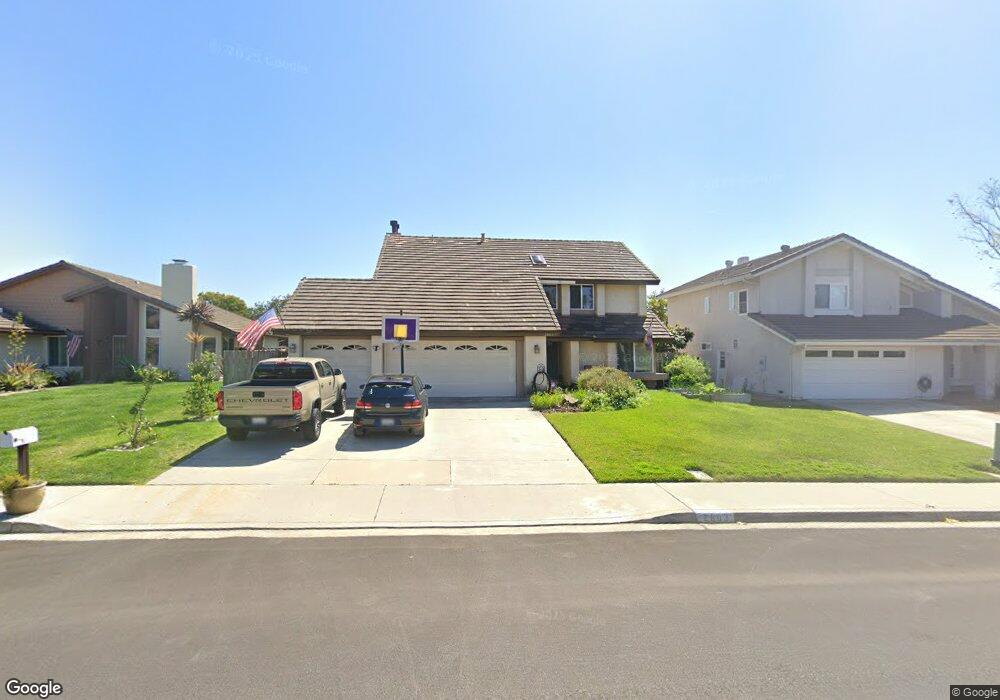

2803 Sombrosa St Carlsbad, CA 92009

La Costa NeighborhoodEstimated Value: $1,768,928 - $2,068,000

4

Beds

3

Baths

2,468

Sq Ft

$788/Sq Ft

Est. Value

About This Home

This home is located at 2803 Sombrosa St, Carlsbad, CA 92009 and is currently estimated at $1,945,232, approximately $788 per square foot. 2803 Sombrosa St is a home located in San Diego County with nearby schools including El Camino Creek Elementary School, Oak Crest Middle School, and La Costa Canyon High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 22, 2013

Sold by

Lahaise Amber Rose and La Haise Benjamin Steven

Bought by

Lahalse Benjamin Steven and La Haise Amber Rose

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Outstanding Balance

$207,711

Interest Rate

3.28%

Mortgage Type

New Conventional

Estimated Equity

$1,737,521

Purchase Details

Closed on

Sep 30, 2011

Sold by

Libman Melvin L and Libman Deena S

Bought by

Lahaise Amber Rose and La Haise Benjamin Steven

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$553,000

Outstanding Balance

$376,257

Interest Rate

4.05%

Mortgage Type

Unknown

Estimated Equity

$1,568,975

Purchase Details

Closed on

Oct 1, 1999

Sold by

Jerry Gradisher

Bought by

Libman Melvin L and Libman Deena S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$292,000

Interest Rate

7.87%

Purchase Details

Closed on

Apr 13, 1999

Sold by

Nelson Edward J and Nelson Mary L

Bought by

Gradisher Jerry

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$248,000

Interest Rate

6.98%

Mortgage Type

Stand Alone First

Purchase Details

Closed on

May 31, 1996

Sold by

Nelson and Mary

Bought by

Nelson Edward J and Nelson Mary L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$66,000

Interest Rate

8.01%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lahalse Benjamin Steven | -- | First American Title Company | |

| Lahaise Amber Rose | $553,000 | Fidelity National Title | |

| Libman Melvin L | $365,000 | First Southwestern Title | |

| Gradisher Jerry | $310,000 | First Southwestern Title | |

| Nelson Edward J | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lahalse Benjamin Steven | $300,000 | |

| Open | Lahaise Amber Rose | $553,000 | |

| Previous Owner | Libman Melvin L | $292,000 | |

| Previous Owner | Gradisher Jerry | $248,000 | |

| Previous Owner | Nelson Edward J | $66,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,926 | $700,740 | $333,018 | $367,722 |

| 2024 | $7,926 | $687,001 | $326,489 | $360,512 |

| 2023 | $7,699 | $673,532 | $320,088 | $353,444 |

| 2022 | $7,517 | $660,326 | $313,812 | $346,514 |

| 2021 | $7,392 | $647,379 | $307,659 | $339,720 |

| 2020 | $7,272 | $640,742 | $304,505 | $336,237 |

| 2019 | $7,130 | $628,180 | $298,535 | $329,645 |

| 2018 | $7,010 | $615,864 | $292,682 | $323,182 |

| 2017 | $92 | $603,790 | $286,944 | $316,846 |

| 2016 | $6,683 | $591,952 | $281,318 | $310,634 |

| 2015 | $6,564 | $583,061 | $277,093 | $305,968 |

| 2014 | $6,414 | $571,641 | $271,666 | $299,975 |

Source: Public Records

Map

Nearby Homes

- 2702 Jacaranda Ave

- 8008 Avenida Secreto

- 7941 Calle Madrid Unit 4

- 8010 Calle Pinon

- 7925 Calle Madrid

- 1278 Avenida Miguel

- 1931 Avenida Joaquin

- 3356 Corte Tiburon

- 1633 Willowspring Dr N

- 1981 Avenida Joaquin

- 721 Summersong Ln

- 1848 Wandering Rd

- 1655 Splitrail Dr

- 3101 Levante St

- 3736 38 Via Rancho Michelle

- 772 Conestoga Ct

- 2204 Recodo Ct

- 1519 Valleda Ln

- 2606 Galicia Way

- 7570 Gibraltar St Unit 101

- 2805 Sombrosa St

- 2801 Sombrosa St

- 2804 El Rastro Ln

- 2807 Sombrosa St

- 2802 El Rastro Ln

- 2806 El Rastro Ln

- 2808 El Rastro Ln

- 2804 Sombrosa St

- 2809 Sombrosa St

- 2802 Sombrosa St

- 2806 Sombrosa St

- 2709 Sombrosa St

- 2810 El Rastro Ln

- 2710 El Rastro Ln

- 2808 Sombrosa St

- 2811 Sombrosa St

- 2707 Sombrosa St

- 2810 Sombrosa St Unit 5

- 2812 El Rastro Ln

- 2708 El Rastro Ln