26 Taylors Way Southampton, PA 18966

Estimated Value: $356,316 - $497,000

2

Beds

2

Baths

1,300

Sq Ft

$314/Sq Ft

Est. Value

About This Home

This home is located at 26 Taylors Way, Southampton, PA 18966 and is currently estimated at $408,829, approximately $314 per square foot. 26 Taylors Way is a home located in Bucks County with nearby schools including Rolling Hills Elementary School, Richboro Middle School, and Council Rock High School - South.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 16, 2007

Sold by

Asay Vanessa and Casey Sandra

Bought by

Asay Vanessa

Current Estimated Value

Purchase Details

Closed on

Aug 12, 2003

Sold by

Dreyer Lisa A

Bought by

Asay Vanessa and Casey Sandra

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$151,200

Outstanding Balance

$69,913

Interest Rate

6.31%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$338,916

Purchase Details

Closed on

Feb 25, 1999

Sold by

Konefsky Gary and Konefsky Eileen

Bought by

Dreyer Lisa A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,250

Interest Rate

6.78%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Asay Vanessa | -- | None Available | |

| Asay Vanessa | $189,000 | Fidelity National Title Insu | |

| Dreyer Lisa A | $95,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Asay Vanessa | $151,200 | |

| Previous Owner | Dreyer Lisa A | $90,250 | |

| Closed | Asay Vanessa | $18,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,575 | $18,560 | $3,000 | $15,560 |

| 2024 | $3,575 | $18,560 | $3,000 | $15,560 |

| 2023 | $3,369 | $18,560 | $3,000 | $15,560 |

| 2022 | $3,338 | $18,560 | $3,000 | $15,560 |

| 2021 | $3,233 | $18,560 | $3,000 | $15,560 |

| 2020 | $3,160 | $18,560 | $3,000 | $15,560 |

| 2019 | $3,025 | $18,560 | $3,000 | $15,560 |

| 2018 | $2,971 | $18,560 | $3,000 | $15,560 |

| 2017 | $2,856 | $18,560 | $3,000 | $15,560 |

| 2016 | $2,856 | $18,560 | $3,000 | $15,560 |

| 2015 | -- | $18,560 | $3,000 | $15,560 |

| 2014 | -- | $18,560 | $3,000 | $15,560 |

Source: Public Records

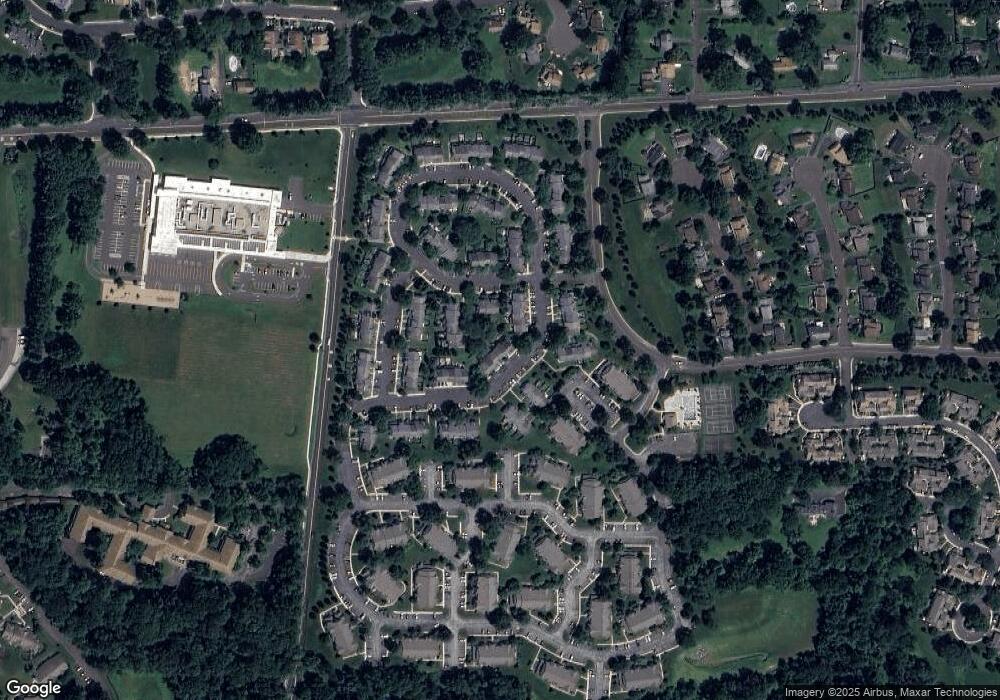

Map

Nearby Homes

- 180 Independence Dr

- 501 Potters Ct

- 10014 Beacon Hill Dr Unit 7

- 66 Nathaniel Rd

- 21 Joanne Rd

- 281 E Village Rd

- 29 Tree Bark Ln

- 102 Keenan Ln

- 21 Tree Bark Ln

- 105 S Timber Rd

- 9015 Heritage Dr Unit 8

- 23 Brianna Rd

- 15 Dover Place

- 48 Old Mill Ln

- 3231 Durham Place

- 134 Nottingham Dr

- 258 Woodlake Dr

- 28 Peter Dr

- 104 Cornell Rd

- 210 E Hanover St