27990 Via de Costa Unit 126 San Juan Capistrano, CA 92675

San Juan Hills NeighborhoodEstimated Value: $1,103,000 - $1,459,000

3

Beds

2

Baths

1,778

Sq Ft

$687/Sq Ft

Est. Value

About This Home

This home is located at 27990 Via de Costa Unit 126, San Juan Capistrano, CA 92675 and is currently estimated at $1,220,907, approximately $686 per square foot. 27990 Via de Costa Unit 126 is a home located in Orange County with nearby schools including Harold Ambuehl Elementary School, Marco Forster Middle School, and San Juan Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 23, 2022

Sold by

Discenzo and Debra

Bought by

Discenzo Family Trust

Current Estimated Value

Purchase Details

Closed on

Jul 7, 2010

Sold by

Discenzo Anthony and Discenzo Debra

Bought by

Discenzo Anthony and Discenzo Debra

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$315,000

Interest Rate

4.76%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 17, 1996

Sold by

Hills S J

Bought by

Discenzo Anthony M and Discenzo Debra B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$170,900

Interest Rate

8.25%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Discenzo Family Trust | -- | -- | |

| Discenzo Anthony | -- | First American Title Company | |

| Discenzo Anthony M | $190,000 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Discenzo Anthony | $315,000 | |

| Previous Owner | Discenzo Anthony M | $170,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,469 | $315,461 | $113,021 | $202,440 |

| 2024 | $3,469 | $309,276 | $110,805 | $198,471 |

| 2023 | $3,337 | $303,212 | $108,632 | $194,580 |

| 2022 | $3,004 | $297,267 | $106,502 | $190,765 |

| 2021 | $2,948 | $291,439 | $104,414 | $187,025 |

| 2020 | $2,921 | $288,451 | $103,343 | $185,108 |

| 2019 | $2,866 | $282,796 | $101,317 | $181,479 |

| 2018 | $2,813 | $277,251 | $99,330 | $177,921 |

| 2017 | $2,786 | $271,815 | $97,382 | $174,433 |

| 2016 | $2,733 | $266,486 | $95,473 | $171,013 |

| 2015 | $2,691 | $262,484 | $94,039 | $168,445 |

| 2014 | $2,642 | $257,343 | $92,197 | $165,146 |

Source: Public Records

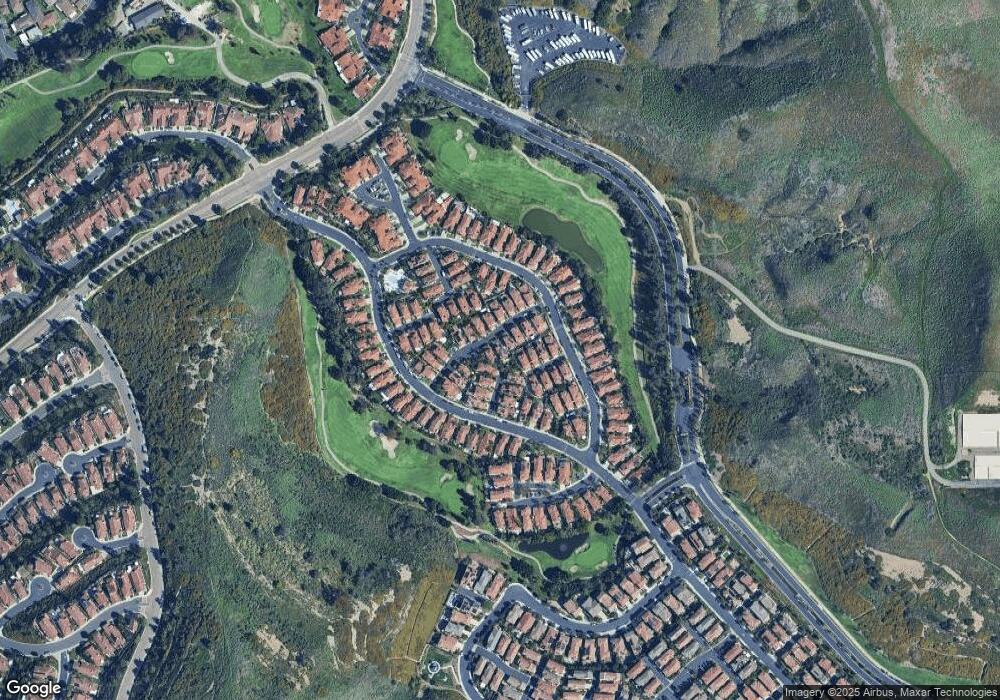

Map

Nearby Homes

- 28257 Via Del Mar

- 27507 Via Sequoia

- 27782 Via Madrina

- 27485 Paseo Amador Unit 5

- 27477 Paseo Amador

- 32055 Via Canela

- 27369 Paseo Placentia Unit 31

- 31232 Calle Bolero

- 27369 Paseo la Serna

- 31262 Avenida Terramar

- 27252 Via Callejon

- 28051 Calle Santa Ynez

- 27151 Via Chicuelina Unit B

- 27172 Paseo Burladero Unit C

- 31645 Rancho Viejo Rd

- 27681 Paseo Esteban

- 31192 Via Cordova

- 27281 Calle de la Rosa

- 27171 Calle Delgado

- 32802 Valle Rd Unit 108

- 27992 Via de Costa

- 27988 Via de Costa Unit 125

- 27982 Via de Costa

- 27994 Via de Costa Unit 128

- 28007 Camino Del Rio

- 28038 Via de Costa

- 27980 Via de Costa Unit 115

- 28036 Via de Costa

- 28009 Camino Del Rio

- 27996 Via de Costa

- 27984 Via de Costa Unit 240

- 27984 Via de Costa

- 28005 Camino Del Rio

- 27978 Via de Costa

- 28034 Via de Costa

- 28011 Camino Del Rio

- 27947 Camino Del Rio Unit 124

- 27976 Via de Costa Unit 113

- 27986 Via de Costa

- 27998 Via de Costa