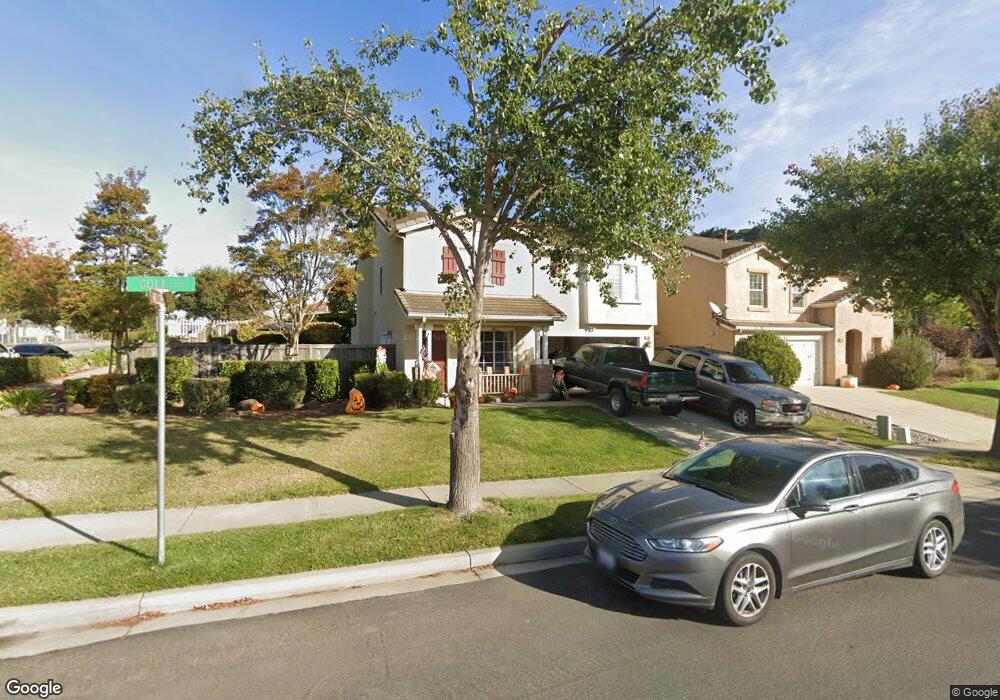

2705 Golf Cir Royal Oaks, CA 95076

Estimated Value: $831,000 - $1,071,000

5

Beds

2

Baths

2,256

Sq Ft

$425/Sq Ft

Est. Value

About This Home

This home is located at 2705 Golf Cir, Royal Oaks, CA 95076 and is currently estimated at $957,852, approximately $424 per square foot. 2705 Golf Cir is a home located in Monterey County with nearby schools including Ohlone Elementary School, Pajaro Middle School, and Watsonville High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 13, 2024

Sold by

Young Michael Timothy and Young Ramona Teresa

Bought by

Vaz Young Family Trust and Young

Current Estimated Value

Purchase Details

Closed on

Jul 26, 1999

Sold by

Kaufman & Broad South Bay Inc

Bought by

Young Michael Timothy and Young Ramona Teresa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$210,000

Interest Rate

7.64%

Purchase Details

Closed on

Jun 9, 1998

Sold by

Yosemite Motels

Bought by

Kaufman & Broad Monterey Bay Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$826,500

Interest Rate

7.17%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vaz Young Family Trust | -- | None Listed On Document | |

| Young Michael Timothy | -- | None Listed On Document | |

| Young Michael Timothy | $287,500 | First American Title Co | |

| Kaufman & Broad Monterey Bay Inc | $1,653,000 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Young Michael Timothy | $210,000 | |

| Previous Owner | Kaufman & Broad Monterey Bay Inc | $826,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,753 | $441,371 | $153,688 | $287,683 |

| 2024 | $5,753 | $432,718 | $150,675 | $282,043 |

| 2023 | $4,957 | $424,234 | $147,721 | $276,513 |

| 2022 | $4,875 | $415,917 | $144,825 | $271,092 |

| 2021 | $4,802 | $407,763 | $141,986 | $265,777 |

| 2020 | $4,637 | $403,583 | $140,531 | $263,052 |

| 2019 | $4,559 | $395,671 | $137,776 | $257,895 |

| 2018 | $4,451 | $387,914 | $135,075 | $252,839 |

| 2017 | $4,421 | $380,309 | $132,427 | $247,882 |

| 2016 | $4,311 | $372,853 | $129,831 | $243,022 |

| 2015 | $4,306 | $367,253 | $127,881 | $239,372 |

| 2014 | $4,220 | $360,060 | $125,376 | $234,684 |

Source: Public Records

Map

Nearby Homes

- 81 Fruitland Ave

- 2100 Stone Ridge Dr

- 22 Easton Rd

- 2600 Garin Rd

- 43 Acres Sill Rd

- 00 Bluff Rd

- 1970 Beach Rd

- 1630 W Beach St

- 101 W Front St Unit 6

- 219 2nd St

- 125 Springfield Rd

- 1900 Highway 1 Unit 104

- 1900 Highway 1 Unit 62

- 1900 Highway 1 Unit 82

- 124 E Riverside Dr

- 401 San Luis Ave

- 1031 Santa Rosa Ct

- 409 San Luis Ave

- 130 Skyline Vista Way

- 133 Skyline Vista Way