2675 Longbranch Rd Eagle Point, OR 97524

Estimated Value: $559,000 - $694,000

2

Beds

2

Baths

1,200

Sq Ft

$507/Sq Ft

Est. Value

About This Home

This home is located at 2675 Longbranch Rd, Eagle Point, OR 97524 and is currently estimated at $608,454, approximately $507 per square foot. 2675 Longbranch Rd is a home located in Jackson County with nearby schools including Shady Cove School, Eagle Point Middle School, and White Mountain Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 28, 2022

Sold by

Earle Donald B

Bought by

Nash Cheryl Ann and Nash Devon Paul

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$425,000

Interest Rate

4.42%

Mortgage Type

Balloon

Purchase Details

Closed on

Sep 25, 2001

Sold by

Finigan Edith E

Bought by

Earle Donald B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$166,315

Interest Rate

6.91%

Purchase Details

Closed on

Sep 24, 2001

Sold by

Earle Donald B

Bought by

Earle Donald B and Earle Michelle K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$166,315

Interest Rate

6.91%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Nash Cheryl Ann | $641,000 | First American Title | |

| Earle Donald B | $185,000 | Jackson County Title | |

| Earle Donald B | $185,000 | Jackson County Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Nash Cheryl Ann | $425,000 | |

| Previous Owner | Earle Donald B | $166,315 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $1,631 | $95,612 | -- | -- |

| 2025 | $1,568 | $124,277 | $15,957 | $108,320 |

| 2024 | $1,568 | $120,778 | $15,608 | $105,170 |

| 2023 | $1,459 | $120,576 | $15,406 | $105,170 |

| 2022 | $1,496 | $120,576 | $15,406 | $105,170 |

| 2021 | $1,447 | $117,190 | $15,070 | $102,120 |

| 2020 | $1,547 | $113,898 | $14,748 | $99,150 |

| 2019 | $1,523 | $107,603 | $14,133 | $93,470 |

| 2018 | $1,527 | $105,988 | $13,848 | $92,140 |

| 2017 | $1,376 | $105,988 | $13,848 | $92,140 |

| 2016 | $1,301 | $100,144 | $13,284 | $86,860 |

| 2015 | $1,310 | $102,634 | $9,964 | $92,670 |

| 2014 | $1,224 | $95,029 | $12,599 | $82,430 |

Source: Public Records

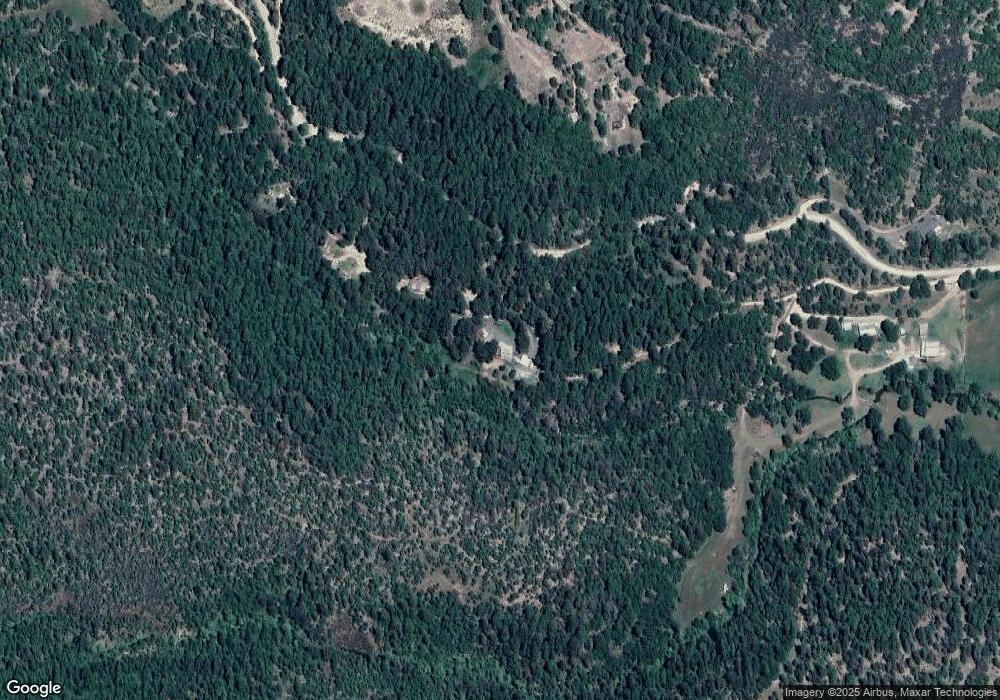

Map

Nearby Homes

- 5845 Rhodes Ln

- 363 Kitty Dr

- 218 Long Branch Rd

- 461 Sawyer Rd

- 536 Rogue Air Dr

- 104 Hart Cir

- 7266 Rogue River Dr

- 0 Citadel Rd

- 330 Penny Ln

- 78 Maple Dr

- 0 Cabetowne Way Unit 220200666

- 120 Birch St

- 551 Hudspeth Ln

- 209 White Oak Way

- 22071 Highway 62 Unit 54

- 176 Cindy Way

- 20455 Highway 62

- 22071 Oregon 62 Unit 36

- 20055 Highway 62 Unit 1

- 20055 Highway 62 Unit 49

- 2675 Long Branch Rd

- 0 Long Branch Rd

- 2601 Long Branch Rd

- 2626 Long Branch Rd

- 2601 Longbranch Rd

- 2755 Long Branch Rd

- 2796 Longbranch Rd

- 2358 Longbranch Rd

- 2320 Longbranch Rd

- 2358 Long Branch Rd

- 2320 Long Branch Rd

- 5991 Rogue River Dr

- 2801 Long Branch Rd

- 5987 Rogue River Dr

- 5939 Rogue River Dr

- 2030 Longbranch Rd

- 2030 Long Branch Rd

- 5885 Rhodes Ln

- 5889 Rogue River Dr

- 5873 Rogue River Dr

Your Personal Tour Guide

Ask me questions while you tour the home.