25592 Breezewood St Unit 57 Dana Point, CA 92629

Del Obispo NeighborhoodEstimated Value: $1,107,000 - $1,204,000

3

Beds

2

Baths

1,831

Sq Ft

$635/Sq Ft

Est. Value

About This Home

This home is located at 25592 Breezewood St Unit 57, Dana Point, CA 92629 and is currently estimated at $1,162,243, approximately $634 per square foot. 25592 Breezewood St Unit 57 is a home located in Orange County with nearby schools including Del Obispo Elementary School, Marco Forster Middle School, and Dana Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 4, 2006

Sold by

Hendrix Mark L

Bought by

Shelton Shayne Rae

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$476,000

Outstanding Balance

$298,612

Interest Rate

7.7%

Mortgage Type

Balloon

Estimated Equity

$863,631

Purchase Details

Closed on

Jul 25, 2006

Sold by

Doyle Charles R

Bought by

Shelton Shayne Rae

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$476,000

Outstanding Balance

$298,612

Interest Rate

7.7%

Mortgage Type

Balloon

Estimated Equity

$863,631

Purchase Details

Closed on

Apr 8, 2005

Sold by

Doyle Charles R

Bought by

Doyle Charles R and Charles R Doyle Living Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Shelton Shayne Rae | -- | First American Title Co | |

| Shelton Shayne Rae | $595,000 | First American Title Co | |

| Doyle Charles R | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Shelton Shayne Rae | $476,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,553 | $797,169 | $541,130 | $256,039 |

| 2024 | $9,553 | $781,539 | $530,520 | $251,019 |

| 2023 | $9,205 | $766,215 | $520,117 | $246,098 |

| 2022 | $8,466 | $716,902 | $509,918 | $206,984 |

| 2021 | $7,964 | $702,846 | $499,920 | $202,926 |

| 2020 | $7,917 | $695,640 | $494,794 | $200,846 |

| 2019 | $7,586 | $682,000 | $485,092 | $196,908 |

| 2018 | $7,217 | $649,000 | $457,888 | $191,112 |

| 2017 | $7,229 | $649,000 | $457,888 | $191,112 |

| 2016 | $6,588 | $590,000 | $398,888 | $191,112 |

| 2015 | $6,160 | $555,000 | $363,888 | $191,112 |

| 2014 | $5,865 | $523,000 | $331,888 | $191,112 |

Source: Public Records

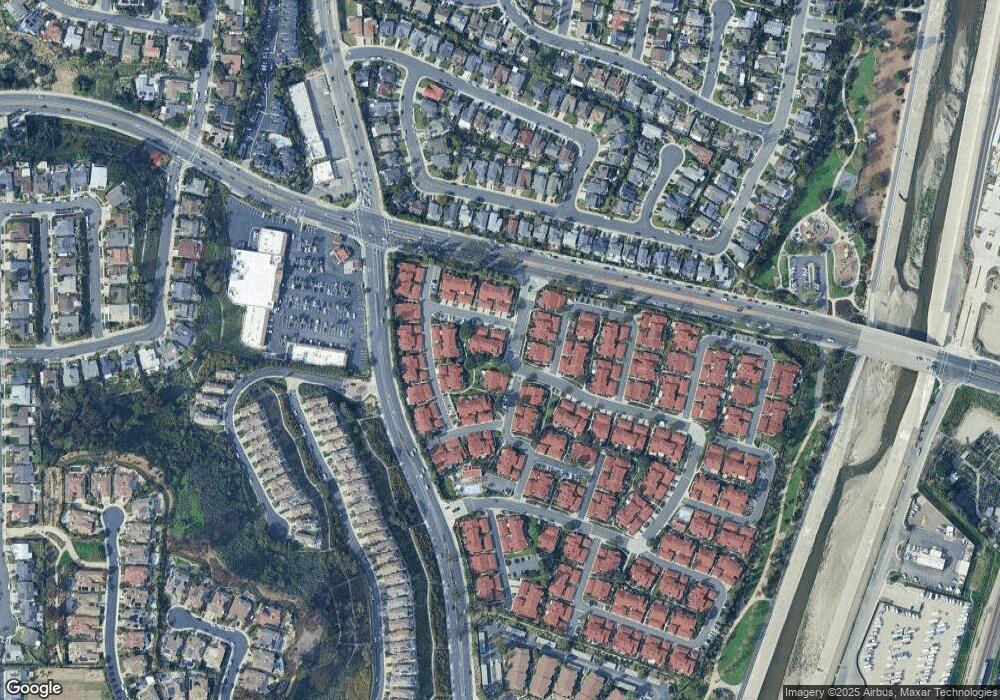

Map

Nearby Homes

- 33651 Surfside Dr Unit 41

- 33772 Bayside Ln Unit 240

- 33852 Del Obispo St Unit 70

- 33852 Del Obispo St Unit 112

- 33852 Del Obispo St Unit 2

- 33852 Del Obispo St Unit 135

- 25591 Leeward Dr

- 25382 Sea Bluffs Dr Unit 8107

- 25422 Sea Bluffs Dr Unit 207

- 25432 Sea Bluffs Dr Unit 302

- 0 Stonehill Dr Unit OC25264877

- 33856 Pequito Dr

- 33831 Camino Capistrano Unit 45

- 33831 Camino Capistrano Unit 50

- 33831 Camino Capistrano Unit 19

- 33791 Mariana Dr Unit 1

- 25102 Alicia Dr

- 34056 Pequito Dr

- 33041 Lighthouse Ct

- 34011 El Contento Dr

- 25586 Breezewood St

- 25582 Breezewood St

- 25576 Breezewood St Unit 54

- 25591 Breezewood St Unit 1

- 25591 Breezewood St

- 33641 Port Marine Dr

- 25585 Breezewood St Unit 2

- 25585 Breezewood St

- 33635 Port Marine Dr Unit 63

- 33625 Port Marine Dr Unit 62

- 25581 Breezewood St Unit 3

- 25581 Breezewood St

- 25575 Breezewood St

- 33615 Port Marine Dr

- 25571 Breezewood St Unit 5

- 33605 Port Marine Dr Unit 59

- 25565 Breezewood St

- 33601 Port Marine Dr Unit 58

- 25555 Breezewood St Unit 7

- 25555 Breezewood St