26 Cree Point Dr Mankato, MN 56001

Franklin Rogers Park NeighborhoodEstimated Value: $298,000 - $314,000

2

Beds

2

Baths

1,701

Sq Ft

$181/Sq Ft

Est. Value

About This Home

This home is located at 26 Cree Point Dr, Mankato, MN 56001 and is currently estimated at $307,780, approximately $180 per square foot. 26 Cree Point Dr is a home located in Blue Earth County with nearby schools including Washington Elementary School, Prairie Winds Middle School, and Mankato East Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 4, 2019

Sold by

Soule Trust

Bought by

Carr Virginia

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,000

Outstanding Balance

$44,168

Interest Rate

3.7%

Mortgage Type

New Conventional

Estimated Equity

$263,612

Purchase Details

Closed on

Sep 27, 2013

Sold by

Straight Edith A and Olson Michael W

Bought by

Johnson Soule Trust

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

4.58%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Carr Virginia | $220,000 | North American Title | |

| Johnson Soule Trust | $185,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Carr Virginia | $50,000 | |

| Previous Owner | Johnson Soule Trust | $100,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,628 | $270,100 | $29,000 | $241,100 |

| 2024 | $2,628 | $251,600 | $29,000 | $222,600 |

| 2023 | $2,524 | $254,400 | $29,000 | $225,400 |

| 2022 | $2,340 | $228,800 | $29,000 | $199,800 |

| 2021 | $2,144 | $200,000 | $29,000 | $171,000 |

| 2020 | $2,096 | $181,000 | $29,000 | $152,000 |

| 2019 | $1,322 | $181,000 | $29,000 | $152,000 |

| 2018 | $2,134 | $176,900 | $29,000 | $147,900 |

| 2017 | $1,866 | $183,900 | $29,000 | $154,900 |

| 2016 | $1,858 | $171,300 | $29,000 | $142,300 |

| 2015 | $19 | $171,300 | $29,000 | $142,300 |

| 2014 | $2,006 | $480,300 | $87,000 | $393,300 |

Source: Public Records

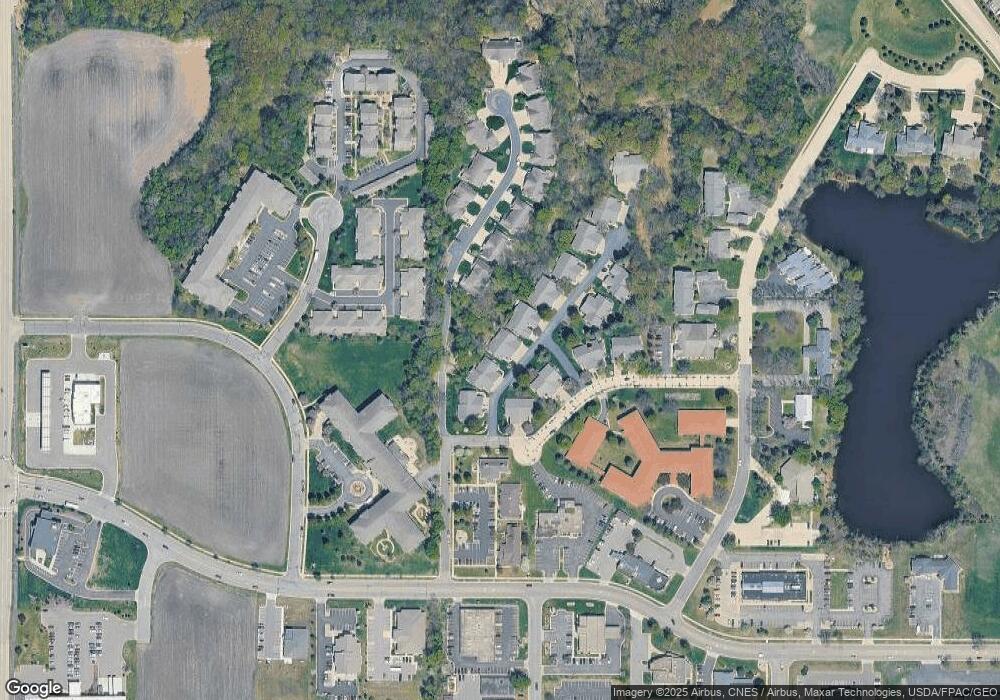

Map

Nearby Homes

- 809 Dublin Ct

- 107 Shiloh Ct

- 74 Cree Point Dr

- 1X Adams St

- 0 Adams St

- TBD #2 Adams St

- 1521 Adams St

- 0 Elwin Add 2

- 109 Teton Ct

- 0 Lot 1 Block 2 Elwin Addition No 2

- 1025 Belle Ave Unit A31

- 104 Oxford Path

- 117 Hope Ct

- 412 Holly Ln

- 125 Thissen Ct

- 0 Tbd N Victory Dr Unit 7036367

- 133 Shamrock Dr

- 0 Tbd St Andrews Dr Unit 7037517

- 59100 Madison Ave

- 3137 Bassett Dr

- 30 Cree Point Dr

- 22 Cree Point Dr

- 34 Cree Point Dr

- 18 Cree Point Dr

- 14 Cree Point Dr

- 38 Cree Point Dr

- 14 14 Cree Point Dr

- 42 Cree Point Dr

- 204 Cree Ct

- 200 Cree Ct

- 212 Cree Ct

- 101 Shiloh Ct

- 208 Cree Ct

- 103 Shiloh Ct

- 46 Cree Point Dr

- 801 Dublin Ct

- 162 Cree Ct

- 105 Shiloh Ct

- 805 Dublin Ct

- 50 Cree Point Dr