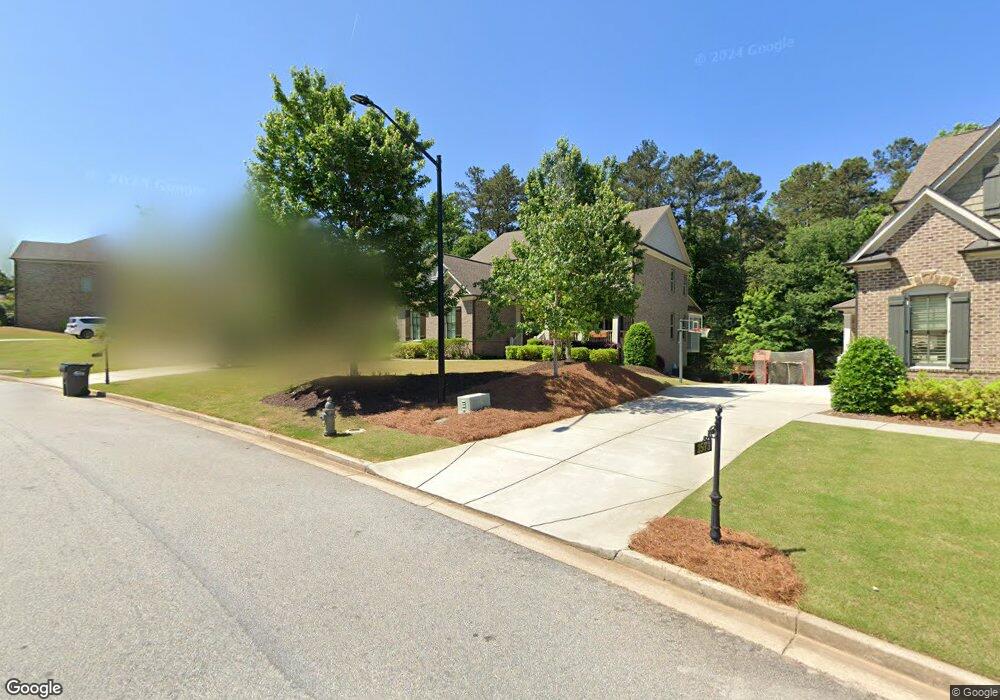

2569 Weeping Oak Trace Unit 5 Marietta, GA 30062

East Cobb NeighborhoodEstimated Value: $1,112,000 - $1,497,000

5

Beds

4

Baths

3,485

Sq Ft

$381/Sq Ft

Est. Value

About This Home

This home is located at 2569 Weeping Oak Trace Unit 5, Marietta, GA 30062 and is currently estimated at $1,326,313, approximately $380 per square foot. 2569 Weeping Oak Trace Unit 5 is a home located in Cobb County with nearby schools including Murdock Elementary School, Hightower Trail Middle School, and Pope High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 1, 2018

Sold by

Fleming Howard

Bought by

Fitzgerald Adam and Fitzgerald Dana

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$666,400

Outstanding Balance

$575,109

Interest Rate

4.5%

Mortgage Type

New Conventional

Estimated Equity

$751,204

Purchase Details

Closed on

Nov 12, 2014

Sold by

Fleming Howard

Bought by

Fleming Howard and Fleming Erin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$535,970

Interest Rate

4%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fitzgerald Adam | -- | -- | |

| Fleming Howard | -- | -- | |

| Fleming Howard | $669,963 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fitzgerald Adam | $666,400 | |

| Previous Owner | Fleming Howard | $535,970 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,761 | $437,968 | $110,000 | $327,968 |

| 2024 | $10,903 | $397,996 | $90,000 | $307,996 |

| 2023 | $10,360 | $397,996 | $90,000 | $307,996 |

| 2022 | $10,981 | $397,996 | $90,000 | $307,996 |

| 2021 | $9,558 | $333,004 | $86,000 | $247,004 |

| 2020 | $9,558 | $333,004 | $86,000 | $247,004 |

| 2019 | $8,846 | $300,480 | $80,000 | $220,480 |

| 2018 | $9,120 | $300,480 | $80,000 | $220,480 |

| 2017 | $8,639 | $300,480 | $80,000 | $220,480 |

| 2016 | $8,639 | $300,480 | $80,000 | $220,480 |

| 2015 | $7,565 | $256,792 | $80,000 | $176,792 |

| 2014 | $891 | $30,000 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 3091 Branford Ct

- 3237 Harvest Way

- 2260 Falkirk Pointe Dr

- 3287 Harvest Way

- 3297 Post Oak Tritt Rd

- 2735 Wendy Ln

- 3152 Normandy Cir NE

- 2864 Saint Andrews Way NE

- 2760 Hembree Rd NE

- 2607 Lulworth Ln

- 2934 Wendover St

- 2510 Camelot Cir

- 2726 Riderwood Ln NE

- 2570 Rocky Springs Dr

- 3461 Salem Trace

- 2866 Lexington Trace

- 2569 Weeping Oak Trace

- 2573 Weeping Oak Trace

- 2565 Weeping Oak Trace

- 0 Weeping Oak Trace Unit 8807963

- 0 Weeping Oak Trace Unit 8963468

- 0 Weeping Oak Trace Unit 7206040

- 0 Weeping Oak Trace Unit 7304954

- 0 Weeping Oak Trace Unit 7351559

- 0 Weeping Oak Trace Unit 7388403

- 0 Weeping Oak Trace Unit 7390596

- 0 Weeping Oak Trace Unit 7418892

- 0 Weeping Oak Trace Unit 7437870

- 0 Weeping Oak Trace Unit 7491857

- 2577 Weeping Oak Trace

- 2570 Weeping Oak Trace

- 2561 Weeping Oak Trace

- 2566 Weeping Oak Trace

- 3055 Post Oak Tritt Rd

- 2557 Weeping Oak Trace

- 3025 Post Oak Tritt Rd