2700 Fm 2135 Cleburne, TX 76031

Estimated Value: $579,988 - $730,000

4

Beds

3

Baths

3,385

Sq Ft

$193/Sq Ft

Est. Value

About This Home

This home is located at 2700 Fm 2135, Cleburne, TX 76031 and is currently estimated at $654,747, approximately $193 per square foot. 2700 Fm 2135 is a home located in Johnson County with nearby schools including Adams Elementary School, Lowell Smith Jr. Middle School, and Cleburne High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 28, 2017

Sold by

Hudson Donnie Paul and Hudson Roanne

Bought by

Blasingame James Brent and Blasingame Kimberly

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$325,375

Outstanding Balance

$269,216

Interest Rate

4.09%

Mortgage Type

New Conventional

Estimated Equity

$385,531

Purchase Details

Closed on

Jan 21, 2005

Sold by

York Jimmy B and York Jason

Bought by

Hudson Donnie Paul and Hudson Roanne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$29,800

Interest Rate

5.71%

Mortgage Type

Future Advance Clause Open End Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Blasingame James Brent | -- | Capital Title | |

| Hudson Donnie Paul | -- | Fatco |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Blasingame James Brent | $325,375 | |

| Previous Owner | Hudson Donnie Paul | $29,800 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,025 | $490,777 | $208,272 | $282,505 |

| 2024 | $8,337 | $490,777 | $208,272 | $282,505 |

| 2023 | $6,323 | $490,777 | $208,272 | $282,505 |

| 2022 | $7,435 | $406,477 | $123,972 | $282,505 |

| 2021 | $7,669 | $0 | $0 | $0 |

| 2020 | $7,004 | $0 | $0 | $0 |

| 2019 | $7,525 | $0 | $0 | $0 |

| 2018 | $7,170 | $0 | $0 | $0 |

| 2017 | $5,086 | $0 | $0 | $0 |

| 2016 | $4,624 | $0 | $0 | $0 |

| 2015 | $3,805 | $0 | $0 | $0 |

| 2014 | $3,805 | $0 | $0 | $0 |

Source: Public Records

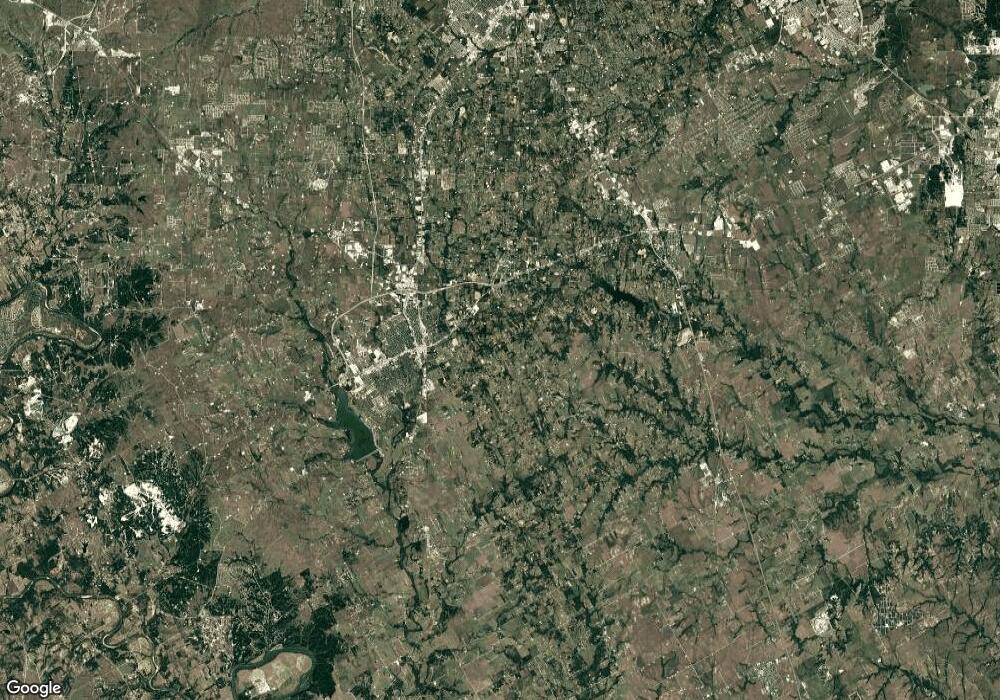

Map

Nearby Homes

- 2480 County Road 312

- 2860 County Road 312

- 2624 County Road 429

- 1615 Cr 429

- 1605 County Road 429

- 3116 County Road 310

- 3501 County Road 312

- 2100 E Fm 4

- 1128 County Road 429

- 2429 Pecan Springs Rd

- 2656 County Road 314

- 2644 County Road 314

- 2600 County Road 314

- 2628 County Road 314

- 2064 E Farm To Market 4

- 2316 Pecan Valley Ct

- 2301 Cr-808 Unit 3 Lot

- 711 801c

- 2301 Cr-808 Unit 2 Lot

- 1021 Traction Trail

- 2620 Fm 2135

- 2625 Fm 2135

- 2721 Fm 2135

- 2612 Fm 2135

- 2501 County Road 312

- 2601 Fm 2135

- 2517 County Road 312

- 2860 Fm 2135 Lot 4

- 2401 County Road 312

- 2440 Cr 312

- 2325 County Road 312

- TBD-Lot #5 County Road 312

- 2420 County Rd 312 Lot 3

- 2420 Cr 312

- 2400 Cr 312

- 2609 Fm 2135

- 2420 County Rd 312 Lot 1

- 2517 Fm 2135

- 2521 Fm 2135

- 2633 County Road 312