26 Copper Moon Rd El Prado, NM 87529

Estimated Value: $708,523 - $1,958,000

--

Bed

--

Bath

1,960

Sq Ft

$623/Sq Ft

Est. Value

About This Home

This home is located at 26 Copper Moon Rd, El Prado, NM 87529 and is currently estimated at $1,221,381, approximately $623 per square foot. 26 Copper Moon Rd is a home with nearby schools including Ranchos de Taos Elementary School, Taos Middle School, and Taos High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 26, 2017

Sold by

Scaramuzza Giuseppe and Scarmuzza Carol A

Bought by

Ridge William Burton and Ridge Lina Esther

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$230,000

Outstanding Balance

$191,658

Interest Rate

3.91%

Mortgage Type

New Conventional

Estimated Equity

$1,029,723

Purchase Details

Closed on

Sep 2, 2010

Sold by

National Residential Nominee Services I

Bought by

Scaramuzza Guiseppe and Scaramuzza Carol A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ridge William Burton | -- | None Available | |

| Scaramuzza Guiseppe | -- | First New Mexico Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ridge William Burton | $230,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,259 | $127,006 | $26,963 | $100,043 |

| 2024 | $2,259 | $127,006 | $26,963 | $100,043 |

| 2023 | $2,250 | $127,006 | $26,963 | $100,043 |

| 2022 | $2,200 | $123,756 | $26,429 | $97,327 |

| 2021 | $2,117 | $123,756 | $26,429 | $97,327 |

| 2020 | $2,015 | $120,601 | $25,910 | $94,691 |

| 2019 | $2,097 | $122,601 | $27,910 | $94,691 |

| 2018 | $1,898 | $113,123 | $25,242 | $87,881 |

| 2017 | $1,898 | $113,123 | $25,242 | $87,881 |

| 2016 | $1,891 | $115,123 | $27,242 | $87,881 |

| 2014 | -- | $109,123 | $21,242 | $87,881 |

| 2013 | -- | $109,123 | $21,242 | $87,881 |

Source: Public Records

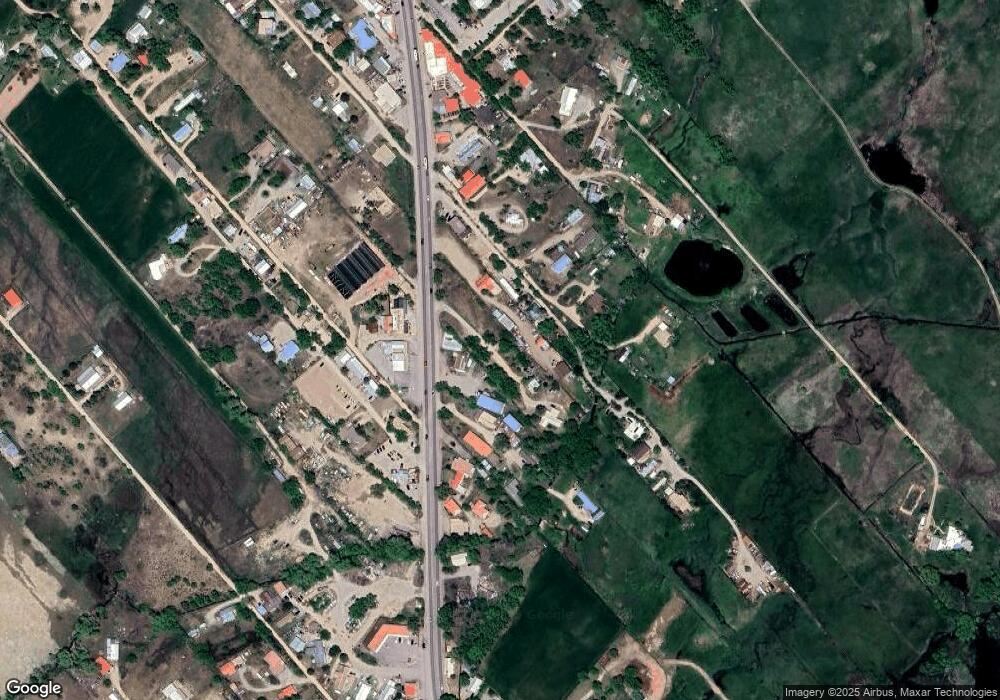

Map

Nearby Homes

- 26 Copper Moon

- 1 San Pasqual Ln

- 296 Los Cordovas Rd

- Lot 42 Baird Dr

- 85 Vista Linda Rd

- B Vista Linda Rd

- C Vista Linda Rd

- D Vista Linda Rd

- A Vista Linda Rd

- 19 Vista Linda Rd

- 63 Baird Dr

- Lot 63C Vista Del Ocaso

- 55 Vista Linda Rd

- Lot 21 Los Cordovas Dr

- 277 Cuchilla Rd

- 33 Vista Del Ocaso

- TBD Tomas H Romero Rd

- 0 Tomas H Romero Rd

- 12 Golf Course Dr

- Adj to Cielo San Antonio

- 20 Copper Moon Rd

- 0 Camino Vista Miguel

- 0 Camino Vista Miguel

- Tract 2 Vista Miguel Subdivision

- 10 Colty Rd

- Tract 1 Vista Miguel Subdivision

- 2 Cielo San Antonio

- 243 Parcel D-8 Los Cordovas Rd

- 243 Parcel D-9 Los Cordovas Rd

- 243 Parcel D-10 Los Cordovas Rd

- 243 Parcel D-5 Los Cordovas Rd

- 243 Parcel D-3 Los Cordovas Rd

- 10 Sunset Elk Dr

- Lot 33 Taos Country Club

- 4 Copper Moon

- 172 Los Alamitos Rd

- 1 67 Acres Los Cordovas Rd

- 241 Los Cordovas Rd

- 2 76 Acres Los Cordovas Rd

- Lot 33 Country Club