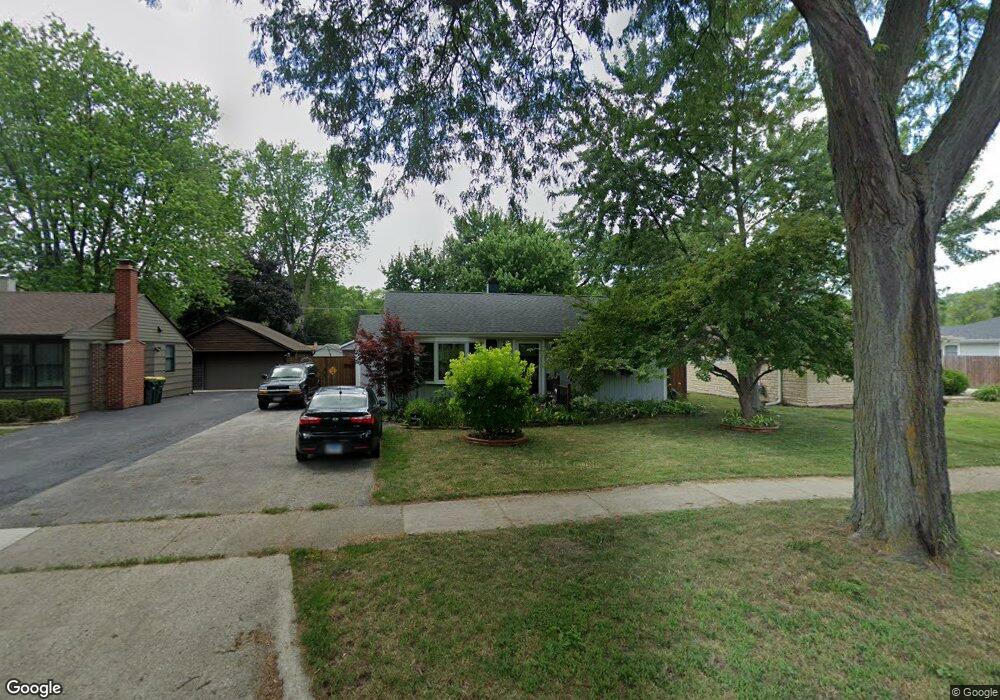

2701 Wilke Rd Rolling Meadows, IL 60008

Estimated Value: $274,000 - $310,049

3

Beds

2

Baths

885

Sq Ft

$327/Sq Ft

Est. Value

About This Home

This home is located at 2701 Wilke Rd, Rolling Meadows, IL 60008 and is currently estimated at $289,762, approximately $327 per square foot. 2701 Wilke Rd is a home located in Cook County with nearby schools including Kimball Hill Elementary School, King Elementary School, and Carl Sandburg Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 11, 2006

Sold by

Humphries Gregory S

Bought by

Humphries Gregory S and Besinaiz Yvette A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$234,650

Outstanding Balance

$156,840

Interest Rate

8.55%

Mortgage Type

New Conventional

Estimated Equity

$132,922

Purchase Details

Closed on

Jun 17, 2002

Sold by

Erbstoesser Diane A

Bought by

Humphries Gregory S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$151,235

Interest Rate

6.49%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 1, 2000

Sold by

Rieber Aaron H and Erbstoesser Diane A

Bought by

Erbstoesser Diane A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Humphries Gregory S | -- | Freedom Title Corp | |

| Humphries Gregory S | $137,000 | Agtf Inc | |

| Erbstoesser Diane A | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Humphries Gregory S | $234,650 | |

| Previous Owner | Humphries Gregory S | $151,235 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,136 | $24,000 | $5,511 | $18,489 |

| 2023 | $5,840 | $24,000 | $5,511 | $18,489 |

| 2022 | $5,840 | $24,000 | $5,511 | $18,489 |

| 2021 | $4,332 | $17,077 | $3,256 | $13,821 |

| 2020 | $4,519 | $17,077 | $3,256 | $13,821 |

| 2019 | $4,554 | $19,081 | $3,256 | $15,825 |

| 2018 | $4,073 | $16,011 | $3,006 | $13,005 |

| 2017 | $4,009 | $16,011 | $3,006 | $13,005 |

| 2016 | $3,995 | $16,011 | $3,006 | $13,005 |

| 2015 | $3,667 | $14,271 | $2,755 | $11,516 |

| 2014 | $3,597 | $14,271 | $2,755 | $11,516 |

| 2013 | $3,492 | $14,271 | $2,755 | $11,516 |

Source: Public Records

Map

Nearby Homes

- 1615 W Johanna Terrace

- 12 S Princeton Ct

- 502 S Reuter Dr

- 222 S Dwyer Ave

- 2201 Kingfisher Ln

- 2100 Martin Ln

- 2611 South St

- 3208 Wren Ln

- 617 N Wilke Rd

- 3316 Trillium Cir

- 3125 Town Square Dr Unit 408

- 1506 W Northwest Hwy

- 3805 Wren Ln

- 751 S Dwyer Ave Unit F

- 3265 Kirchoff Rd Unit 223

- 105 S Mitchell Ave

- 318 W Wing St

- 1602 W Orchard Place Unit 1602C

- 314 W Wing St

- 3400 Wellington Ct Unit 306