275 Cross Wind Loop Unit A Westerville, OH 43081

Estimated Value: $177,000 - $198,000

2

Beds

3

Baths

1,100

Sq Ft

$171/Sq Ft

Est. Value

About This Home

This home is located at 275 Cross Wind Loop Unit A, Westerville, OH 43081 and is currently estimated at $187,821, approximately $170 per square foot. 275 Cross Wind Loop Unit A is a home located in Franklin County with nearby schools including Pointview Elementary School, Genoa Middle School, and Westerville South High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 20, 2024

Sold by

Palmer Johnny and Palmer Jodi L

Bought by

Hopkins Olivia

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$189,000

Outstanding Balance

$187,519

Interest Rate

6.81%

Mortgage Type

New Conventional

Estimated Equity

$302

Purchase Details

Closed on

Jul 24, 2023

Sold by

Palmer Johnny

Bought by

Palmer Johnny and Palmer Jodi L

Purchase Details

Closed on

Jul 18, 2023

Sold by

Palmer Johnny

Bought by

Palmer Johnny and Palmer Jodi L

Purchase Details

Closed on

Dec 30, 2005

Sold by

Wildermuth Jennifer L and Wildermuth David

Bought by

Palmer Johnny

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,436

Interest Rate

6.34%

Mortgage Type

FHA

Purchase Details

Closed on

Nov 8, 1994

Sold by

Burton Terence W

Bought by

Brown Jennifer L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$38,300

Interest Rate

8.75%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 1, 1985

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hopkins Olivia | $189,000 | First Ohio Title Insurance Age | |

| Palmer Johnny | -- | None Listed On Document | |

| Palmer Johnny | -- | None Listed On Document | |

| Palmer Johnny | $91,900 | None Available | |

| Brown Jennifer L | $47,900 | -- | |

| -- | $219,600 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hopkins Olivia | $189,000 | |

| Previous Owner | Palmer Johnny | $90,436 | |

| Previous Owner | Brown Jennifer L | $38,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,639 | $45,360 | $7,700 | $37,660 |

| 2023 | $2,523 | $45,360 | $7,700 | $37,660 |

| 2022 | $2,142 | $29,400 | $3,570 | $25,830 |

| 2021 | $2,160 | $29,400 | $3,570 | $25,830 |

| 2020 | $2,154 | $29,400 | $3,570 | $25,830 |

| 2019 | $1,902 | $24,510 | $2,980 | $21,530 |

| 2018 | $1,897 | $24,510 | $2,980 | $21,530 |

| 2017 | $1,932 | $24,510 | $2,980 | $21,530 |

| 2016 | $1,993 | $23,770 | $3,750 | $20,020 |

| 2015 | $1,930 | $23,770 | $3,750 | $20,020 |

| 2014 | $1,932 | $23,770 | $3,750 | $20,020 |

| 2013 | $1,071 | $26,390 | $4,165 | $22,225 |

Source: Public Records

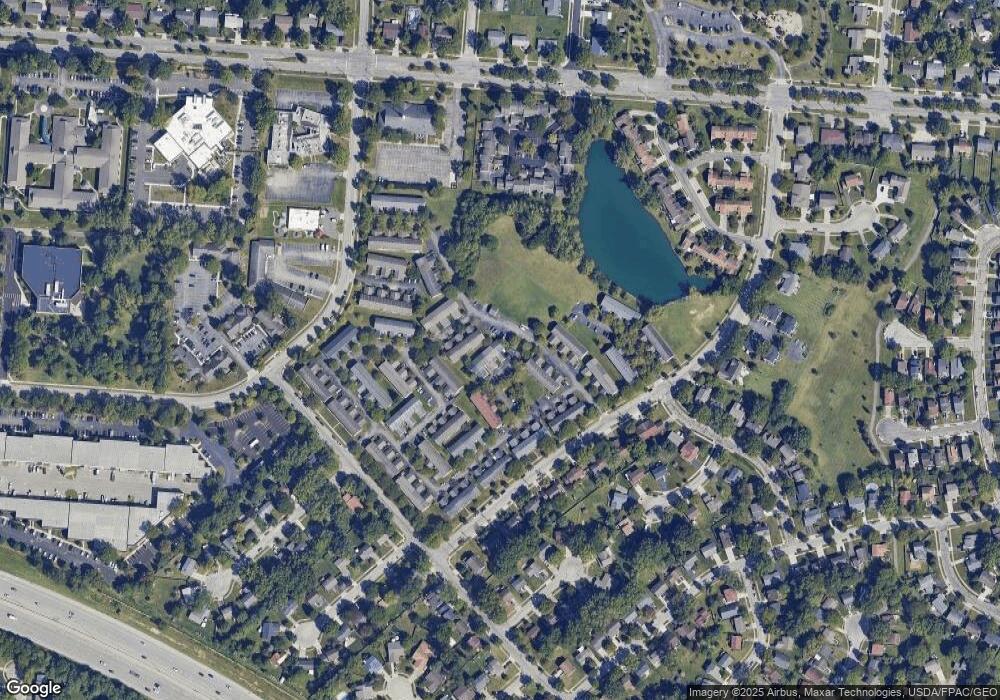

Map

Nearby Homes

- 393 Sentry Ln

- 1025 Woodington Rd

- 974 Timberbank Dr

- 3512 Fox Run Rd

- 615 Vancouver Dr

- 183 Barcelona Ave

- 203 Fairdale Ave

- 3362 Reno Rd

- 3619 Bolamo Dr

- 5888 Montevideo Rd

- 3596 Manila Dr

- 3627 Manila Dr

- 6001 Cairo Rd

- 5910 Cairo Rd

- 994 Autumn Lake Ct

- 3719 Caracas Dr

- 1015 Autumn Woods Dr

- 539 Cherrington Rd

- 559 Allview Ct

- 581 Westbury Woods Ct

- 277 Cross Wind Loop

- 277 Crosswind Dr

- 277 Cross Wind Loop Unit B

- 279 Cross Wind Loop Unit C

- 279 Crosswind Dr

- 281 Cross Wind Loop Unit C

- 281 Cross Wind Loop Unit D

- 281 Cross Wind Dr

- 946 Cross Country Dr W Unit B

- 283 Cross Wind Loop Unit E

- 944 Cross Country Dr W Unit A

- 285 Cross Wind Loop

- 305 Cross Wind Dr Unit A

- 948 Cross Country Dr W Unit C

- 950 Cross Country Dr W Unit D

- 952 Cross Country Dr W Unit E

- 309 Cross Wind Dr

- 954 Cross Country Dr W Unit F

- 289 Cross Wind Loop

- 289 Cross Wind Loop Unit A