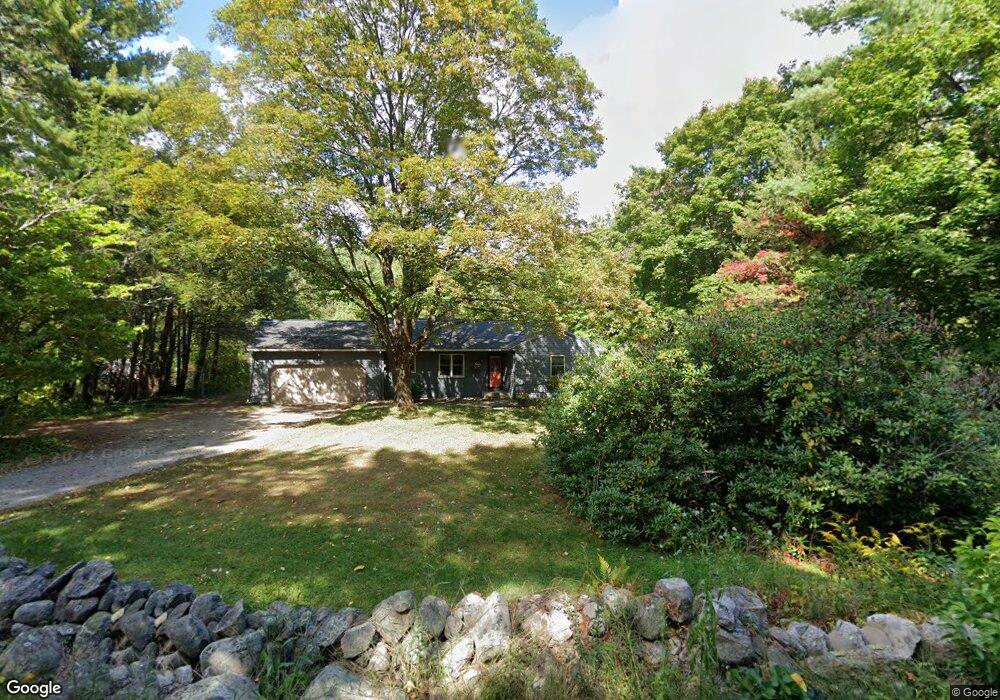

28 Crane Rd Littleton, MA 01460

Estimated Value: $650,000 - $855,000

3

Beds

4

Baths

1,126

Sq Ft

$637/Sq Ft

Est. Value

About This Home

This home is located at 28 Crane Rd, Littleton, MA 01460 and is currently estimated at $717,095, approximately $636 per square foot. 28 Crane Rd is a home located in Middlesex County with nearby schools including Shaker Lane Elementary School, Russell Street Elementary School, and Littleton Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 27, 1998

Sold by

Phillips Margaret E

Bought by

Dimase John F and Dimase Lois B

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$170,000

Outstanding Balance

$30,633

Interest Rate

6.85%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$686,462

Purchase Details

Closed on

Jul 26, 1995

Sold by

Perry Steven F and Perry Barbara L

Bought by

Phillips Margaret

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$83,220

Interest Rate

7.56%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dimase John F | $215,000 | -- | |

| Phillips Margaret | $167,220 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Phillips Margaret | $170,000 | |

| Previous Owner | Phillips Margaret | $25,000 | |

| Previous Owner | Phillips Margaret | $114,500 | |

| Previous Owner | Phillips Margaret | $83,220 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $83 | $556,600 | $245,700 | $310,900 |

| 2024 | $7,726 | $520,600 | $245,700 | $274,900 |

| 2023 | $7,413 | $456,200 | $226,300 | $229,900 |

| 2022 | $7,482 | $422,500 | $226,300 | $196,200 |

| 2021 | $7,215 | $407,600 | $217,600 | $190,000 |

| 2020 | $6,897 | $388,100 | $201,500 | $186,600 |

| 2019 | $6,643 | $364,200 | $175,800 | $188,400 |

| 2018 | $6,376 | $351,500 | $173,600 | $177,900 |

| 2017 | $6,282 | $346,100 | $173,600 | $172,500 |

| 2016 | $6,036 | $341,200 | $173,600 | $167,600 |

| 2015 | $6,161 | $340,400 | $150,000 | $190,400 |

Source: Public Records

Map

Nearby Homes

- 14 Leonard Rd

- 63 Leonard Rd Unit 63

- Lot 2 Strawberry Farm

- 221 Foster St

- 777 Depot Rd

- 139 Picnic St

- 305 Harwood Ave

- 146 Tahattawan Rd

- 3 Taylor St

- 332 Old Littleton Rd

- 4 Omega Way

- 4 Huron Rd

- 58 Spencer Rd Unit 18K

- 31 Mohawk Dr

- 68 Macintosh Ln

- 50 Spencer Rd Unit 36

- 17 Hartwell Ave

- 53 Swanson Ct Unit 36C

- 35 Queen Rd

- 220 Swanson Rd Unit 605