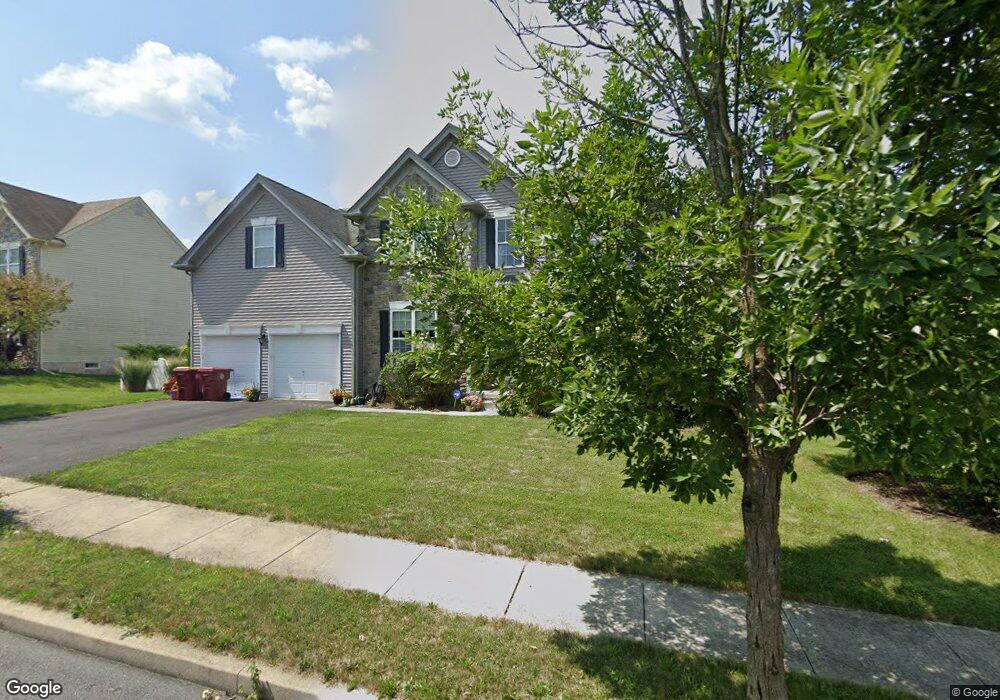

2811 Clark Place Unit Lot2 Easton, PA 18040

Estimated Value: $595,000 - $657,000

4

Beds

3

Baths

2,748

Sq Ft

$226/Sq Ft

Est. Value

About This Home

This home is located at 2811 Clark Place Unit Lot2, Easton, PA 18040 and is currently estimated at $620,883, approximately $225 per square foot. 2811 Clark Place Unit Lot2 is a home located in Northampton County with nearby schools including Shawnee Elementary School, Easton Area Middle School, and Easton Area High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 12, 2018

Sold by

Patel Dilesh

Bought by

Taylor Aponavicius Steven V and Taylor Aponavicius

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$280,000

Outstanding Balance

$247,178

Interest Rate

4.9%

Mortgage Type

New Conventional

Estimated Equity

$373,705

Purchase Details

Closed on

Mar 14, 2018

Sold by

Bank Of America Na

Bought by

Patel Dilesh

Purchase Details

Closed on

Mar 1, 2018

Sold by

Villalba Ubonel M and Molina Jadwiga

Bought by

Bank Of America N A

Purchase Details

Closed on

Apr 30, 2010

Sold by

Signature Homes

Bought by

Villalba Ubonel M and Molina Jadwiga

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$365,262

Interest Rate

5.25%

Mortgage Type

FHA

Purchase Details

Closed on

Dec 8, 2008

Sold by

Red Rock Land Corporation

Bought by

Signature Homes and J T Maloney At Countryside Estates Lp

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Taylor Aponavicius Steven V | $350,000 | Southeastern Abstract Compan | |

| Patel Dilesh | $285,000 | None Available | |

| Bank Of America N A | $1,477 | None Available | |

| Villalba Ubonel M | $372,000 | None Available | |

| Signature Homes | $98,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Taylor Aponavicius Steven V | $280,000 | |

| Previous Owner | Villalba Ubonel M | $365,262 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,230 | $113,900 | $22,600 | $91,300 |

| 2024 | $9,980 | $113,900 | $22,600 | $91,300 |

| 2023 | $9,828 | $113,900 | $22,600 | $91,300 |

| 2022 | $9,679 | $113,900 | $22,600 | $91,300 |

| 2021 | $9,647 | $113,900 | $22,600 | $91,300 |

| 2020 | $9,642 | $113,900 | $22,600 | $91,300 |

| 2019 | $9,704 | $116,300 | $22,600 | $93,700 |

| 2018 | $9,538 | $116,300 | $22,600 | $93,700 |

| 2017 | $9,252 | $116,300 | $22,600 | $93,700 |

| 2016 | -- | $116,300 | $22,600 | $93,700 |

| 2015 | -- | $116,300 | $22,600 | $93,700 |

| 2014 | -- | $116,300 | $22,600 | $93,700 |

Source: Public Records

Map

Nearby Homes

- 2755 Destiny Ln

- 2665 Pond Dr

- 286 Park Ridge Dr

- 329 Knollwood Dr

- 311 Knollwood Dr

- 257 Park Ridge Dr

- 195 Park Ridge Dr

- 977 S Fork Dr

- 202 Park Ridge Dr

- 2567 Chestnut Ln

- 104 Winding Rd

- 107 Winding Rd

- 226 Winding Rd

- REGENT Plan at Lafayette Hills - Twins

- Derby Duplex Plan at Lafayette Hills - Twins

- 1300 Upstream Farm Rd

- 1325 Silo Dr

- PENWELL Plan at Lafayette Hills

- GALEN Plan at Lafayette Hills

- 2201 Huntington Ln

- 2811 Clark Place

- 2811 Clark Place Unit 2

- 2799 Clark Place

- 2799 Clark Place Unit 3

- 2823 Clark Place

- 2823 Clark Place Unit 1

- 2804 Milano Dr

- 2802 Milano Dr

- 2787 Clark Place

- 2787 Clark Place Unit 4

- 2796 Clark Place

- 2796 Clark Place Unit 13

- 2820 Clark Place Unit 11

- 2820 Clark Place

- 500 Adrian Dr

- 2800 Milano Dr

- 2784 Clark Place

- 2784 Clark Place Unit 14

- 2775 Clark Place

- 2775 Clark Place Unit 5