2612 Fm 2135 Cleburne, TX 76031

Osage-North Fisk NeighborhoodEstimated Value: $394,000 - $443,177

4

Beds

2

Baths

2,256

Sq Ft

$184/Sq Ft

Est. Value

About This Home

This home is located at 2612 Fm 2135, Cleburne, TX 76031 and is currently estimated at $416,044, approximately $184 per square foot. 2612 Fm 2135 is a home located in Johnson County with nearby schools including Adams Elementary School, Lowell Smith Jr. Middle School, and Cleburne High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 18, 2014

Sold by

The Secretary Of Hud

Bought by

Stanley John A and Stanley Alberta R

Current Estimated Value

Purchase Details

Closed on

Jun 7, 2014

Sold by

Wells Fargo Bank Na

Bought by

The Secretary Of Hud

Purchase Details

Closed on

Apr 1, 2014

Sold by

Carter Robert Lee

Bought by

Wells Fargo Bank Na

Purchase Details

Closed on

Apr 30, 2013

Sold by

Briarpath Fund Lp

Bought by

Carter Robert Lee

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,228

Interest Rate

3.25%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 17, 2011

Sold by

Benson Brodrick K

Bought by

Briarpath Fund Lp

Purchase Details

Closed on

Nov 1, 2008

Sold by

Benson Brodrick K and Estate Of Clifford Elton Benso

Bought by

Benson Brodrick K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$62,000

Interest Rate

5.05%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stanley John A | -- | None Available | |

| The Secretary Of Hud | -- | None Available | |

| Wells Fargo Bank Na | $103,750 | None Available | |

| Carter Robert Lee | -- | None Available | |

| Briarpath Fund Lp | -- | None Available | |

| Benson Brodrick K | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Carter Robert Lee | $150,228 | |

| Previous Owner | Benson Brodrick K | $62,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,405 | $259,345 | $149,280 | $110,065 |

| 2024 | $4,405 | $259,345 | $149,280 | $110,065 |

| 2023 | $4,404 | $259,345 | $149,280 | $110,065 |

| 2022 | $3,550 | $184,705 | $74,640 | $110,065 |

| 2021 | $3,655 | $184,705 | $74,640 | $110,065 |

| 2020 | $3,609 | $175,375 | $65,310 | $110,065 |

| 2019 | $3,877 | $175,375 | $65,310 | $110,065 |

| 2018 | $3,474 | $157,031 | $65,310 | $91,721 |

| 2017 | $3,454 | $157,031 | $65,310 | $91,721 |

| 2016 | $3,454 | $157,031 | $65,310 | $91,721 |

| 2015 | $3,049 | $157,031 | $65,310 | $91,721 |

| 2014 | $3,049 | $158,661 | $65,310 | $93,351 |

Source: Public Records

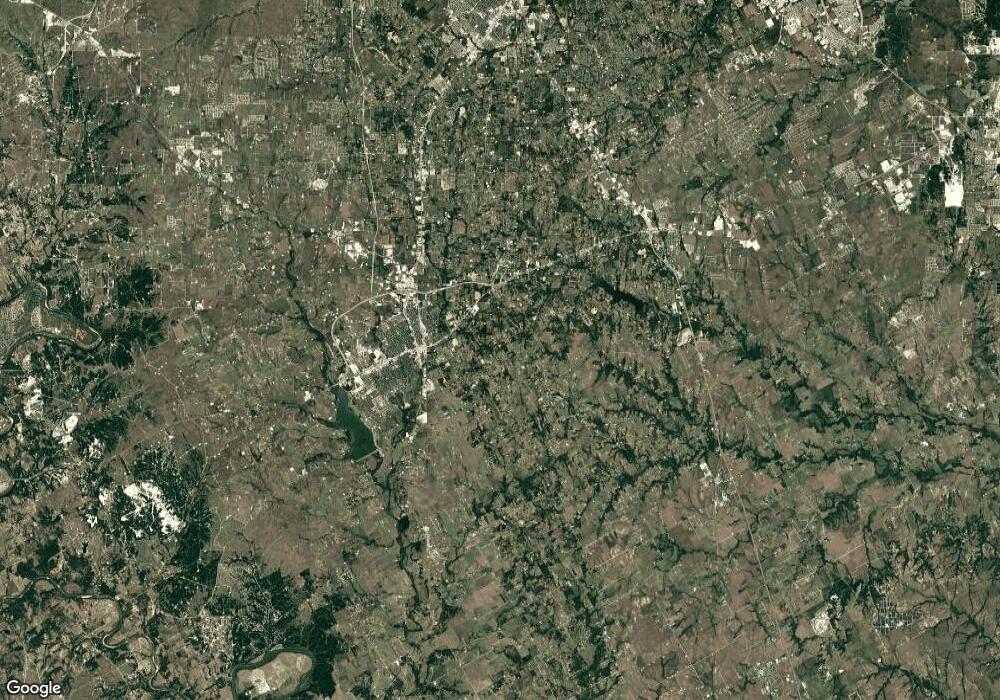

Map

Nearby Homes

- 2480 County Road 312

- 2324 Gage Rd

- 2860 County Road 312

- 1615 Cr 429

- 1605 County Road 429

- 3501 County Road 312

- 4017 County Road 310

- 2100 E Fm 4

- 2524 Pecan Springs Rd

- 3048 S Highway 171

- 4009 County Road 310

- 1128 County Road 429

- 2532 S Highway 171

- 2429 Pecan Springs Rd

- 2656 County Road 314

- 2644 County Road 314

- 2600 County Road 314

- 2628 County Road 314

- 868 Fuller Ave

- 725 Fuller Ave

- 2620 Fm 2135

- 2601 Fm 2135

- 2625 Fm 2135

- 2700 Fm 2135

- 2517 Fm 2135

- 2721 Fm 2135

- 2521 Fm 2135

- 2609 Fm 2135

- 2517 County Road 312

- 2325 County Road 312

- 2501 County Road 312

- 2401 County Road 312

- 2860 Fm 2135 Lot 4

- 2500 Fm 2135

- 2440 Cr 312

- 2401 Fm 2135

- 2420 Cr 312

- 2420 County Rd 312 Lot 3

- TBD-Lot #5 County Road 312

- 2405 Fm 2135