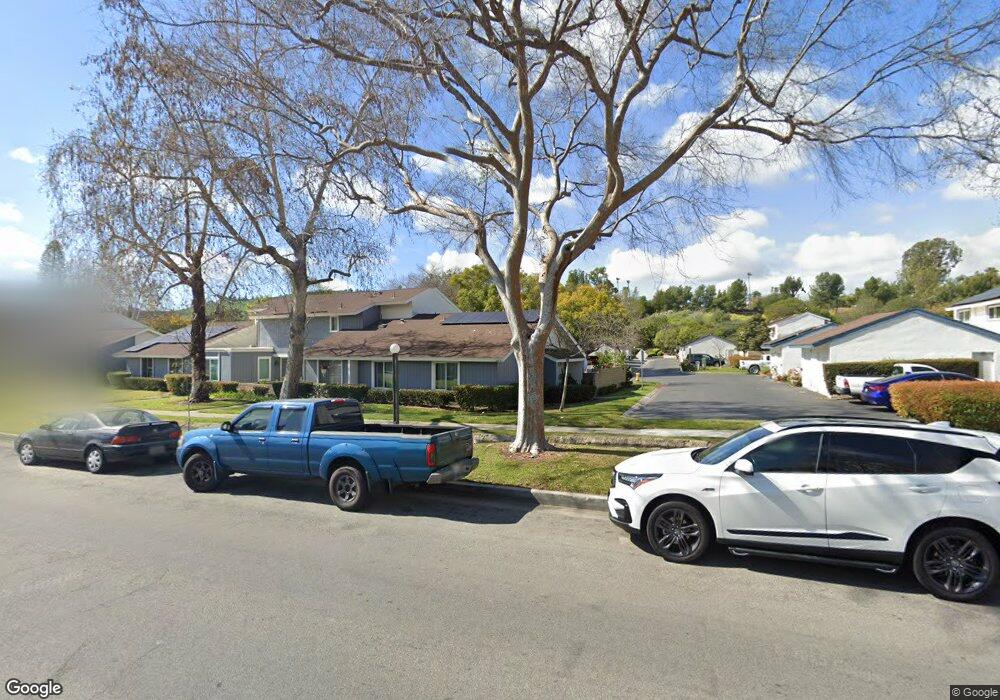

26376 Eastview Ct San Juan Capistrano, CA 92675

Estimated Value: $738,547 - $1,046,000

3

Beds

1

Bath

1,062

Sq Ft

$814/Sq Ft

Est. Value

About This Home

This home is located at 26376 Eastview Ct, San Juan Capistrano, CA 92675 and is currently estimated at $864,137, approximately $813 per square foot. 26376 Eastview Ct is a home located in Orange County with nearby schools including Viejo Elementary School, Newhart Middle School, and Capistrano Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 23, 2024

Sold by

Romero Salvador

Bought by

Romero Eleuteria

Current Estimated Value

Purchase Details

Closed on

Mar 29, 2004

Sold by

Delatorre Veronica

Bought by

Romero Salvador

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$337,600

Interest Rate

6.49%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 23, 2003

Sold by

Delatorre Juan

Bought by

Delatorre Veronica

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$234,400

Interest Rate

5.22%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 27, 2003

Sold by

Rivera J Hector and Rivera Margarita

Bought by

Delatorre Veronica

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$234,400

Interest Rate

5.22%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Romero Eleuteria | -- | None Listed On Document | |

| Romero Salvador | $422,000 | First American Title Co | |

| Delatorre Veronica | -- | Fidelity National Title Co | |

| Delatorre Veronica | $293,000 | Fidelity National Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Romero Salvador | $337,600 | |

| Previous Owner | Delatorre Veronica | $234,400 | |

| Closed | Romero Salvador | $84,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,382 | $599,987 | $513,455 | $86,532 |

| 2024 | $6,382 | $588,223 | $503,387 | $84,836 |

| 2023 | $5,120 | $470,857 | $400,940 | $69,917 |

| 2022 | $4,773 | $461,625 | $393,078 | $68,547 |

| 2021 | $4,685 | $452,574 | $385,371 | $67,203 |

| 2020 | $4,692 | $452,574 | $385,371 | $67,203 |

| 2019 | $4,605 | $443,700 | $377,814 | $65,886 |

| 2018 | $4,523 | $435,000 | $370,405 | $64,595 |

| 2017 | $4,225 | $402,000 | $337,405 | $64,595 |

| 2016 | $4,230 | $402,000 | $337,405 | $64,595 |

| 2015 | $3,464 | $329,000 | $264,405 | $64,595 |

| 2014 | $2,922 | $276,750 | $212,155 | $64,595 |

Source: Public Records

Map

Nearby Homes

- 29546 Spotted Bull Ln

- 29302 Edgewood Rd

- 29919 Hidden Creek Dr

- 29931 Camino Capistrano

- 113 Pearl Unit 106

- 82 Largo St

- 29282 Rue Cerise Unit 7

- 33 Aruba St Unit 217

- 1 Martinique St

- 29592 Los Osos Dr

- 28705 Charreadas

- 27281 Viewpoint Cir

- 29901 Weatherwood

- 28305 Paseo el Siena Unit 10

- 28215 Paseo el Siena Unit 46

- 25602 Paseo la Vista Unit 4

- 25575 Paseo la Vista Unit 75

- 30671 Marbella Vista

- 25625 Paseo la Cresta Unit 39

- 25641 Paseo la Cresta

- 26372 Eastview Ct

- 26366 Eastview Ct

- 26364 Eastview Ct

- 26371 Eastview Ct

- 26375 Eastview Ct

- 26365 Eastview Ct

- 26361 Eastview Ct

- 26362 Eastview Ct

- 26402 Woodcrest Ln

- 26342 Eastview Ct

- 26381 Smoketree Ln

- 26358 Eastview Ct

- 26344 Eastview Ct

- 26341 Eastview Ct

- 26336 Eastview Ct

- 29576 Brook Ct

- 26406 Woodcrest Ln

- 26356 Eastview Ct

- 26346 Eastview Ct

- 26335 Eastview Ct