26 Bluff Point Cedar Grove, TN 38321

Estimated Value: $333,192 - $432,000

3

Beds

3

Baths

2,802

Sq Ft

$136/Sq Ft

Est. Value

About This Home

This home is located at 26 Bluff Point, Cedar Grove, TN 38321 and is currently estimated at $380,798, approximately $135 per square foot. 26 Bluff Point is a home located in Henderson County.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 2, 2011

Sold by

Regions Morgan Keegan Trus

Bought by

Yeager Barry and Yeager Veronica

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,200

Outstanding Balance

$82,171

Interest Rate

4.4%

Mortgage Type

Commercial

Estimated Equity

$298,627

Purchase Details

Closed on

Jun 30, 2011

Sold by

Marshall Johnny H

Bought by

Regions Morgan Keegan Trust De

Purchase Details

Closed on

Feb 12, 2004

Sold by

David Gremmels C

Bought by

Marshall Johnny H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$187,000

Interest Rate

5.97%

Purchase Details

Closed on

Dec 3, 2003

Bought by

Marshall Johnny H

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Yeager Barry | $149,000 | -- | |

| Regions Morgan Keegan Trust De | -- | -- | |

| Marshall Johnny H | $187,000 | -- | |

| Marshall Johnny H | $187,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Yeager Barry | $119,200 | |

| Previous Owner | Marshall Johnny H | $187,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,219 | $77,100 | $2,500 | $74,600 |

| 2023 | $1,219 | $77,100 | $2,500 | $74,600 |

| 2022 | $1,324 | $55,850 | $6,250 | $49,600 |

| 2021 | $1,324 | $55,850 | $6,250 | $49,600 |

| 2020 | $1,324 | $55,850 | $6,250 | $49,600 |

| 2019 | $1,324 | $55,850 | $6,250 | $49,600 |

| 2018 | $1,617 | $70,800 | $6,250 | $64,550 |

| 2017 | $1,187 | $51,975 | $6,250 | $45,725 |

| 2016 | $1,187 | $49,950 | $6,250 | $43,700 |

| 2015 | $1,187 | $49,950 | $6,250 | $43,700 |

| 2014 | $1,187 | $49,953 | $0 | $0 |

Source: Public Records

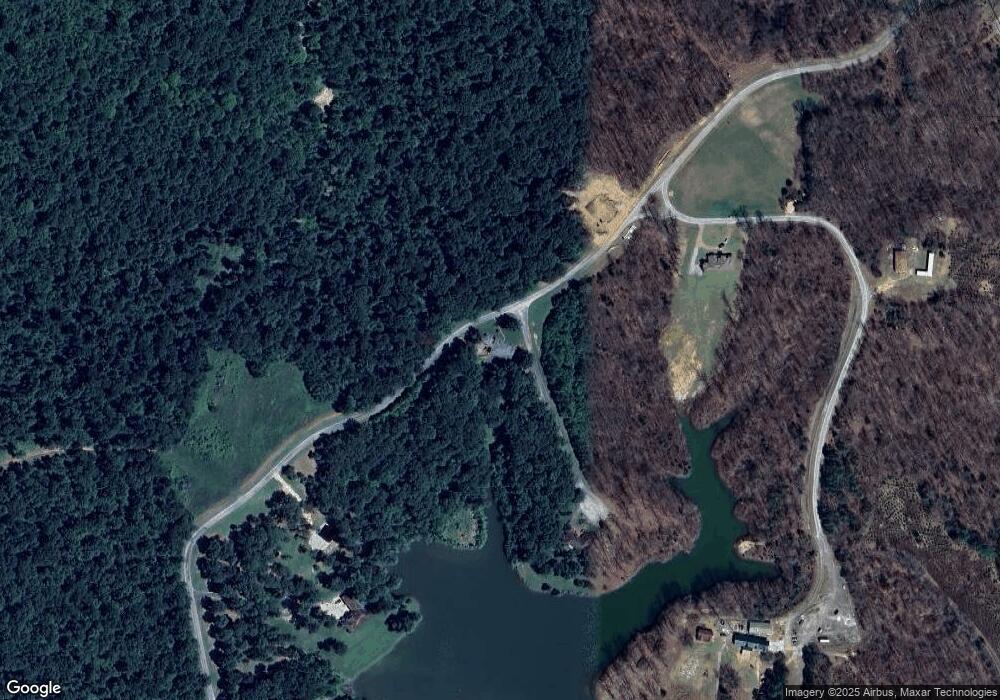

Map

Nearby Homes

- 400 Summit Chase Rd

- 00 Royal Fox Point

- 878 Palmer Rd

- 0 Daws Ln

- 4555 Rue Hamner Rd

- 155 Fire Tower Rd

- 5300 Mount Gilead Rd

- 0 Union Cross Rd

- 0 Pearson Rd

- 935 Pearson Rd

- 115 Baudy James Rd

- 151 Williams Ln

- 000 Mt Gilead

- 2438 Leo Woods Rd

- 57 Scarlet Ln

- 000 Hart Cemetery Rd

- Lot 5 Jason Hollow Rd

- 5 Jason Hollow Rd

- 213 Jason Hollow Rd

- 255 Jason Hollow Rd

- 21 Bluff Point

- 114 Bluff Point

- 16 Summit Chase Rd

- 605 Peregrine Place

- 45 Woodsedge

- 000 Summit Chase Lot 4

- 862 Peregrine Place

- Tract 3 Peregrine Place

- Tract 2 Peregrine Place

- 0 Mount Gilead Rd

- 0 Royal Fox Point Unit RTC2681963

- 0 Royal Fox Point Unit RTC2577786

- 0 Royal Fox Point Unit RTC2442091

- 56 Royal Fox Pointe

- 00 Royal Fox Pointe

- 1700 Mt Gilead Rd

- 2940 Mount Gilead Rd

- Lot 46 Peregrine Place

- 1685 Mount Gilead Rd

- 000 Chip Shot