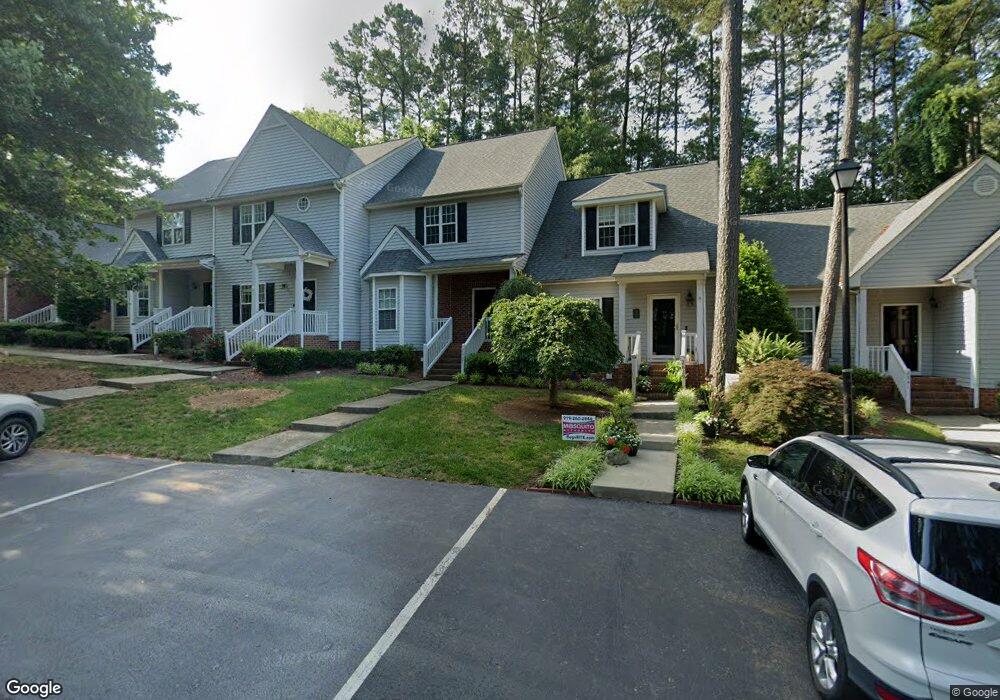

2637 Broad Oaks Place Raleigh, NC 27603

South Raleigh NeighborhoodEstimated Value: $277,000 - $301,000

2

Beds

3

Baths

1,250

Sq Ft

$230/Sq Ft

Est. Value

About This Home

This home is located at 2637 Broad Oaks Place, Raleigh, NC 27603 and is currently estimated at $287,691, approximately $230 per square foot. 2637 Broad Oaks Place is a home located in Wake County with nearby schools including Dillard Drive Magnet Elementary School, Dillard Drive Magnet Middle School, and Longleaf School Of The Arts.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 12, 2015

Sold by

Sandlin Karin L

Bought by

Sandlin Michael J and Sandlin Karin L

Current Estimated Value

Purchase Details

Closed on

Jul 23, 2007

Sold by

Sandlin Michael James and Sandlin Karin L

Bought by

Sandlin Michael J and Sandlin Karin L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$115,200

Interest Rate

6.52%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Purchase Details

Closed on

May 21, 2003

Sold by

Smith Steven A and Smith Cassandra J

Bought by

Sandlin Michael James

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$115,883

Interest Rate

5.79%

Mortgage Type

FHA

Purchase Details

Closed on

Apr 27, 2000

Sold by

Peterson Properties Llc

Bought by

Smith Steven A and Smith Cassandra J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$101,500

Interest Rate

8.24%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sandlin Michael J | -- | None Available | |

| Sandlin Michael J | -- | None Available | |

| Sandlin Michael James | $117,500 | -- | |

| Smith Steven A | $127,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sandlin Michael J | $115,200 | |

| Previous Owner | Sandlin Michael James | $115,883 | |

| Previous Owner | Smith Steven A | $101,500 | |

| Closed | Smith Steven A | $17,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,602 | $296,103 | $90,000 | $206,103 |

| 2024 | $2,592 | $296,103 | $90,000 | $206,103 |

| 2023 | $2,202 | $200,152 | $52,000 | $148,152 |

| 2022 | $2,047 | $200,152 | $52,000 | $148,152 |

| 2021 | $1,967 | $200,152 | $52,000 | $148,152 |

| 2020 | $1,932 | $200,152 | $52,000 | $148,152 |

| 2019 | $1,603 | $136,609 | $22,000 | $114,609 |

| 2018 | $1,513 | $136,609 | $22,000 | $114,609 |

| 2017 | $1,441 | $136,609 | $22,000 | $114,609 |

| 2016 | $1,412 | $136,609 | $22,000 | $114,609 |

| 2015 | $1,433 | $136,428 | $22,000 | $114,428 |

| 2014 | -- | $136,428 | $22,000 | $114,428 |

Source: Public Records

Map

Nearby Homes

- 2636 Scattered Oak Ct

- 2607 Sterling Park Dr

- 3113 Henslowe Dr

- 2271 Trailwood Valley Cir

- 2220 Hoot Owl Ct

- 2816 Alder Ridge Ln

- 2221 Mountain Mist Ct Unit 201

- 2901 Alder Ridge Ln

- 2228 Trailwood Valley Cir

- 2528 Beech Gap Ct

- 2505 Ferndown Ct

- 1901 Trailwood Heights Ln Unit 304

- 2208 Sierra Dr

- 2524 Ferndown Ct

- 2801 Henslowe Dr

- 2108 Leadenhall Way

- 2005 Shenandoah Rd

- 2621 Ivory Run Way Unit 105

- 2831 Barrymore St Unit 107

- 2920 Barrymore St Unit 106

- 2639 Broad Oaks Place Unit 21

- 2633 Broad Oaks Place

- 2641 Broad Oaks Place Unit 20

- 2631 Broad Oaks Place Unit 25

- 2645 Broad Oaks Place

- 2627 Broad Oaks Place

- 2647 Broad Oaks Place

- 2604 Buck Spring Ct

- 2625 Broad Oaks Place

- 2649 Broad Oaks Place

- 2651 Broad Oaks Place

- 2621 Broad Oaks Place Unit 29

- 2670 Lineberry Dr

- 2616 Broad Oaks Place

- 2605 Buck Spring Ct

- 2619 Broad Oaks Place

- 2608 Buck Spring Ct

- 2686 Broad Oaks Place

- 2686 Broad Oaks Place Unit 58

- 2618 Broad Oaks Place Unit 49