2661 Wyndham Dr SE Unit 43 Grand Rapids, MI 49546

Estimated Value: $417,632 - $442,000

3

Beds

3

Baths

2,644

Sq Ft

$161/Sq Ft

Est. Value

About This Home

This home is located at 2661 Wyndham Dr SE Unit 43, Grand Rapids, MI 49546 and is currently estimated at $426,658, approximately $161 per square foot. 2661 Wyndham Dr SE Unit 43 is a home located in Kent County with nearby schools including Thornapple Elementary School, Central Woodlands 5/6 School, and Central Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 30, 2023

Sold by

Shafer Colleen A

Bought by

Colleen A Shafer Declaration Of Trust and Shafer

Current Estimated Value

Purchase Details

Closed on

Mar 30, 2005

Sold by

The Leona R Debruyne Trust

Bought by

Shafer Colleen A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$112,500

Interest Rate

5.71%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jan 26, 1995

Bought by

Debruyne Leona R Trust and Shafer Colleen A

Purchase Details

Closed on

Apr 28, 1994

Bought by

Debruyne Leona R Trust and Shafer Colleen A

Purchase Details

Closed on

Mar 10, 1992

Bought by

Shafer Parks and Shafer Colleen A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Colleen A Shafer Declaration Of Trust | -- | Michigan Land Title | |

| Shafer Colleen A | $225,000 | Chicago Title | |

| Debruyne Leona R Trust | -- | -- | |

| Debruyne Leona R Trust | $174,900 | -- | |

| Shafer Parks | $186,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Shafer Colleen A | $112,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,544 | $219,200 | $0 | $0 |

| 2024 | $2,544 | $186,400 | $0 | $0 |

| 2023 | $3,562 | $176,800 | $0 | $0 |

| 2022 | $3,447 | $168,300 | $0 | $0 |

| 2021 | $3,361 | $167,700 | $0 | $0 |

| 2020 | $2,271 | $152,200 | $0 | $0 |

| 2019 | $3,296 | $146,000 | $0 | $0 |

| 2018 | $3,296 | $134,800 | $0 | $0 |

| 2017 | $3,284 | $119,000 | $0 | $0 |

| 2016 | $3,169 | $112,000 | $0 | $0 |

| 2015 | -- | $112,000 | $0 | $0 |

| 2013 | -- | $94,600 | $0 | $0 |

Source: Public Records

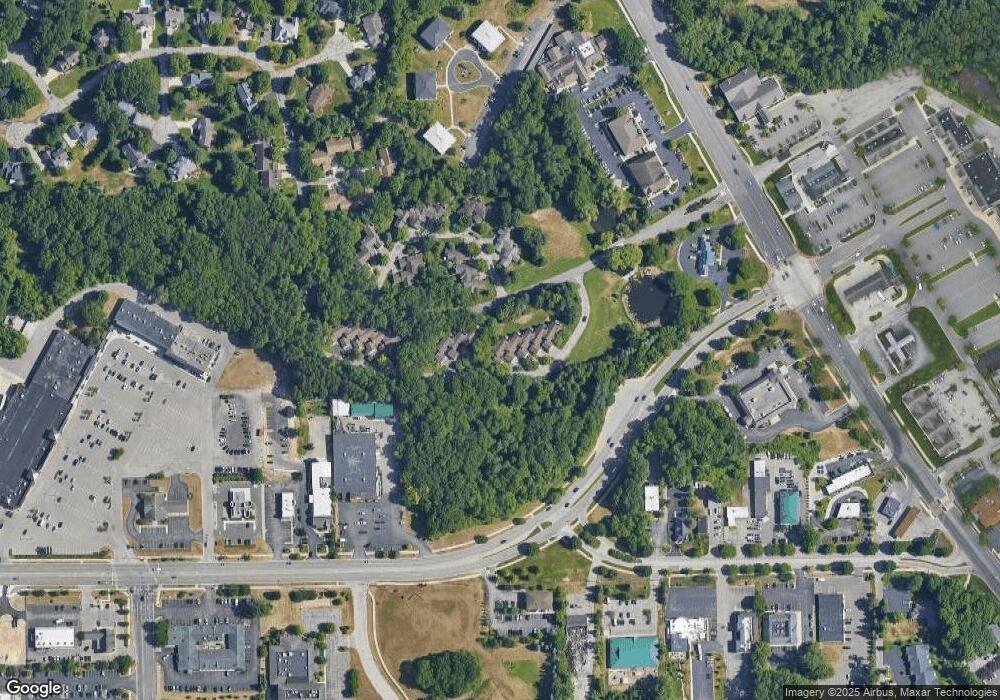

Map

Nearby Homes

- 6663 Waybridge Dr SE Unit 37

- 6657 Waybridge Dr SE

- 6716 Cascade Rd SE Unit 46

- 6587 Waybridge Dr SE

- 6574 Round Hill Ct SE Unit Lot 5

- 6574 Round Hill Ct SE

- 6562 Round Hill Ct SE

- 6562 Round Hill Ct SE Unit Lot 6

- 6554 Round Hill Ct SE

- 6554 Round Hill Ct SE Unit Lot 7

- 6334 Bechalla Dr SE

- 6761 Burton St SE

- 2726 Orange Ave SE

- 2984 Chapshire Dr SE Unit 59

- 3039 Jeanlin Dr SE

- 6348 Greenway Dr SE Unit 62

- 3005 Chapshire Dr SE

- 6249 Acropolis Dr SE

- 2757 Cascade Springs Dr SE

- 2444 Irene Ave SE

- 2659 Wyndham Dr SE

- 2659 Wyndham Dr SE Unit 44

- 2649 Wyndham Dr SE Unit 28

- 2664 Wyndham Dr SE

- 2647 Wyndham Dr SE

- 2643 Wyndham Dr SE Unit 33

- 2638 Wyndham Dr SE

- 6671 Waybridge Dr SE Unit 39

- 6663 Waybridge Dr SE

- 6667 Waybridge Dr SE Unit 38

- 2636 Wyndham Dr SE Unit 31

- 6657 Waybridge Dr SE Unit (36)

- 6653 Waybridge Dr SE

- 6653 Waybridge Dr SE Unit 35

- 2641 Wyndham Dr SE

- 6625 Waybridge Dr SE

- 6625 Waybridge Dr SE Unit 15

- 6619 Waybridge Dr SE

- 2639 Wyndham Dr SE

- 2639 Wyndham Dr SE Unit 40