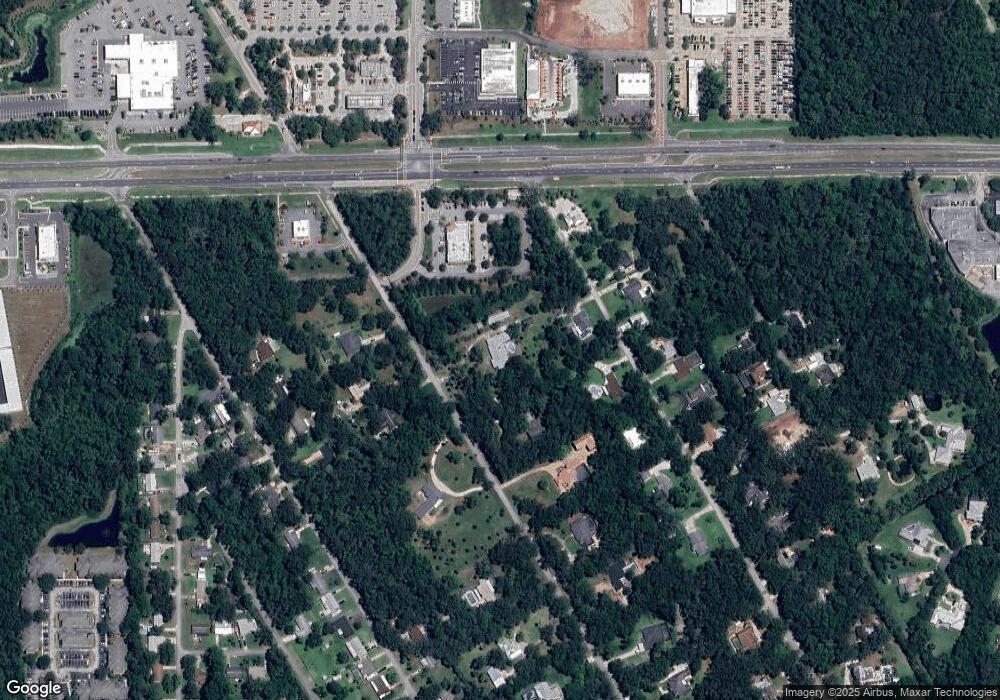

275 S Timberlane Dr New Smyrna Beach, FL 32168

Glencoe NeighborhoodEstimated Value: $700,000 - $959,065

5

Beds

3

Baths

4,618

Sq Ft

$183/Sq Ft

Est. Value

About This Home

This home is located at 275 S Timberlane Dr, New Smyrna Beach, FL 32168 and is currently estimated at $844,016, approximately $182 per square foot. 275 S Timberlane Dr is a home located in Volusia County with nearby schools including Read-Pattillo Elementary School, New Smyrna Beach Middle School, and New Smyrna Beach High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 28, 2024

Sold by

Banks Roger W and Banks Debra E

Bought by

Sapp Jack M and Sapp Michael S

Current Estimated Value

Purchase Details

Closed on

Aug 21, 2023

Sold by

Sapp Jack M and Sapp Michael S

Bought by

Sapp Jack M and Sapp Michael S

Purchase Details

Closed on

Jan 23, 2020

Sold by

Sapp Patricia E and Sapp Jack M

Bought by

Sapp Patricia E and Sapp Jack M

Purchase Details

Closed on

Nov 25, 2019

Sold by

Sapp Patricia E and Sapp Jack M

Bought by

Sapp Patricia E and Sapp Jack M

Purchase Details

Closed on

Apr 26, 2016

Sold by

Banks Roger W and Banks Derra E

Bought by

Leavella Kara Lynn

Purchase Details

Closed on

Apr 11, 2006

Sold by

Sapp Jack M and Sapp Patricia E

Bought by

Banks Roger W and Banks Debra E

Purchase Details

Closed on

Jun 15, 1975

Bought by

Sapp Patricia E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sapp Jack M | $100 | None Listed On Document | |

| Sapp Jack M | $100 | None Listed On Document | |

| Sapp Patricia E | -- | Attorney | |

| Sapp Patricia E | -- | Attorney | |

| Leavella Kara Lynn | -- | None Available | |

| Banks Roger W | $1,500 | Attorney | |

| Sapp Patricia E | $141,500 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,026 | $739,328 | $368,880 | $370,448 |

| 2024 | $5,026 | $742,975 | $368,880 | $374,095 |

| 2023 | $5,026 | $319,066 | $0 | $0 |

| 2022 | $4,963 | $309,773 | $0 | $0 |

| 2021 | $5,125 | $300,750 | $0 | $0 |

| 2020 | $5,051 | $296,598 | $0 | $0 |

| 2019 | $5,299 | $289,930 | $0 | $0 |

| 2018 | $5,396 | $284,524 | $0 | $0 |

| 2017 | $5,420 | $278,672 | $0 | $0 |

| 2016 | $5,610 | $272,940 | $0 | $0 |

| 2015 | $5,755 | $271,043 | $0 | $0 |

| 2014 | $5,676 | $268,892 | $0 | $0 |

Source: Public Records