

Bought by

Fielding Chad R and Fielding Jacqueline S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$28,800

Interest Rate

5.2%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 28, 2009

Sold by

Powell Fred G

Bought by

Wells Fargo Financial Ohio 1 Inc

Purchase Details

Closed on

Mar 17, 1988

Sold by

Sakowski John J and Sakowski Ellen M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Byrd Marcus M | $54,200 | Chicago Title | |

| Fielding Chad R | $36,000 | Attorney | |

| Wells Fargo Financial Ohio 1 Inc | $60,000 | None Available | |

| -- | $52,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Byrd Marcus M | $52,826 | |

| Previous Owner | Fielding Chad R | $28,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $787 | $25,305 | $4,270 | $21,035 |

| 2023 | $1,183 | $17,815 | $7,385 | $10,430 |

| 2022 | $1,185 | $17,815 | $7,385 | $10,430 |

| 2021 | $1,209 | $17,815 | $7,385 | $10,430 |

| 2020 | $1,157 | $14,875 | $6,160 | $8,715 |

| 2019 | $1,122 | $14,875 | $6,160 | $8,715 |

| 2018 | $1,068 | $14,875 | $6,160 | $8,715 |

| 2017 | $1,015 | $12,600 | $5,215 | $7,385 |

| 2016 | $1,020 | $36,000 | $14,900 | $21,100 |

| 2015 | $1,011 | $36,000 | $14,900 | $21,100 |

| 2014 | $793 | $12,610 | $5,220 | $7,390 |

| 2013 | $793 | $12,610 | $5,220 | $7,390 |

Source: Public Records

Map

Nearby Homes

- 2560 Charlestown Ave

- 3905 Rushland Ave

- 2447 Portsmouth Ave

- 2433 Georgetown Ave

- 2426 Berdan Ave

- 4128 Douglas Rd

- 3823 Woodmont Rd

- 3714 Douglas Rd

- 3712 Douglas Rd

- 3723 Maxwell Rd

- 4015 Roanoke Rd

- 2255 Charlestown Ave

- 3840 Garrison Rd

- 4210 Bowen Rd

- 2645 Grantwood Dr

- 3805 Garrison Rd

- 3564 Rushland Ave

- 2624 Grantwood Dr

- 4315 Bales Rd

- 2277 Castlewood Dr

- 2537 Charlestown Ave

- 2545 Charlestown Ave

- 2549 Charlestown Ave

- 2529 Charlestown Ave

- 2553 Charlestown Ave

- 2540 Portsmouth Ave

- 2536 Portsmouth Ave

- 2544 Portsmouth Ave

- 2532 Portsmouth Ave

- 2548 Portsmouth Ave

- 2525 Charlestown Ave

- 2557 Charlestown Ave

- 2540 Charlestown Ave

- 2528 Portsmouth Ave

- 2552 Portsmouth Ave

- 2536 Charlestown Ave

- 2544 Charlestown Ave

- 2534 Charlestown Ave

- 2550 Charlestown Ave

- 2521 Charlestown Ave