26819 Live Oak Ct Agoura Hills, CA 91301

Estimated Value: $1,154,029 - $1,310,000

4

Beds

3

Baths

1,866

Sq Ft

$666/Sq Ft

Est. Value

About This Home

This home is located at 26819 Live Oak Ct, Agoura Hills, CA 91301 and is currently estimated at $1,242,507, approximately $665 per square foot. 26819 Live Oak Ct is a home located in Los Angeles County with nearby schools including Lupin Hill Elementary, Arthur E. Wright Middle School, and Calabasas High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 29, 2019

Sold by

Shagrin Dale and Shagrin Lenore

Bought by

Shagrin Dale H and Shagrin Lenore J

Current Estimated Value

Purchase Details

Closed on

Apr 6, 1998

Sold by

Temple Alan C and Temple Anne F

Bought by

Shagrin Dale and Shagrin Lenore

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$265,500

Interest Rate

7.13%

Purchase Details

Closed on

May 6, 1996

Sold by

Smith Jerry L

Bought by

Temple Alan C and Temple Anne F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$206,250

Interest Rate

8.42%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Shagrin Dale H | -- | None Available | |

| Shagrin Dale | -- | None Available | |

| Shagrin Dale | $295,000 | First American Title | |

| Temple Alan C | $275,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Shagrin Dale | $265,500 | |

| Previous Owner | Temple Alan C | $206,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,698 | $471,020 | $254,031 | $216,989 |

| 2024 | $5,698 | $461,785 | $249,050 | $212,735 |

| 2023 | $5,597 | $452,731 | $244,167 | $208,564 |

| 2022 | $5,423 | $443,855 | $239,380 | $204,475 |

| 2021 | $5,398 | $435,153 | $234,687 | $200,466 |

| 2019 | $5,209 | $422,248 | $227,727 | $194,521 |

| 2018 | $5,128 | $413,969 | $223,262 | $190,707 |

| 2016 | $4,858 | $397,896 | $214,594 | $183,302 |

| 2015 | $4,779 | $391,920 | $211,371 | $180,549 |

| 2014 | $4,719 | $384,244 | $207,231 | $177,013 |

Source: Public Records

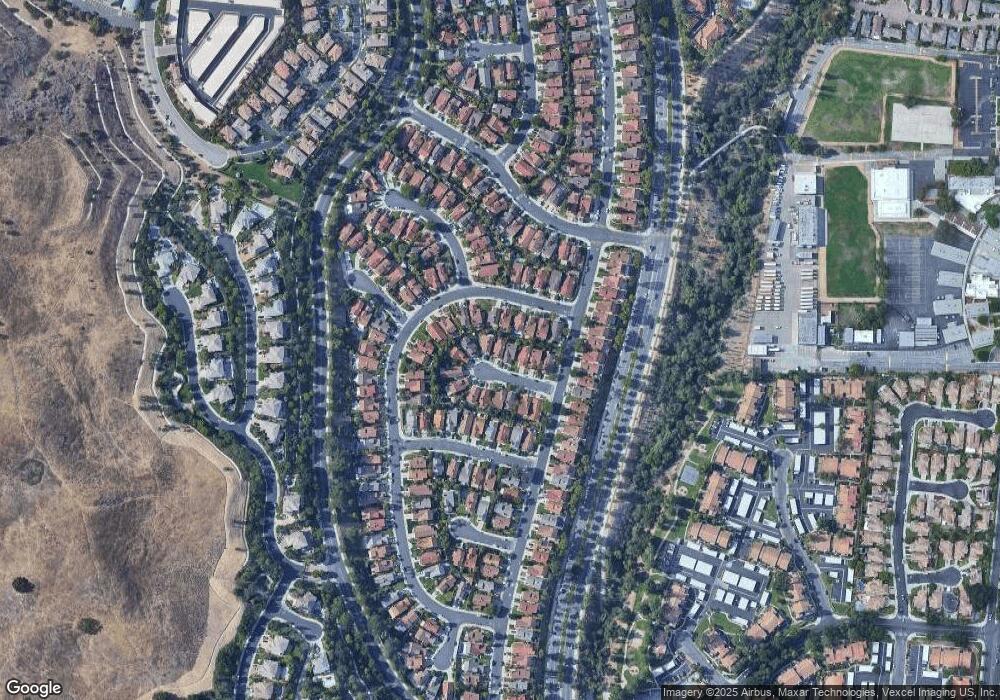

Map

Nearby Homes

- 3966 Leighton Point Rd

- 4229 Via Mira Monte

- 26823 Hot Springs Place

- 4240 Lost Hills Rd Unit 1702

- 4240 Lost Hills Rd Unit 503

- 4240 Lost Hills Rd Unit 602

- 4240 Lost Hills Rd Unit 3004

- 4240 Lost Hills Rd Unit 1902

- 4201 Las Virgenes Rd Unit 112

- 4201 Las Virgenes Rd Unit 115

- 4275 Las Virgenes Rd Unit 3

- 4337 Willow Glen St

- 5021 Ambridge Dr

- 27311 Country Glen Rd

- 3936 United Rd

- 27300 Agoura Rd

- 3952 Patrick Henry Place

- 4591 Camino Del Sol

- 4622 Cielo Cir

- 5260 Edgeware Dr

- 26813 Live Oak Ct

- 26823 Live Oak Ct

- 26811 Live Oak Ct

- 4032 Cottonwood Grove Trail

- 26827 Live Oak Ct

- 4036 Cottonwood Grove Trail

- 4026 Cottonwood Grove Trail

- 4040 Cottonwood Grove Trail

- 26807 Live Oak Ct

- 4020 Cottonwood Grove Trail

- 26831 Live Oak Ct

- 4044 Cottonwood Grove Trail

- 4014 Cottonwood Grove Trail

- 26820 Live Oak Ct

- 26803 Live Oak Ct

- 26814 Live Oak Ct

- 26824 Live Oak Ct

- 26810 Live Oak Ct

- 26832 Live Oak Ct

- 4008 Cottonwood Grove Trail