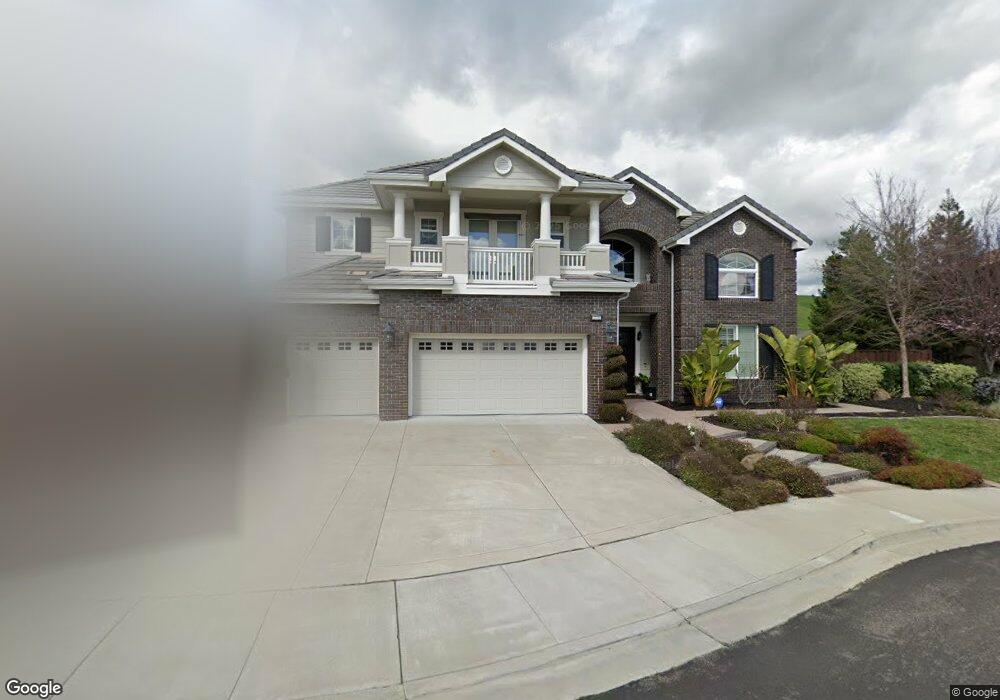

2731 E Cog Hill Terrace Dublin, CA 94568

Dublin Ranch NeighborhoodEstimated Value: $2,687,191 - $3,168,000

5

Beds

5

Baths

4,886

Sq Ft

$580/Sq Ft

Est. Value

About This Home

This home is located at 2731 E Cog Hill Terrace, Dublin, CA 94568 and is currently estimated at $2,834,548, approximately $580 per square foot. 2731 E Cog Hill Terrace is a home located in Alameda County with nearby schools including J.M. Amador Elementary School, Dublin High School, and The Quarry Lane School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 28, 2015

Sold by

Lee Sung Han and Lee Yevonne C

Bought by

Khan Ammad M and Banin Zahra

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,240,000

Outstanding Balance

$975,982

Interest Rate

3.81%

Mortgage Type

New Conventional

Estimated Equity

$1,858,566

Purchase Details

Closed on

Mar 14, 2005

Sold by

Toll Ca Ii Lp

Bought by

Lee Sung Han and Lee Yevonne C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$950,000

Interest Rate

5.37%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Khan Ammad M | $1,550,000 | Chicago Title Company | |

| Lee Sung Han | $1,492,000 | First American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Khan Ammad M | $1,240,000 | |

| Previous Owner | Lee Sung Han | $950,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $23,642 | $1,834,842 | $556,371 | $1,278,471 |

| 2024 | $23,642 | $1,798,867 | $545,463 | $1,253,404 |

| 2023 | $23,405 | $1,763,604 | $534,770 | $1,228,834 |

| 2022 | $23,132 | $1,729,025 | $524,285 | $1,204,740 |

| 2021 | $22,948 | $1,695,126 | $514,006 | $1,181,120 |

| 2020 | $21,469 | $1,677,750 | $508,737 | $1,169,013 |

| 2019 | $21,536 | $1,644,860 | $498,764 | $1,146,096 |

| 2018 | $21,055 | $1,612,620 | $488,988 | $1,123,632 |

| 2017 | $20,796 | $1,581,000 | $479,400 | $1,101,600 |

| 2016 | $18,946 | $1,550,000 | $470,000 | $1,080,000 |

| 2015 | $17,045 | $1,420,000 | $426,000 | $994,000 |

| 2014 | $16,908 | $1,377,000 | $413,100 | $963,900 |

Source: Public Records

Map

Nearby Homes

- 2848 E Cog Hill Terrace

- 2528 Amantea Way

- 6010 Turnberry Dr

- 6013 Kingsmill Terrace

- 2371 Capistrello St

- 3005 Vittoria Loop

- 3105 Vittoria Loop

- 3135 Vittoria Loop

- 3956 Jordan Ranch Dr

- 3970 Jordan Ranch Dr

- 4456 Sunset View Dr

- 4369 Table Mountain Rd

- 4439 Sunset View Dr

- 3898 Highpointe Ct

- 1856 S Terracina Dr

- 1937 Whitney Ave

- 1691 S Wren St

- 2378 Carbondale Way

- 4287 Loyalton Rd

- 2336 Carbondale Way

- 2757 E Cog Hill Terrace

- 2725 E Cog Hill Terrace

- 2752 E Cog Hill Terrace

- 5695 Saddle Creek Terrace

- 2771 E Cog Hill Terrace

- 2768 E Cog Hill Terrace

- 5681 Saddle Creek Terrace

- 2787 E Cog Hill Terrace

- 2782 E Cog Hill Terrace

- 2701 Highlands Meadows Ct

- 2709 Highlands Meadows Ct

- 5673 Saddle Creek Terrace

- 2805 E Cog Hill Terrace

- 2796 E Cog Hill Terrace

- 2721 Highlands Meadows Ct

- 5655 Saddle Creek Terrace

- 2824 E Cog Hill Terrace

- 2827 E Cog Hill Terrace

- 2700 Highland Meadows Ct

- 2733 Highlands Meadows Ct