Estimated Value: $335,000 - $399,000

3

Beds

3

Baths

1,584

Sq Ft

$228/Sq Ft

Est. Value

About This Home

This home is located at 2765 Upton Rd, Ovid, MI 48866 and is currently estimated at $360,541, approximately $227 per square foot. 2765 Upton Rd is a home located in Clinton County with nearby schools including Leonard Elementary School, E.E. Knight Elementary School, and Ovid-Elsie Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 5, 2012

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Coon James D and Coon Vickie S

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$142,110

Outstanding Balance

$98,203

Interest Rate

3.92%

Mortgage Type

New Conventional

Estimated Equity

$262,338

Purchase Details

Closed on

Aug 3, 2011

Sold by

Britton Paul J Eugene and Warner Sherry Lynne

Bought by

Federal Home Loan Mortgage Corporation

Purchase Details

Closed on

Nov 10, 2005

Sold by

Sloat Leslie F and Sloat Debra J

Bought by

Warner Sherry Lynne and Britton Ii Paul J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$166,250

Interest Rate

6.17%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Coon James D | $157,900 | Attorneys Title Agency Llc | |

| Federal Home Loan Mortgage Corporation | $167,252 | None Available | |

| Warner Sherry Lynne | $175,000 | Metropolitan Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Coon James D | $142,110 | |

| Previous Owner | Warner Sherry Lynne | $166,250 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | -- | $148,500 | $21,300 | $127,200 |

| 2024 | $12 | $136,400 | $15,300 | $121,100 |

| 2023 | $1,172 | $127,900 | $0 | $0 |

| 2022 | $2,743 | $111,600 | $14,900 | $96,700 |

| 2021 | $2,668 | $106,700 | $13,800 | $92,900 |

| 2020 | $2,590 | $101,300 | $13,800 | $87,500 |

| 2019 | $2,464 | $95,200 | $10,000 | $85,200 |

| 2018 | $2,392 | $86,300 | $10,000 | $76,300 |

| 2017 | $2,378 | $89,900 | $12,000 | $77,900 |

| 2016 | $2,370 | $85,100 | $11,000 | $74,100 |

| 2015 | -- | $84,800 | $0 | $0 |

| 2011 | -- | $91,500 | $0 | $0 |

Source: Public Records

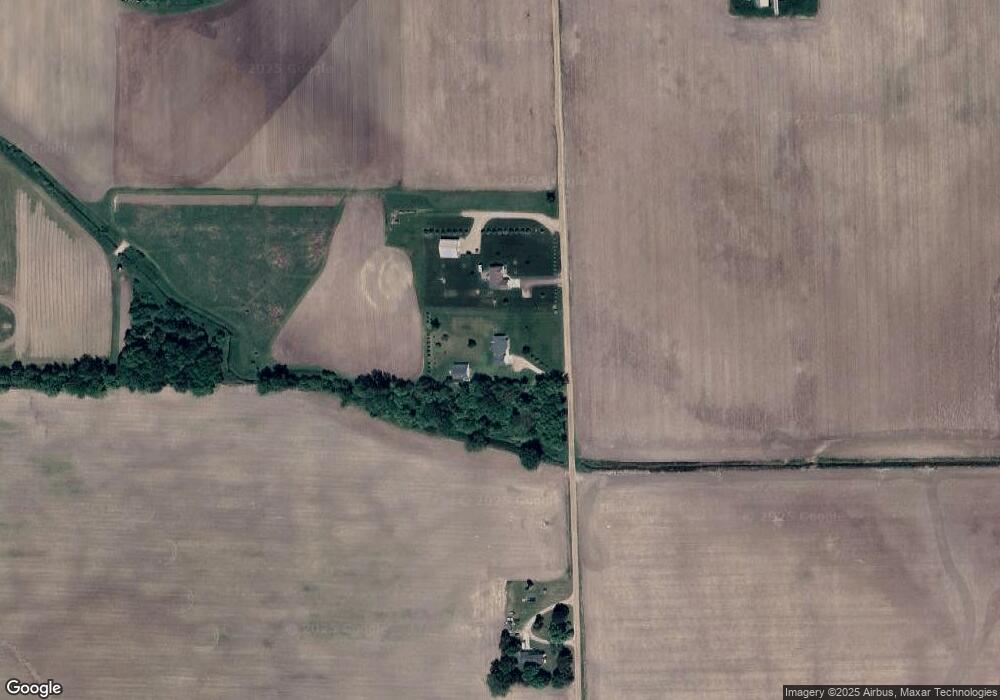

Map

Nearby Homes

- 2625 N Ovid Rd

- 228 W Pearl St

- 9992 Middleton Rd

- 613 S Main St

- 3585 N Harmon Rd

- 2300 N Watson Rd

- 9875 W M 21

- 6822 N Maple River Rd

- 8411 W M 21

- 155 W Main St

- 204 W Pine St

- 3575 S Hollister Rd

- 208 W Oak St

- 117 E Oak St

- 135 E Elm St

- 147 E Elm St

- 249 E Elm St

- 563 N Ovid St

- 2843 Trillium Creek Way

- 2848 Trillium Creek Way

Your Personal Tour Guide

Ask me questions while you tour the home.