2750 Country Home Rd Concord, NC 28025

Estimated Value: $291,000 - $345,000

4

Beds

3

Baths

2,210

Sq Ft

$144/Sq Ft

Est. Value

About This Home

This home is located at 2750 Country Home Rd, Concord, NC 28025 and is currently estimated at $317,995, approximately $143 per square foot. 2750 Country Home Rd is a home located in Cabarrus County with nearby schools including A.T. Allen Elementary School, Mount Pleasant Middle School, and Mount Pleasant High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 27, 2016

Sold by

Fannie Mae

Bought by

Davis Lee Vincent

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$147,283

Outstanding Balance

$117,259

Interest Rate

3.58%

Mortgage Type

FHA

Estimated Equity

$200,736

Purchase Details

Closed on

Jul 20, 2015

Sold by

Woodward Dennis Jon and Woodward Sherry Merle Rose

Bought by

Federal National Mortgage Association and Fannie Mae

Purchase Details

Closed on

Mar 1, 1996

Bought by

Woodward Dennis J

Purchase Details

Closed on

Nov 1, 1991

Bought by

Woodward Dennis J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Davis Lee Vincent | -- | None Available | |

| Federal National Mortgage Association | $105,752 | None Available | |

| Woodward Dennis J | -- | -- | |

| Woodward Dennis J | $88,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Davis Lee Vincent | $147,283 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,849 | $269,560 | $68,890 | $200,670 |

| 2024 | $1,849 | $269,560 | $68,890 | $200,670 |

| 2023 | $1,319 | $155,180 | $38,070 | $117,110 |

| 2022 | $1,288 | $155,180 | $38,070 | $117,110 |

| 2021 | $1,265 | $155,180 | $38,070 | $117,110 |

| 2020 | $1,265 | $155,180 | $38,070 | $117,110 |

| 2019 | $1,191 | $146,190 | $56,860 | $89,330 |

| 2018 | $1,162 | $146,190 | $56,860 | $89,330 |

| 2017 | $1,107 | $146,590 | $56,860 | $89,730 |

| 2016 | $1,107 | $141,520 | $56,860 | $84,660 |

| 2015 | $1,054 | $141,520 | $56,860 | $84,660 |

| 2014 | $1,054 | $141,520 | $56,860 | $84,660 |

Source: Public Records

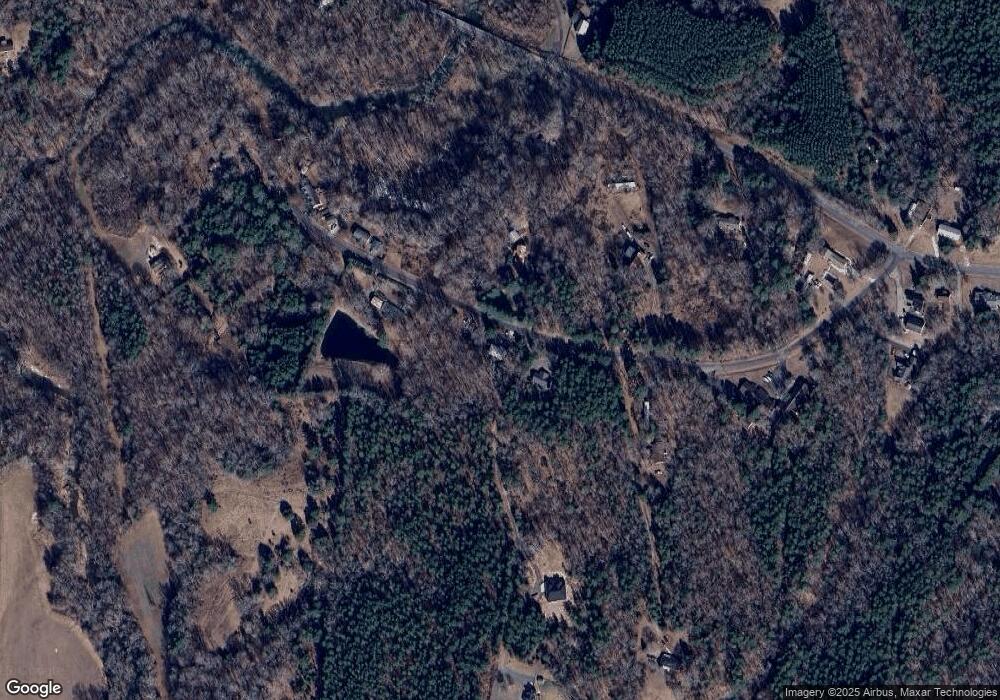

Map

Nearby Homes

- 3350 Miami Church Rd

- 4374 Flowes Store Rd

- 0 Hwy 601 Hwy Unit 3073112

- 2905 Atando Rd

- 3560 Us Highway 601 S

- 4815 Chadwick Dr

- 2628 State Highway 49

- 5625 Us Highway 601 S

- 6175 U S 601

- 847 Kathryn Dr SE

- 363 Morning Dew Dr

- 2752 State Highway 49

- 2369 Baxter Place SE

- 2365 Baxter Place SE

- 5052 Daffodil Ln

- 5079 Sable Ct

- 2314 Fairport Dr SE

- 1009 Braxton Dr

- 4957 Phoenix Cir

- 705 Shellbark Dr

- 2810 Country Home Rd

- 2751 Country Home Rd

- 2809 Country Home Rd

- 2700 Country Home Rd

- 2701 Country Home Rd

- 2920 Country Home Rd

- 2876 Country Home Rd

- 2661 Country Home Rd

- 2840 Country Home Rd

- 2800 Miami Church Rd

- 2655 Country Home Rd

- 2670 Country Home Rd

- 2930 Miami Church Rd

- 2966 Miami Church Rd

- 2624 Country Home Rd

- 2804 Country Home Rd

- 2825 Miami Church Rd

- 2645 Country Home Rd

- 2808 Country Home Rd

- 2820 Country Home Rd