25598 Prado de Azul Calabasas, CA 91302

Estimated Value: $5,451,000 - $6,321,000

5

Beds

5

Baths

6,480

Sq Ft

$911/Sq Ft

Est. Value

About This Home

This home is located at 25598 Prado de Azul, Calabasas, CA 91302 and is currently estimated at $5,903,585, approximately $911 per square foot. 25598 Prado de Azul is a home located in Los Angeles County with nearby schools including Chaparral Elementary School, Alice C. Stelle Middle School, and Calabasas High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 7, 2010

Sold by

Roseman Adam and Roseman Rachel

Bought by

Wetterhahn Steven and Wetterhahn Susanne

Current Estimated Value

Purchase Details

Closed on

Sep 26, 2008

Sold by

Williams Rod

Bought by

Roseman Adam and Roseman Rachel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,950,000

Interest Rate

6.5%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jan 19, 2006

Sold by

Wl Homes Llc

Bought by

Williams Rod

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,304,022

Interest Rate

7.12%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wetterhahn Steven | $2,480,000 | Fidelity National Title | |

| Roseman Adam | $3,000,000 | Fidelity National Title | |

| Williams Rod | $1,739,000 | Fidelity National Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Roseman Adam | $1,950,000 | |

| Previous Owner | Williams Rod | $1,304,022 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $39,099 | $3,138,877 | $1,518,190 | $1,620,687 |

| 2024 | $39,099 | $3,077,331 | $1,488,422 | $1,588,909 |

| 2023 | $38,356 | $3,016,992 | $1,459,238 | $1,557,754 |

| 2022 | $37,175 | $2,957,836 | $1,430,626 | $1,527,210 |

| 2021 | $37,095 | $2,899,840 | $1,402,575 | $1,497,265 |

| 2019 | $35,862 | $2,813,831 | $1,360,975 | $1,452,856 |

| 2018 | $35,481 | $2,758,659 | $1,334,290 | $1,424,369 |

| 2016 | $34,322 | $2,651,539 | $1,282,479 | $1,369,060 |

| 2015 | $33,804 | $2,611,711 | $1,263,215 | $1,348,496 |

| 2014 | $33,347 | $2,560,552 | $1,238,471 | $1,322,081 |

Source: Public Records

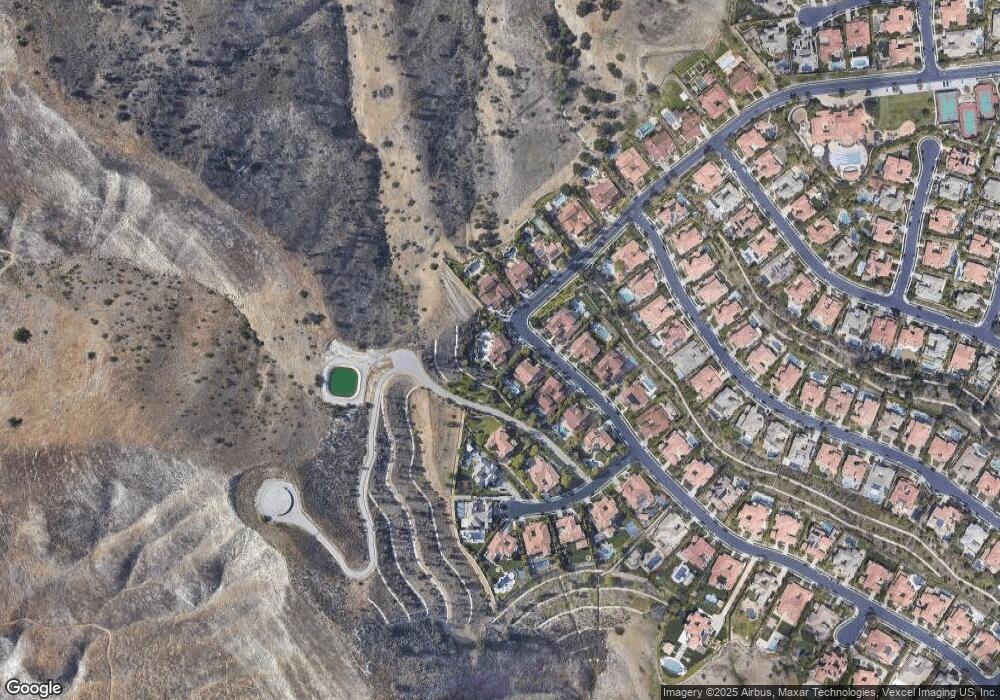

Map

Nearby Homes

- 25471 Prado de Oro

- 3915 Prado Del Maiz

- 25430 Prado de Azul

- 25410 Prado de Las Bellotas

- 25411 Prado de Oro

- 317 Acres - the Calabasas Ranch

- 3801 Prado Del Trigo

- 3850 Prado de Las Uvas

- 4622 Cielo Cir

- 4130 Prado de Los Caballos

- 25230 Prado de Las Panteras

- 25305 Prado de la Felicidad

- 4322 Willow Glen St

- 4275 Las Virgenes Rd Unit 3

- 4201 Las Virgenes Rd Unit 115

- 4201 Las Virgenes Rd Unit 220

- 25242 Prado Del Grandioso

- 25200 Calabasas Rd

- 0 Stokes Canyon Rd Unit V1-31372

- 4240 Lost Hills Rd Unit 3004

- 25590 Prado de Azul

- 25599 Prado de Las Flores

- 25580 Prado de Azul

- 25599 Prado de Azul

- 25591 Prado de Las Flores

- 25591 Prado de Azul

- 25581 Prado de Amarillo

- 25570 Prado de Azul

- 25581 Prado de Las Flores

- 25581 Prado de Azul

- 25591 Prado de Amarillo

- 25571 Prado de Amarillo

- 25560 Prado de Azul

- 25571 Prado de Azul

- 25571 Prado de Las Flores

- 25590 Prado de Oro

- 25580 Prado de Oro

- 25570 Prado de Oro

- 25599 Prado de Amarillo

- 25561 Prado de Azul