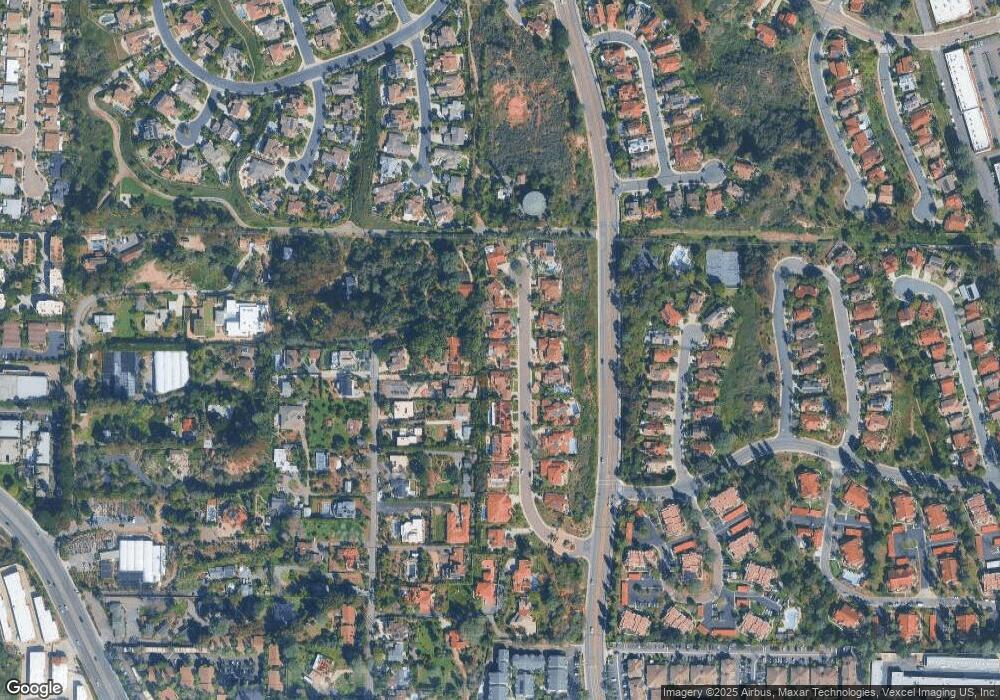

260 Via Tierra Encinitas, CA 92024

Central Encinitas NeighborhoodEstimated Value: $1,939,000 - $2,226,000

2

Beds

3

Baths

2,305

Sq Ft

$913/Sq Ft

Est. Value

About This Home

This home is located at 260 Via Tierra, Encinitas, CA 92024 and is currently estimated at $2,103,810, approximately $912 per square foot. 260 Via Tierra is a home located in San Diego County with nearby schools including Park Dale Lane Elementary, Oak Crest Middle School, and La Costa Canyon High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 20, 2018

Sold by

Mounts Christopher L and Mounts Eileen M

Bought by

Mounts Christopher Lindsey and Mounts Eileen Marie

Current Estimated Value

Purchase Details

Closed on

May 6, 2002

Sold by

York Douglas L and York Sally A

Bought by

Mounts Christopher L and Smith Eileen M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,700

Interest Rate

6.86%

Purchase Details

Closed on

Sep 29, 1993

Sold by

Eichen Paul and Eichen Amy E

Bought by

York Douglas L and York Sally A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$319,200

Interest Rate

6.94%

Purchase Details

Closed on

Aug 13, 1987

Purchase Details

Closed on

Jan 28, 1986

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mounts Christopher Lindsey | -- | None Available | |

| Mounts Christopher L | $638,000 | California Title Company | |

| York Douglas L | $399,000 | North American Title Company | |

| -- | $360,000 | -- | |

| -- | $100,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Mounts Christopher L | $300,700 | |

| Previous Owner | York Douglas L | $319,200 | |

| Closed | Mounts Christopher L | $200,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,440 | $952,883 | $499,314 | $453,569 |

| 2024 | $10,440 | $934,200 | $489,524 | $444,676 |

| 2023 | $10,153 | $915,883 | $479,926 | $435,957 |

| 2022 | $9,918 | $897,925 | $470,516 | $427,409 |

| 2021 | $9,759 | $880,320 | $461,291 | $419,029 |

| 2020 | $9,608 | $871,295 | $456,562 | $414,733 |

| 2019 | $9,414 | $854,211 | $447,610 | $406,601 |

| 2018 | $9,246 | $837,463 | $438,834 | $398,629 |

| 2017 | $9,084 | $821,043 | $430,230 | $390,813 |

| 2016 | $8,801 | $804,945 | $421,795 | $383,150 |

| 2015 | $8,650 | $792,855 | $415,460 | $377,395 |

| 2014 | $8,456 | $777,325 | $407,322 | $370,003 |

Source: Public Records

Map

Nearby Homes

- 508 Hidden Ridge Ct

- 213 Via Palacio

- 407 Via Ultimo

- 515 Verbena Ct

- 350 N El Camino Real Unit 50

- 350 N El Camino Real Unit 72

- 201 Coneflower St

- 557 Samuel Ct

- 444 N El Camino Real Unit 47

- 444 N El Camino Real Unit SPC 42

- 444 N El Camino Real Unit 119

- 760 Bonita Dr

- 0 Mays Hollow Ln

- 1519 Valleda Ln

- 608 Crest Dr

- 1517 Shields Ave

- 722 Piedras Oro Calle Unit 6

- 623 Quail Gardens Ln

- 1129 Bonita Dr

- 1153 Crest Dr