26021 Osprey Nest Ct Unit 30 Bonita Springs, FL 34134

Bonita Bay NeighborhoodEstimated Value: $2,337,000 - $2,653,000

4

Beds

5

Baths

6,023

Sq Ft

$416/Sq Ft

Est. Value

About This Home

This home is located at 26021 Osprey Nest Ct Unit 30, Bonita Springs, FL 34134 and is currently estimated at $2,505,570, approximately $416 per square foot. 26021 Osprey Nest Ct Unit 30 is a home located in Lee County with nearby schools including Spring Creek Elementary School, Bonita Springs Elementary School, and Pinewoods Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 15, 2010

Sold by

26021 Osprey Nest Court Ltd

Bought by

Jones Peter L and Jones Julie Diane

Current Estimated Value

Purchase Details

Closed on

Apr 28, 2006

Sold by

Summum Marketing Inc

Bought by

26021 Osprey Nest Court Ltd

Purchase Details

Closed on

Apr 24, 1999

Sold by

Devito Kenneth F

Bought by

Summum Marketing Inc

Purchase Details

Closed on

Aug 16, 1996

Sold by

Bonita Bay Prop Inc

Bought by

Devito Kenneth F and Devito Lenore

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$172,500

Interest Rate

8.12%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jones Peter L | $98,500 | Attorney | |

| 26021 Osprey Nest Court Ltd | $1,850,000 | Attorney | |

| Summum Marketing Inc | $255,000 | -- | |

| Devito Kenneth F | $230,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Devito Kenneth F | $172,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $16,408 | $1,331,321 | -- | -- |

| 2024 | $16,106 | $1,293,801 | -- | -- |

| 2023 | $16,106 | $1,256,117 | $0 | $0 |

| 2022 | $15,858 | $1,219,531 | $0 | $0 |

| 2021 | $16,186 | $1,243,120 | $403,529 | $839,591 |

| 2020 | $16,450 | $1,167,664 | $292,445 | $875,219 |

| 2019 | $17,238 | $1,211,934 | $0 | $0 |

| 2018 | $17,247 | $1,189,337 | $0 | $0 |

| 2017 | $17,369 | $1,164,875 | $0 | $0 |

| 2016 | $17,343 | $1,140,916 | $387,298 | $753,618 |

| 2015 | $19,429 | $1,261,738 | $379,002 | $882,736 |

| 2014 | -- | $1,065,601 | $338,819 | $726,782 |

| 2013 | -- | $972,474 | $260,164 | $712,310 |

Source: Public Records

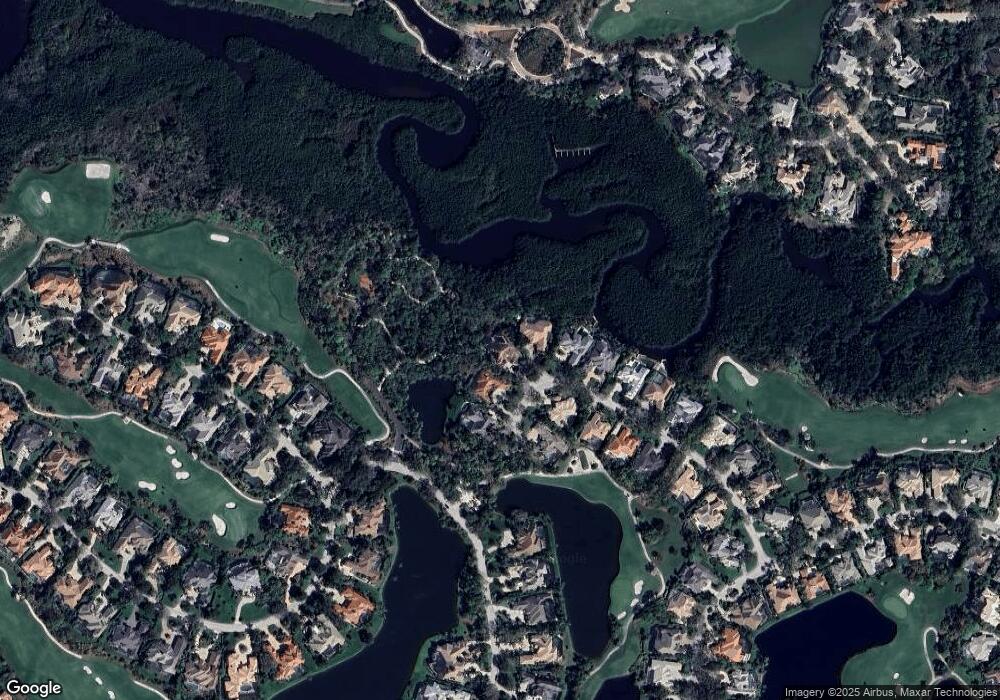

Map

Nearby Homes

- 3540 Creekview Dr

- 3460 Oak Hammock Ct

- 3687 Olde Cottage Ln

- 26211 Siena Dr

- 3978 Woodlake Dr

- 25224 Pelican Creek Cir Unit 203

- 25232 Pelican Creek Cir Unit 102

- 25160 Sandpiper Greens Ct Unit 202

- 3471 Pointe Creek Ct Unit 204

- 25212 Pelican Creek Cir Unit 103

- 3461 Pointe Creek Ct Unit 102

- 3461 Pointe Creek Ct Unit 204

- 25208 Pelican Creek Cir Unit 201

- 3466 Pointe Creek Ct Unit 201

- 25203 Pelican Creek Cir Unit 102

- 3431 Pointe Creek Ct Unit 104

- 26031 Osprey Nest Ct

- 26011 Osprey Nest Ct

- 26041 Osprey Nest Ct

- 26001 Osprey Nest Ct Unit 30

- 26050 Osprey Nest Ct

- 26051 Osprey Nest Ct

- 26000 Osprey Nest Ct

- 26060 Osprey Nest Ct

- 26061 Osprey Nest Ct Unit 30

- 26070 Osprey Nest Ct Unit 30

- 26071 Osprey Nest Ct

- 26073 Fawnwood Ct

- 26090 Osprey Nest Ct

- 26031 Mandevilla Dr

- 26081 Osprey Nest Ct

- 26069 Fawnwood Ct

- 26079 Fawnwood Ct

- 26041 Mandevilla Dr Unit 32

- 26065 Fawnwood Ct

- 26100 Osprey Nest Ct