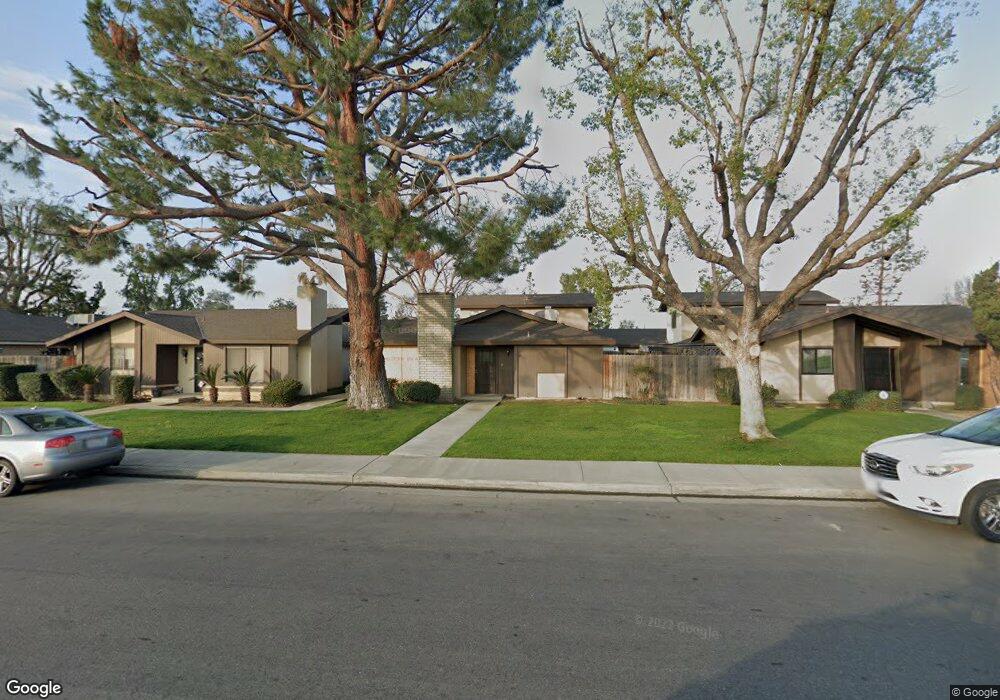

2601 Edmonton St Unit 12B Bakersfield, CA 93309

Southwest Bakersfield NeighborhoodEstimated Value: $170,000 - $174,000

2

Beds

1

Bath

792

Sq Ft

$217/Sq Ft

Est. Value

About This Home

This home is located at 2601 Edmonton St Unit 12B, Bakersfield, CA 93309 and is currently estimated at $171,542, approximately $216 per square foot. 2601 Edmonton St Unit 12B is a home located in Kern County with nearby schools including Stine Elementary School, Fred L. Thompson Junior High School, and West High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 16, 2024

Sold by

Church Family Trust and Church Norman K

Bought by

Mastro Matthew and Mastro Kelly

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$104,000

Outstanding Balance

$102,634

Interest Rate

7.22%

Mortgage Type

New Conventional

Estimated Equity

$68,908

Purchase Details

Closed on

Jan 16, 2009

Sold by

Church Norman K

Bought by

Church Norman K and The Church Family Trust

Purchase Details

Closed on

Jan 7, 2004

Sold by

Dayan David and Dayan Irene

Bought by

Dayan Joseph and Dayan Steve A

Purchase Details

Closed on

Dec 16, 2003

Sold by

Dayan Joseph and Dayan Steve Allen

Bought by

Church Norman K

Purchase Details

Closed on

May 22, 1995

Sold by

Dayan Wendy H

Bought by

Dayan Steve Allen

Purchase Details

Closed on

Feb 10, 1995

Sold by

Dayan Joseph and Dayan Sari

Bought by

Dayan Joseph

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mastro Matthew | $160,000 | Lennar Title | |

| Church Norman K | -- | None Available | |

| Dayan Joseph | -- | Ticor Title | |

| Church Norman K | $42,000 | Ticor Title | |

| Dayan Steve Allen | -- | -- | |

| Dayan Joseph | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mastro Matthew | $104,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,354 | $163,200 | $51,000 | $112,200 |

| 2024 | $1,325 | $58,519 | $20,897 | $37,622 |

| 2023 | $1,325 | $57,373 | $20,488 | $36,885 |

| 2022 | $1,266 | $56,250 | $20,087 | $36,163 |

| 2021 | $1,170 | $55,149 | $19,694 | $35,455 |

| 2020 | $1,132 | $54,585 | $19,493 | $35,092 |

| 2019 | $1,115 | $54,585 | $19,493 | $35,092 |

| 2018 | $1,075 | $52,469 | $18,737 | $33,732 |

| 2017 | $1,042 | $51,441 | $18,370 | $33,071 |

| 2016 | $812 | $34,433 | $18,010 | $16,423 |

| 2015 | $979 | $49,676 | $17,740 | $31,936 |

| 2014 | $953 | $48,704 | $17,393 | $31,311 |

Source: Public Records

Map

Nearby Homes

- 2600 Layton Dr

- 5009 Stormy Ct

- 4517 Meadowlark Way

- 4608 Posada Ave

- 4701 Misty Ct

- 2808 Edmonton St

- 2304 Bladen St

- 2415 Bladen St

- 2213 Sandpiper Rd

- 4408 Flicker Dr

- 5005 Surrey Ln

- 2209 Westminster Dr

- 5001 Appleblossom Dr

- 2504 Prestwick Ct

- 5116 Sherman Ave

- 2109 Oriole St

- 3104 Summer Side Ct

- 2608 Hallisey St

- 5611 Wilson Rd

- 5512 Appletree Ln

- 2601 Edmonton St

- 2601 Edmonton St Unit 12A

- 2601 Edmonton St Unit 11A

- 2601 Edmonton St Unit 11B

- 2601 Edmonton St Unit 10B

- 2601 Edmonton St Unit 10A

- 2601 Edmonton St Unit 9A

- 2601 Edmonton St Unit 9B

- 2601 Edmonton St Unit 8A

- 2601 Edmonton St Unit 8B

- 2601 Edmonton St Unit 1A

- 2601 Edmonton St Unit 1B

- 2601 Edmonton St Unit 2B

- 2601 Edmonton St Unit 2A

- 2601 Edmonton St Unit 3A

- 2601 Edmonton St Unit 3B

- 2601 Edmonton St Unit 4B

- 2601 Edmonton St Unit 4A

- 2601 Edmonton St Unit 5A

- 2601 Edmonton St Unit 5B