26100 Hawks Flight Salinas, CA 93908

Corral de Tierra NeighborhoodEstimated Value: $1,692,000 - $2,851,000

4

Beds

6

Baths

5,043

Sq Ft

$450/Sq Ft

Est. Value

About This Home

This home is located at 26100 Hawks Flight, Salinas, CA 93908 and is currently estimated at $2,271,435, approximately $450 per square foot. 26100 Hawks Flight is a home located in Monterey County with nearby schools including Washington Elementary School, Toro Park Elementary School, and San Benancio Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 4, 2005

Sold by

Kobrinsky Samuel and Kobrinsky Marguerite D

Bought by

Samuel & Marguerite Kobrinsky Revocable

Current Estimated Value

Purchase Details

Closed on

Dec 7, 1999

Sold by

Kobrinsky Marguerite

Bought by

Kobrinsky Samuel

Purchase Details

Closed on

Feb 12, 1998

Sold by

Kobrinsky Marguerite D

Bought by

Kobrinsky Samuel

Purchase Details

Closed on

May 3, 1994

Sold by

Union Bank

Bought by

Kobrinsky Samuel and Kobrinsky Marguerite D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$700,000

Interest Rate

8.52%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Samuel & Marguerite Kobrinsky Revocable | -- | None Available | |

| Kobrinsky Samuel | -- | First American Title | |

| Kobrinsky Samuel | -- | Old Republic Title | |

| Kobrinsky Samuel | $1,300,000 | First American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Kobrinsky Samuel | $700,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $22,996 | $2,122,040 | $618,921 | $1,503,119 |

| 2024 | $22,996 | $2,080,433 | $606,786 | $1,473,647 |

| 2023 | $22,170 | $2,039,641 | $594,889 | $1,444,752 |

| 2022 | $22,334 | $1,999,649 | $583,225 | $1,416,424 |

| 2021 | $21,361 | $1,960,441 | $571,790 | $1,388,651 |

| 2020 | $20,893 | $1,940,340 | $565,927 | $1,374,413 |

| 2019 | $20,813 | $1,902,295 | $554,831 | $1,347,464 |

| 2018 | $20,372 | $1,864,996 | $543,952 | $1,321,044 |

| 2017 | $20,676 | $1,828,429 | $533,287 | $1,295,142 |

| 2016 | $20,049 | $1,792,579 | $522,831 | $1,269,748 |

| 2015 | $19,851 | $1,765,654 | $514,978 | $1,250,676 |

| 2014 | $19,188 | $1,731,068 | $504,891 | $1,226,177 |

Source: Public Records

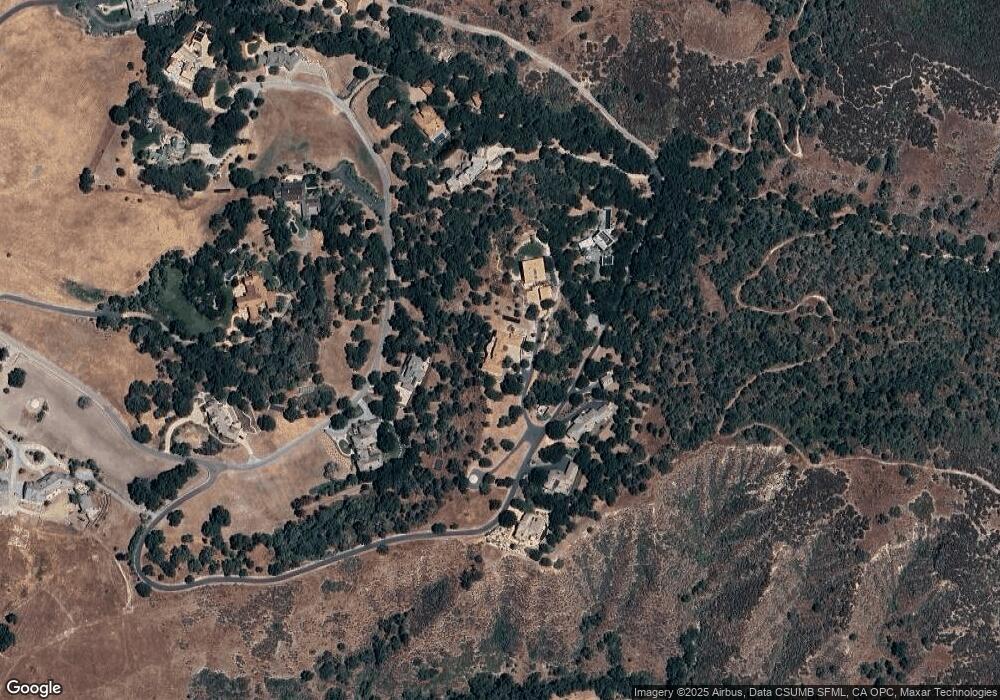

Map

Nearby Homes

- 180 San Benancio Rd

- 25603 Creekview Cir

- 274 Corral de Tierra Rd

- 0 Corral de Tierra Rd

- 382 Corral de Tierra Rd

- 15460 Weather Rock Way

- 90 Harper Canyon Rd

- 14105 Mountain Quail Rd

- 14220 Mountain Quail Rd

- 13500 Paseo Terrano

- 442 Corral de Tierra Rd

- 453 Corral de Tierra Rd

- 23799 Monterey Salinas Hwy Unit 18

- 23799 Monterey Salinas Hwy Unit 13

- 23799 Monterey Salinas Hwy Unit 20

- 27412 Vista Del Toro Place

- 26135 Laureles Grade

- 26131 Laureles Grade

- 0 Laureles Grade

- 12167 Saddle Rd

- 14400 Castlerock Rd

- 26000 Hawks Flight

- 26000 Hawks Flight

- 28951 Falcon Ridge Rd

- 29001 Falcon Ridge Rd

- 28950 Falcon Ridge Rd

- 14370 Castlerock Rd

- 28900 Falcon Ridge Rd

- 29051 Falcon Ridge Rd

- 14450 Castlerock Rd

- 14540 Campos Del Cielo

- 14451 Castlerock Rd

- 14361 Castlerock Rd

- 14500 Castlerock Rd

- 25850 Falcon Ridge Rd

- 14501 Castlerock Rd

- 14550 Castlerock Rd

- 14300 Castlerock Rd

- 25951 Red Pony Ln

- 14561 Roland Canyon Rd