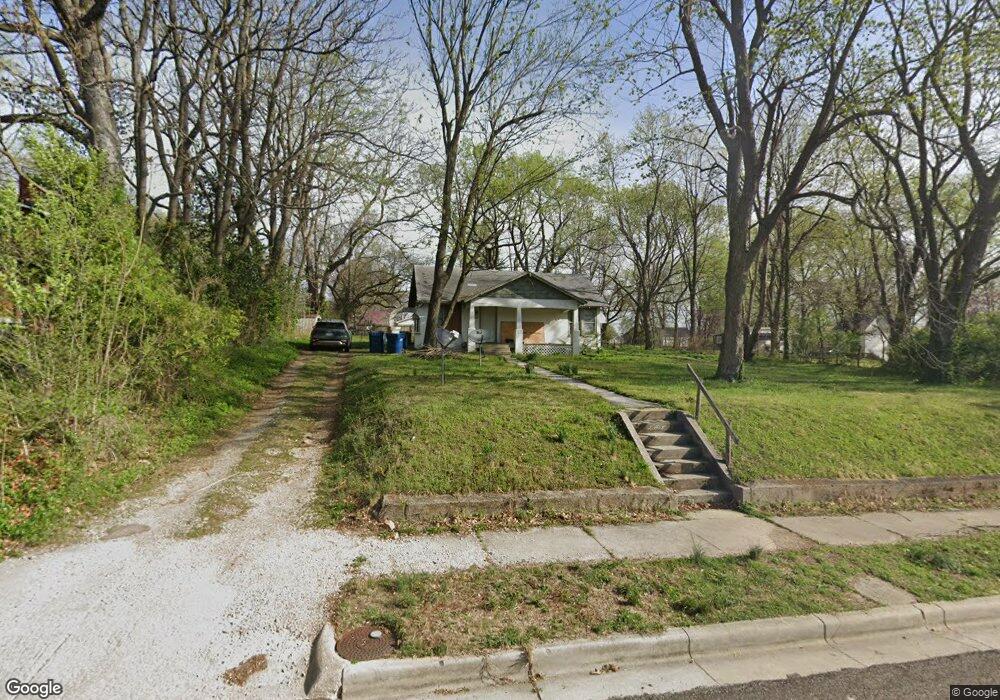

2643 E 3rd St Joplin, MO 64801

Oak Grove NeighborhoodEstimated Value: $122,229 - $132,000

2

Beds

1

Bath

1,250

Sq Ft

$101/Sq Ft

Est. Value

About This Home

This home is located at 2643 E 3rd St, Joplin, MO 64801 and is currently estimated at $125,807, approximately $100 per square foot. 2643 E 3rd St is a home located in Jasper County with nearby schools including McKinley Elementary School, East Middle School, and Joplin High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 3, 2010

Sold by

Navigator Reo Fund Manager Llc

Bought by

Steele Barbara S and Steele Richard L

Current Estimated Value

Purchase Details

Closed on

Oct 20, 2009

Sold by

Realholdings Llc

Bought by

Navigator Reo Fund Manager Llc

Purchase Details

Closed on

Aug 28, 2009

Sold by

Fannie Mae

Bought by

Realholdings Llc

Purchase Details

Closed on

Nov 14, 2008

Sold by

Kerr Kyle M

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Jan 26, 2006

Sold by

Edwards Lyn M

Bought by

Kerr Kyle M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$48,410

Interest Rate

6.22%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Steele Barbara S | $12,500 | Fatco | |

| Navigator Reo Fund Manager Llc | -- | None Available | |

| Realholdings Llc | -- | Fatco | |

| Federal National Mortgage Association | $39,523 | None Available | |

| Kerr Kyle M | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kerr Kyle M | $48,410 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $379 | $9,060 | $2,400 | $6,660 |

| 2024 | $379 | $8,210 | $2,400 | $5,810 |

| 2023 | $379 | $8,210 | $2,400 | $5,810 |

| 2022 | $371 | $8,070 | $2,400 | $5,670 |

| 2021 | $369 | $8,070 | $2,400 | $5,670 |

| 2020 | $354 | $7,570 | $2,400 | $5,170 |

| 2019 | $354 | $7,570 | $2,400 | $5,170 |

| 2018 | $353 | $7,570 | $0 | $0 |

| 2017 | $354 | $7,570 | $0 | $0 |

| 2016 | $350 | $7,570 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 306 S Florida Ave

- 414 S Brownell Ave

- 317 Mc Connell Ave

- 609 S Patterson Ave

- 2808 E 7th St

- 311 S Park Ave

- 417 S Park Ave

- 2650 E 8th St

- 611 S Park Ave

- Tract 6 Jericho Ln

- Tract 3 Jericho Ln

- 609 S Saint Charles Ave

- 728 S Highland Ave

- 1026 Texas Cir

- 3154 Turkey Creek Rd

- 506 S Saint Louis Ave Unit 14 & 15

- 2916 E 9th St

- 2211 E 10th St

- 1516 E 5th St

- 3037 E 10th St