26492 Las Palmas Unit 1 Laguna Hills, CA 92656

Estimated Value: $546,000 - $655,000

1

Bed

1

Bath

738

Sq Ft

$780/Sq Ft

Est. Value

About This Home

This home is located at 26492 Las Palmas Unit 1, Laguna Hills, CA 92656 and is currently estimated at $575,831, approximately $780 per square foot. 26492 Las Palmas Unit 1 is a home located in Orange County with nearby schools including Linda Vista Elementary School, La Paz Intermediate School, and Laguna Hills High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 23, 2022

Sold by

Pearsall-Lynch Sandra and Lynch Sandra

Bought by

Lynch Sandra

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$693,000

Outstanding Balance

$680,941

Interest Rate

2.73%

Mortgage Type

Reverse Mortgage Home Equity Conversion Mortgage

Estimated Equity

-$105,110

Purchase Details

Closed on

Mar 4, 2011

Sold by

Pearsall Lynch Sandra

Bought by

Pearsall Lynch Sandra

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$277,500

Interest Rate

4.77%

Mortgage Type

Reverse Mortgage Home Equity Conversion Mortgage

Purchase Details

Closed on

Oct 1, 2010

Sold by

Tyson Ronald K and Tyson Mary A

Bought by

Lynch Sandra J Pearsall

Purchase Details

Closed on

Feb 25, 2006

Sold by

Tyson Ronald K and Tyson Mary

Bought by

Tyson Ronald K and Tyson Mary A

Purchase Details

Closed on

Dec 22, 1998

Sold by

Lee Sandra J Pearsall

Bought by

Tyson Ronald K and Tyson Mary

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lynch Sandra | -- | Timios | |

| Pearsall Lynch Sandra | -- | First American Title Ins Co | |

| Lynch Sandra J Pearsall | -- | None Available | |

| Tyson Ronald K | -- | None Available | |

| Tyson Ronald K | -- | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lynch Sandra | $693,000 | |

| Previous Owner | Pearsall Lynch Sandra | $277,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,204 | $224,198 | $131,384 | $92,814 |

| 2024 | $2,204 | $219,802 | $128,807 | $90,995 |

| 2023 | $2,151 | $215,493 | $126,282 | $89,211 |

| 2022 | $2,111 | $211,268 | $123,806 | $87,462 |

| 2021 | $2,139 | $207,126 | $121,378 | $85,748 |

| 2020 | $2,120 | $205,003 | $120,134 | $84,869 |

| 2019 | $2,078 | $200,984 | $117,779 | $83,205 |

| 2018 | $2,040 | $197,044 | $115,470 | $81,574 |

| 2017 | $1,114 | $107,178 | $107,178 | $0 |

| 2016 | $285 | $107,178 | $107,178 | $0 |

| 2015 | $1,122 | $107,178 | $107,178 | $0 |

| 2014 | $1,828 | $182,896 | $107,178 | $75,718 |

Source: Public Records

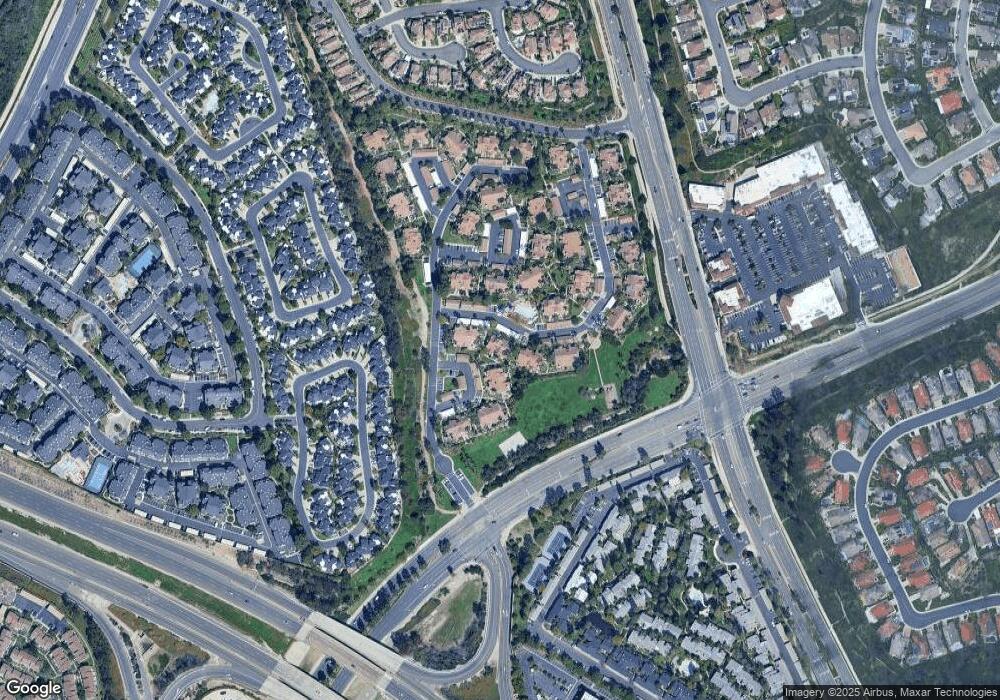

Map

Nearby Homes

- 24392 Acaso Unit 8

- 26532 Merienda Unit 5

- 26431 Las Alturas Ave

- 26701 Quail Creek Unit 142

- 26701 Quail Creek Unit 143

- 26701 Quail Creek Unit 168

- 26272 Yolanda St

- 24852 Buckboard Ln

- 101 Abbeywood Ln

- 65 Briarwood Ln Unit 86

- 24378 Larchmont Ct Unit 67

- 65 Rambling Ln Unit 207

- 19 Briarwood Ln Unit 66

- 24922 Buckboard Ln

- 24391 Larchmont Ct Unit 37

- 24377 Larchmont Ct Unit 32

- 3 Rambling Ln Unit 182

- 16 Abbey Ln Unit 332

- 24321 El Pilar Unit 11

- 26622 Stetson Place

- 26541 Las Palmas

- 26541 Las Palmas

- 26541 Las Palmas Unit 6

- 26492 Las Palmas Unit 3

- 26492 Las Palmas Unit 4

- 26541 Las Palmas Unit 5

- 26541 Las Palmas Unit 3

- 26492 Las Palmas Unit 2

- 26492 Las Palmas Unit 7

- 26541 Las Palmas Unit 8

- 26492 Las Palmas Unit 6

- 26541 Las Palmas Unit 4

- 26541 Las Palmas Unit 7

- 26541 Las Palmas Unit 1

- 26492 Las Palmas Unit 8

- 26541 Las Palmas Unit 2

- 26492 Las Palmas Unit 5

- 26491 Las Palmas Unit 3

- 26491 Las Palmas Unit 4

- 26491 Las Palmas Unit 8