281 Curlew Cir Altamonte Springs, FL 32701

Estimated Value: $357,000 - $437,000

3

Beds

3

Baths

1,767

Sq Ft

$222/Sq Ft

Est. Value

About This Home

This home is located at 281 Curlew Cir, Altamonte Springs, FL 32701 and is currently estimated at $391,898, approximately $221 per square foot. 281 Curlew Cir is a home located in Seminole County with nearby schools including Altamonte Elementary School, Lyman High School, and Milwee Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 22, 2020

Sold by

Steffens Ferdinand and Steffens Mary E

Bought by

Kumar Angela and Kumar Levina

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$132,500

Outstanding Balance

$92,681

Interest Rate

3.3%

Mortgage Type

New Conventional

Estimated Equity

$299,217

Purchase Details

Closed on

Sep 30, 2014

Sold by

Sterchi Kerri L

Bought by

Steffens Ferdinand and Steffens Mary E

Purchase Details

Closed on

Mar 14, 2001

Sold by

Percy W Cump M and Percy Dorothy E

Bought by

Cump Dorothy Tr E

Purchase Details

Closed on

Aug 1, 2000

Bought by

Steffens Ferdinand and Steffens Mary E

Purchase Details

Closed on

May 12, 1994

Sold by

D R Horton Inc

Bought by

Cump Percy W and Cump Dorothy E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$60,000

Interest Rate

8.48%

Purchase Details

Closed on

Dec 1, 1993

Bought by

Steffens Ferdinand and Steffens Mary E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kumar Angela | $252,500 | Land Title Of Florida Llc | |

| Steffens Ferdinand | $155,500 | Pcs Title | |

| Cump Dorothy Tr E | -- | -- | |

| Steffens Ferdinand | $100 | -- | |

| Cump Percy W | $119,700 | -- | |

| Steffens Ferdinand | $38,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kumar Angela | $132,500 | |

| Previous Owner | Cump Dorothy Tr E | $30,000 | |

| Previous Owner | Cump Percy W | $60,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,619 | $321,393 | -- | -- |

| 2023 | $4,955 | $292,175 | $0 | $0 |

| 2021 | $4,053 | $241,467 | $55,000 | $186,467 |

| 2020 | $1,839 | $150,049 | $0 | $0 |

| 2019 | $1,808 | $146,675 | $0 | $0 |

| 2018 | $1,784 | $143,940 | $0 | $0 |

| 2017 | $1,764 | $140,979 | $0 | $0 |

| 2016 | $1,788 | $139,046 | $0 | $0 |

| 2015 | $1,424 | $137,119 | $0 | $0 |

| 2014 | $1,424 | $117,446 | $0 | $0 |

Source: Public Records

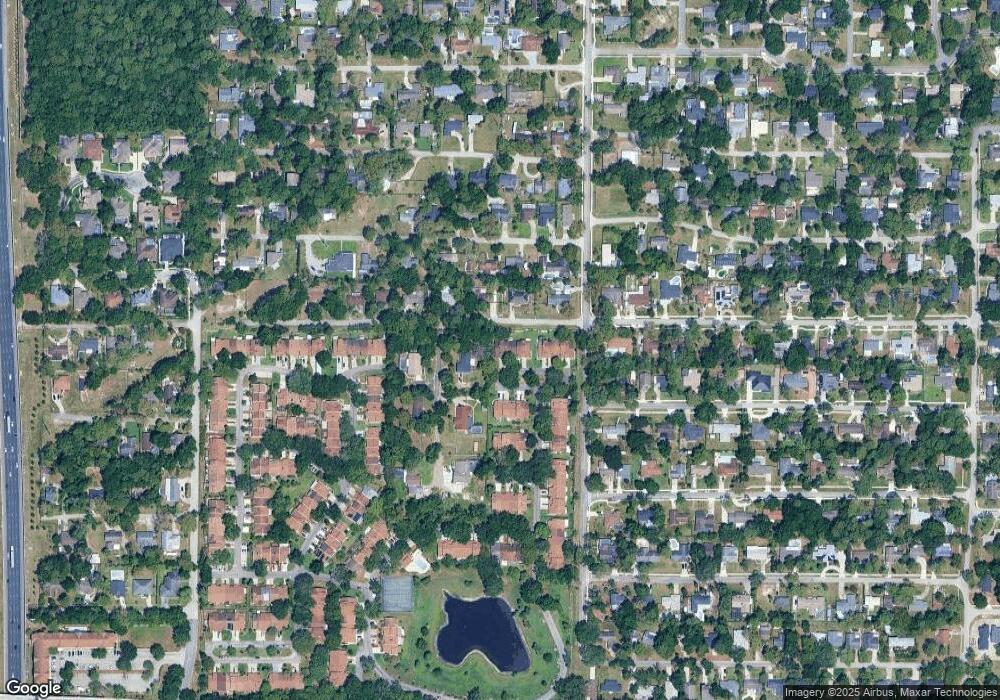

Map

Nearby Homes

- 256 Alpine St

- 234 Alpine St

- 213 Egret Ct

- 135 E Citrus St

- 216 Egret Ct

- 971 Blackwood St

- 620 Cranes Way Unit 207

- 570 Cranes Way Unit 246

- 570 Cranes Way Unit 248

- 155 Hidden Woods Cove

- 412 E Orange St

- 520 Cranes Way Unit 202

- 510 Cranes Way Unit 105

- 444 E Orange St

- 457 E Highland St

- 1823 North St

- 495 Howard Ave

- 450 Andrews Dr

- 109 Peacock Dr

- 900 Red Fox Rd

- 283 Curlew Cir

- 285 Curlew Cir

- 287 Curlew Cir

- 721 Arnold St

- 289 Curlew Cir

- 241 E Hillcrest St

- 291 Curlew Cir

- 247 E Hillcrest St

- 293 Curlew Cir

- 280 Curlew Cir

- 282 Curlew Cir

- 284 Curlew Cir

- 237 E Hillcrest St

- 295 Curlew Cir

- 286 Curlew Cir

- 253 E Hillcrest St

- 252 Alpine St

- 722 Arnold St

- 715 Arnold St

- 735 Swan Ln